Thursday, December 28, 2006

What's Berkshire Hathaway Worth, Anyway -- II ?

Monday, December 25, 2006

Altria is Most Overvalued Dow Stock

The obvious question that report raised was -- are there any stocks that are significantly overvalued? There are two stocks that our models rate as overvalued by at least 20%, Hewlett Packard, and Altria, the former Philip Morris. Of the two, Altria's Dividend Valuation Model is most convincing.

The chart below shows that Altria's current price is approximately 20% above its valuation "steps." The model also shows that the two previous times in the last 20 years when MO became overvalued for an extended period of time it experienced a sharp pullback.

We are not calling for a sharp pullback in MO, but we have a lot of confidence in our models and we believe MO is at least entering a period when valuation headwinds are likely to be swirling.

......................Altria Dividend Valuation................

Monday, December 18, 2006

Pfizer Hikes Dividend 21%: Good News or Bad News

Wednesday, December 13, 2006

GE: Price-Valuation Divergence is Growing

By Greg Donaldson and Mike Hull,

Donaldson Capital Management

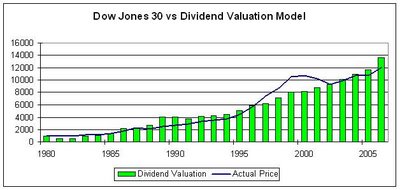

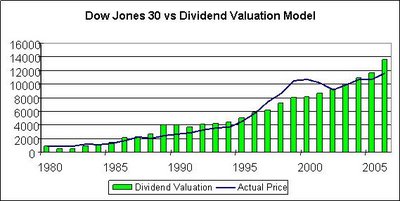

We just completed a look at each stock in the Dow Jones Industrial Average through the lens of our Dividend Valuation Model.

Here's the good news. Among the 30 Dow stocks, the model shows that the average stock is about 10% undervalued. That is an important level because it is the same level of undervaluation that our top-down dividend valuation model is showing.

One of the most undervalued stocks in the Dow is General Electric. The interesting thing about GE is that it has had some good news lately that the market has completely ignored. CEO Jeffrey Immelt recently announced a 12% dividend hike, the third such double digit hike in as many years. He also confirmed earnings guidance for 2007 in the range of 10-13%.

GE has been a disappointing stock for the last few years. But a look at our dividend valuation chart for the company shows a wide gap has formed between the current selling price and the "fair value," as measured by historical relationships between dividends, interest rates and price.

Dividend Valuation Chart

The green candy cane at the far right of the chart below shows our dividend valuation model estimate of GE's price for the coming year. This is not an exact science, but it does give clues about how GE has acted in the past with the dividend growth and interest rates we are predicting for the coming year.

Probably the most important signal we see in the chart is that GE's valuation "steps" have been rising consistently for the last three years while the stock price has been flat to down. While the fit between GE and it dividend valuation is not particularly tight, it is clear that, except for the bubble in the late 1990s, GE's price has trended at the same angle as the model.

The divergence between price and valuation over the past three years is not likely to hold. Either valuation will come tumbling down, and soon, or price has a lot of catching up to do.

Our best guess is that GE might be as much as 25% undervalued.

..............GE Dividend Valuation........

This blog is for information purposes only. Do not buy and sell decisions based on the information contained here. Consult your own financial advisor.

Monday, December 11, 2006

Housing: It Ain't Over 'Til Its Over

Wednesday, December 06, 2006

Donaldson Capital's New Website

Wednesday, November 29, 2006

Wachovia: Know Them by the Companies -- They Buy

Wednesday, November 22, 2006

Are the REITS too High?

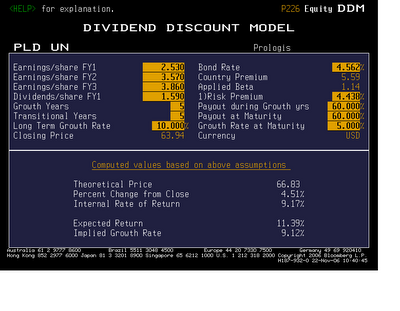

I estimated that the Funds From Operations and dividends would grow at 10% per year over the next 5 years and then decline over the next 5 years to 5% long-term growth. I used a discount factor of 9%, which I think is about right with 10-year T-bonds at 4.5%.

Using these data points, the model --click to enlarge the table -- shows that PLD's theoretical value is $66.83. With the price about $64 that means that PLD is, actually, about fairly valued. If that is the case, I would expect it to go sideways from here. If it continues going straight up, and anyone starts using those dangerous words, "It's different this time," I would run for the hills.

This blog is for information purposes only. Do not make buy and sell decisions based on what you read here. Please consult your own financial advisor.

I estimated that the Funds From Operations and dividends would grow at 10% per year over the next 5 years and then decline over the next 5 years to 5% long-term growth. I used a discount factor of 9%, which I think is about right with 10-year T-bonds at 4.5%.

Using these data points, the model --click to enlarge the table -- shows that PLD's theoretical value is $66.83. With the price about $64 that means that PLD is, actually, about fairly valued. If that is the case, I would expect it to go sideways from here. If it continues going straight up, and anyone starts using those dangerous words, "It's different this time," I would run for the hills.

This blog is for information purposes only. Do not make buy and sell decisions based on what you read here. Please consult your own financial advisor.

Wednesday, November 15, 2006

About Bonds

Thursday, November 09, 2006

Stocks Are Still Undervalued

The change in political leadership is not a great surprise to the market. The polls and various overseas betting lines showed such a possibility for months.

The momentum remains positive for stocks and, in my judgment, there is a clear valuation gap that is likely to close to some degree over the next year.

The change in political leadership is not a great surprise to the market. The polls and various overseas betting lines showed such a possibility for months.

The momentum remains positive for stocks and, in my judgment, there is a clear valuation gap that is likely to close to some degree over the next year.

Thursday, November 02, 2006

Coke Bubbles Up

Think of the green bars as "value" steps, or intrinsic value. For the 7 years from 1986 through 1993, Coke's market price (blue line) consistently sold below its intrinsic value. Beginning in 1995, things changed and under valuation was replaced with over valuation, as Coke appeared to be climbing a stairway to heaven.

By 1998, with Coke levitating 40% above its DVM, there was no shortage of buy recommendations by Wall Street analysts.

Coke's downtrend over the last 7 years has been caused by a combination of a normal correction back to its intrinsic value, and its own abysmal performance.

Two years ago, Coke finally appeared to correct their leadership problem by promoting Irishman Neville Isdell to CEO. By most accounts, he has the support of Coke employees and bottlers. In recent quarters, sales and earnings have bottomed and begun to firm.

Recently, the company reported much better than expected earnings, which push the stock higher. I noticed that the consensus ranking by Wall Street analysts did not budge with the good news on earnings. They still rank the stock as an average performer for the coming year. With the stock undervalued and big cap blue chip stocks back in favor, to ignore the progress that Coke has made is shortsighted. Besides seven years is a long time for Wall Street to hold a grudge.

Look for Coke to begin a long slow climb as more and more Wall Street types forgive the company for past missteps and admit that there is no such thing as an idiot proof company.

The Dividend Valuation Model says we are in the first year of an upturn. I wonder if that means, we can count on 6 more years of price gains? Stay tuned.

This blog is for information purposes only. Do not make buy and sell decisions based on what I have said here. Clients, Employees, and Principals of Donaldson Capital Management may own shares of Coke.

Think of the green bars as "value" steps, or intrinsic value. For the 7 years from 1986 through 1993, Coke's market price (blue line) consistently sold below its intrinsic value. Beginning in 1995, things changed and under valuation was replaced with over valuation, as Coke appeared to be climbing a stairway to heaven.

By 1998, with Coke levitating 40% above its DVM, there was no shortage of buy recommendations by Wall Street analysts.

Coke's downtrend over the last 7 years has been caused by a combination of a normal correction back to its intrinsic value, and its own abysmal performance.

Two years ago, Coke finally appeared to correct their leadership problem by promoting Irishman Neville Isdell to CEO. By most accounts, he has the support of Coke employees and bottlers. In recent quarters, sales and earnings have bottomed and begun to firm.

Recently, the company reported much better than expected earnings, which push the stock higher. I noticed that the consensus ranking by Wall Street analysts did not budge with the good news on earnings. They still rank the stock as an average performer for the coming year. With the stock undervalued and big cap blue chip stocks back in favor, to ignore the progress that Coke has made is shortsighted. Besides seven years is a long time for Wall Street to hold a grudge.

Look for Coke to begin a long slow climb as more and more Wall Street types forgive the company for past missteps and admit that there is no such thing as an idiot proof company.

The Dividend Valuation Model says we are in the first year of an upturn. I wonder if that means, we can count on 6 more years of price gains? Stay tuned.

This blog is for information purposes only. Do not make buy and sell decisions based on what I have said here. Clients, Employees, and Principals of Donaldson Capital Management may own shares of Coke.

Friday, October 27, 2006

Slowing Economy, Rising Stocks

Tuesday, October 24, 2006

The Pigs Are Flying

Thursday, October 19, 2006

Healthcare Sector: In the Pink?

So what is the sector doing making new highs when sales and earnings growth are still so meager and lawsuits are as common and curable as a cold? When I showed this to Mike Hull, the first thing he said was: go long the Republicans. By that I think he means that since the Democrats have led the attacks against the drug companies, a break to a new high by the sector would mean that big investors are betting that the Republicans are going to remain in power in the November elections. That is a completely counterintuitive thought because the main stream media has virtually ceded control of at least the House of Representatives to the Democrats.

On the other hand, since the break out is coming so near the elections and the Democrats are leading in the polls, the market may be saying that the drug companies can cut a better deal under new political leadership. Unfortunately, that is neither easy to say or believe.

I prefer to believe that the agony of the past 7 years, has provided the drug companies with a new model that investors believe is viable and sustainable. That model is based much more on cost savings and a more focused approach to research and development.

Even though sales gains have been tough in the sector, many of the main players such as JNJ and PFE have reported earnings growth much higher than Wall Street estimates.

From a valuation perspective, the drugs are about as cheap on a relative basis as any group. In our September 16th edition, we showed JNJ was nearly 20% undervalued. That is probably about the average of the stocks in the sector.

Having negotiated all these "what ifs," I think the Healthcare breakout should be seen as good news for stocks, in general, because it is such an important sector in the S&P 500. In addition, with the drugs so out of favor among big investors, there is good reason to believe that this breakout will likely get a lot of attention and draw in fresh money. I'll keep you updated as we go.

So what is the sector doing making new highs when sales and earnings growth are still so meager and lawsuits are as common and curable as a cold? When I showed this to Mike Hull, the first thing he said was: go long the Republicans. By that I think he means that since the Democrats have led the attacks against the drug companies, a break to a new high by the sector would mean that big investors are betting that the Republicans are going to remain in power in the November elections. That is a completely counterintuitive thought because the main stream media has virtually ceded control of at least the House of Representatives to the Democrats.

On the other hand, since the break out is coming so near the elections and the Democrats are leading in the polls, the market may be saying that the drug companies can cut a better deal under new political leadership. Unfortunately, that is neither easy to say or believe.

I prefer to believe that the agony of the past 7 years, has provided the drug companies with a new model that investors believe is viable and sustainable. That model is based much more on cost savings and a more focused approach to research and development.

Even though sales gains have been tough in the sector, many of the main players such as JNJ and PFE have reported earnings growth much higher than Wall Street estimates.

From a valuation perspective, the drugs are about as cheap on a relative basis as any group. In our September 16th edition, we showed JNJ was nearly 20% undervalued. That is probably about the average of the stocks in the sector.

Having negotiated all these "what ifs," I think the Healthcare breakout should be seen as good news for stocks, in general, because it is such an important sector in the S&P 500. In addition, with the drugs so out of favor among big investors, there is good reason to believe that this breakout will likely get a lot of attention and draw in fresh money. I'll keep you updated as we go.

Saturday, October 14, 2006

What's Berkshire Hathaway Worth, Anyway?

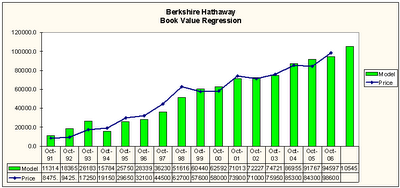

Click to enlarge

The last green bar (far right) shows the expected value of BRK/A based on projected year-end 2006 book value and current interest rates. Our model suggests that the fair value of Berkshire is over $105,000. We would expect that book value will grow by low double digits in 2007. That would push its fair value even higher. In our judgment, the close fit between BRK/A and our regression model suggest Mr. Buffett's net worth will be rising in the year ahead.

We own the Class B stock of Berkshire Hathaway in our Blue Chip Growth investment style. Clients, employees, and principals of our firm own the stock.

We offer this analysis for information purposes only. Do not make buy and sell decisions based on this blog.

Click to enlarge

The last green bar (far right) shows the expected value of BRK/A based on projected year-end 2006 book value and current interest rates. Our model suggests that the fair value of Berkshire is over $105,000. We would expect that book value will grow by low double digits in 2007. That would push its fair value even higher. In our judgment, the close fit between BRK/A and our regression model suggest Mr. Buffett's net worth will be rising in the year ahead.

We own the Class B stock of Berkshire Hathaway in our Blue Chip Growth investment style. Clients, employees, and principals of our firm own the stock.

We offer this analysis for information purposes only. Do not make buy and sell decisions based on this blog.

Friday, October 06, 2006

Still Room to Go

The main reason the model is so undervalued is the very low level of interest rates combined with higher than average dividend growth. I think the odds of these two trends continuing are very high. For that reason, I see valuation creation growing above historical long-term trends for the next several quarters.

There are certainly issues in the economy and the geopolitical arena, but in my estimation, they are amply discounted in the current prices of the Dow.

If there is a surprise, it is that high quality Blue Chip stocks will continue to rise even as the economy slows. More on that later.

The main reason the model is so undervalued is the very low level of interest rates combined with higher than average dividend growth. I think the odds of these two trends continuing are very high. For that reason, I see valuation creation growing above historical long-term trends for the next several quarters.

There are certainly issues in the economy and the geopolitical arena, but in my estimation, they are amply discounted in the current prices of the Dow.

If there is a surprise, it is that high quality Blue Chip stocks will continue to rise even as the economy slows. More on that later.

Thursday, September 28, 2006

Real Estate and the Tipping Point

Sunday, September 24, 2006

Dow Jones Industrials New High -- About Time

Thursday, September 21, 2006

Sam Would Be Proud -- Wal-Mart

Saturday, September 16, 2006

Johnson and Johnson -- Ready for A Turn?

Please click to enlarge.

Very simply, the model is saying that based on JNJ's 20-year average relationships between price growth, dividend growth, and changes in interest rates its stock is cheap. Furthermore, 2007 earnings are expected to rise sharply over 2006.

There are a lot of cheap drug stocks, and they deserve to be cheap because they are not the companies today that they were a decade ago. That is not the case with JNJ. Almost alone among US drug stocks, JNJ has weaved its way through the land mines of drug recalls, patent battles, and mind-boggling lawsuits that have blown up so many heretofore great companies.

JNJ's reliance on block buster drugs is much less than many of the pharmaceuticals, and they have developed a solid line of OTC drugs that were formerly only available by prescription.

Our model says JNJ is significantly undervalued. That does not guarantee success. It is just an indication that JNJ's current earnings and dividends are not as highly prized as they have been on average over the las 20 years. My belief is that JNJ's accelerating earnings in 2007 will look very good compared to the many earnings disappointments I expect during the coming year.

A lot of traders are avoiding the drug stocks like the plague because the drugs are having so much trouble. But for longer term investors, buying stocks that are out of favor yet whose prospects appear to be improving makes good sense.

The model shows that buying JNJ when its "fair value" line (gold) has been higher than its price line (green) has always worked out. I can't see the future, and I'm sure you know that the past is no gurantee of the future, but I would not be surprised to see JNJ trading in the mid 70s sometime in the next year or two.

You guessed it. I own the stock.

Please click to enlarge.

Very simply, the model is saying that based on JNJ's 20-year average relationships between price growth, dividend growth, and changes in interest rates its stock is cheap. Furthermore, 2007 earnings are expected to rise sharply over 2006.

There are a lot of cheap drug stocks, and they deserve to be cheap because they are not the companies today that they were a decade ago. That is not the case with JNJ. Almost alone among US drug stocks, JNJ has weaved its way through the land mines of drug recalls, patent battles, and mind-boggling lawsuits that have blown up so many heretofore great companies.

JNJ's reliance on block buster drugs is much less than many of the pharmaceuticals, and they have developed a solid line of OTC drugs that were formerly only available by prescription.

Our model says JNJ is significantly undervalued. That does not guarantee success. It is just an indication that JNJ's current earnings and dividends are not as highly prized as they have been on average over the las 20 years. My belief is that JNJ's accelerating earnings in 2007 will look very good compared to the many earnings disappointments I expect during the coming year.

A lot of traders are avoiding the drug stocks like the plague because the drugs are having so much trouble. But for longer term investors, buying stocks that are out of favor yet whose prospects appear to be improving makes good sense.

The model shows that buying JNJ when its "fair value" line (gold) has been higher than its price line (green) has always worked out. I can't see the future, and I'm sure you know that the past is no gurantee of the future, but I would not be surprised to see JNJ trading in the mid 70s sometime in the next year or two.

You guessed it. I own the stock.

Friday, September 08, 2006

Is Procter and Gamble Fairly Valued?

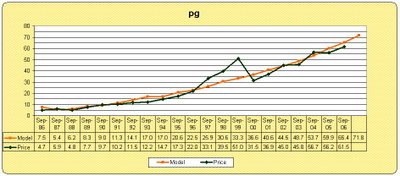

To see the model more clearly please click the image.

The green line (dark) shows PG's annual price since 1986. The gold line (light) is our Dividend Valuation Model's indicated "fair value" for each year. You will note a lot of wiggling and wobbling between the two lines, but they are clearly highly correlated, and, as we have shown previously, price does most of the wiggling and wobbling.

The model currently says that the expected "fair value" for 2007 is 71.80, or about 17% above the current price of $61.50. Our model says PG is very cheap.

..............................Procter and Gamble...........................

To see the model more clearly please click the image.

The green line (dark) shows PG's annual price since 1986. The gold line (light) is our Dividend Valuation Model's indicated "fair value" for each year. You will note a lot of wiggling and wobbling between the two lines, but they are clearly highly correlated, and, as we have shown previously, price does most of the wiggling and wobbling.

The model currently says that the expected "fair value" for 2007 is 71.80, or about 17% above the current price of $61.50. Our model says PG is very cheap.

..............................Procter and Gamble...........................

Chart II shows Bloomberg's Dividend Discount Model valuation of PG. A Dividend Discount analysis is a forward looking computation of the discounted present value of PG's future dividend payments.

Looking at the lower half of the table you can see that the Theoretical Price of PG, as computed by the Dividend Discount Model, is $77.04, or 25% higher than the current price.

I'll leave for another time a wider discussion of the table.

Here's the last word. The slowing economy will cause many stock groups to either go flat or fall. The consumer staples sector is not likely to be affected much by the slowing economy because the products they sell are modestly priced and we use them everyday. As the economic slowdown becomes more apparent, I believe the consistent earnings and dividend growth of PG (and many of the other stocks in the consumer staples sector) will become more highly prized by Wall Street, and the momentum players will drive PG's price higher.

The valuation models shown here suggest that PG has a ways to go just to reach "fair value," and as I said in the beginning, stocks don't spend much time fairly valued. I would argue that PG might see a time during the next 18 months when the momentum players will push it above fair value. You do the math.

Blessings,

Donaldson Capital clients, employees, and I own PG. This is not a buy recommendation, it is an example of valuation models and macro-economic analysis. In addition, we may sell PG in the future without notice.

Chart II shows Bloomberg's Dividend Discount Model valuation of PG. A Dividend Discount analysis is a forward looking computation of the discounted present value of PG's future dividend payments.

Looking at the lower half of the table you can see that the Theoretical Price of PG, as computed by the Dividend Discount Model, is $77.04, or 25% higher than the current price.

I'll leave for another time a wider discussion of the table.

Here's the last word. The slowing economy will cause many stock groups to either go flat or fall. The consumer staples sector is not likely to be affected much by the slowing economy because the products they sell are modestly priced and we use them everyday. As the economic slowdown becomes more apparent, I believe the consistent earnings and dividend growth of PG (and many of the other stocks in the consumer staples sector) will become more highly prized by Wall Street, and the momentum players will drive PG's price higher.

The valuation models shown here suggest that PG has a ways to go just to reach "fair value," and as I said in the beginning, stocks don't spend much time fairly valued. I would argue that PG might see a time during the next 18 months when the momentum players will push it above fair value. You do the math.

Blessings,

Donaldson Capital clients, employees, and I own PG. This is not a buy recommendation, it is an example of valuation models and macro-economic analysis. In addition, we may sell PG in the future without notice.

Monday, September 04, 2006

DCM President, Mike Hull, Responds to a Client's Question

Thursday, August 31, 2006

BAC's Dividend Growth and the Cure for Jim Cramer

Sunday, August 27, 2006

Energy: The New Y2K: Investing in Prudence

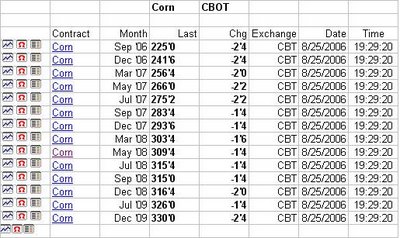

The fourth column under Corn is the price. To transpose it into dollars per bushel, just put the decimal point after the first digit, ie. the price for the contract for Sep '06, which reads 225'0, would mean $2.25 per bushel.

As you go down the table; you will notice that prices go up every year until we reach a high price of $3.30 for the Dec '09 contract.

For a speculator to make a profit on the Dec '09 contract, the price of corn will have to exceed $3.30 per bushel. That is nearly 50% higher than today's price, and much higher than would ordinarily be expected.

Why are commodity traders so bullish on corn? Do they know something about the weather that we don't know? That is possible because they can now trade the weather, but I think the reason corn futures are so high is contained in one word: ethanol.

Lots of big money believe, as I do, that changes are coming in the way we power our machines. In this case, they are betting that corn (ethanol) will have an increasing role as a fuel for our cars, trucks, and tractors.

To me the growing use of ethanol ( no matter its actual energy efficiency) is a forgone conclusion among the big players in both the agricultural as well as the automotive industries. As shown here, this will drive up corn prices (you might want to hoard some corn flakes for the kids and some whiskey for yourself), but it will give Americans some feeling of greater control over their energy needs.

But, in my judgment, the greater use of ethanol and biodiesels are just the beginning. There are scores of hybrid engines on the way that will get up to 50 miles per gallon and more. They will cost more, but what is given up in dollars will be more than made up in a growing sense of prudence.

Prudence may seem like an old fashion word, but billions of dollars are spent annually on prudence called by another name: insurance.

Archer Daniel Midland -- ADM -- is the way most people are playing ethanol and biodiesel. I'm kind of a "picks and shovels" guy. I like Deere. Ethanol and biodiesel will mean fence row to fence row planting throughout the world. Deere is dominant between the fence rows.

Donaldson Capital nor I own either of the stocks, although we are evaluating Deere. Both companies are first rate, even in the absence of ethanol and biodiesel opportunities.

The fourth column under Corn is the price. To transpose it into dollars per bushel, just put the decimal point after the first digit, ie. the price for the contract for Sep '06, which reads 225'0, would mean $2.25 per bushel.

As you go down the table; you will notice that prices go up every year until we reach a high price of $3.30 for the Dec '09 contract.

For a speculator to make a profit on the Dec '09 contract, the price of corn will have to exceed $3.30 per bushel. That is nearly 50% higher than today's price, and much higher than would ordinarily be expected.

Why are commodity traders so bullish on corn? Do they know something about the weather that we don't know? That is possible because they can now trade the weather, but I think the reason corn futures are so high is contained in one word: ethanol.

Lots of big money believe, as I do, that changes are coming in the way we power our machines. In this case, they are betting that corn (ethanol) will have an increasing role as a fuel for our cars, trucks, and tractors.

To me the growing use of ethanol ( no matter its actual energy efficiency) is a forgone conclusion among the big players in both the agricultural as well as the automotive industries. As shown here, this will drive up corn prices (you might want to hoard some corn flakes for the kids and some whiskey for yourself), but it will give Americans some feeling of greater control over their energy needs.

But, in my judgment, the greater use of ethanol and biodiesels are just the beginning. There are scores of hybrid engines on the way that will get up to 50 miles per gallon and more. They will cost more, but what is given up in dollars will be more than made up in a growing sense of prudence.

Prudence may seem like an old fashion word, but billions of dollars are spent annually on prudence called by another name: insurance.

Archer Daniel Midland -- ADM -- is the way most people are playing ethanol and biodiesel. I'm kind of a "picks and shovels" guy. I like Deere. Ethanol and biodiesel will mean fence row to fence row planting throughout the world. Deere is dominant between the fence rows.

Donaldson Capital nor I own either of the stocks, although we are evaluating Deere. Both companies are first rate, even in the absence of ethanol and biodiesel opportunities.

Wednesday, August 23, 2006

Welcome to Normal

Sunday, August 20, 2006

Don't Count Your Shekels

Tuesday, August 15, 2006

The Y2K Effect, Here It Comes Again

Wednesday, August 09, 2006

Big Over Small, Dividends Over All

The first chart is of the S&P 600 Small Cap Index vs. the S&P 500 index. The graph on the top of the chart shows the Index itself, while the lower graph shows the Index vs. the S&P 500. The index looks very toppy, but the lower graph shows a serious breakdown compared to the S&P 500. In other the words, small cap stocks are not only falling, they are falling at an accelerating pace relative to large cap stocks. Another blow to small caps may be near. Notice that the lower graph (most recent data at lower right) appears to be breaking down from its recent consolidation attempt. Small Caps have underperformed large caps by nearly 11% over the past three months. The chart makes clear that, at least over the last 3 months, big caps have overtaken small caps, and this trend looks pretty solid to me.

..................S&P 500 vs. S&P 500 Value................

The first chart is of the S&P 600 Small Cap Index vs. the S&P 500 index. The graph on the top of the chart shows the Index itself, while the lower graph shows the Index vs. the S&P 500. The index looks very toppy, but the lower graph shows a serious breakdown compared to the S&P 500. In other the words, small cap stocks are not only falling, they are falling at an accelerating pace relative to large cap stocks. Another blow to small caps may be near. Notice that the lower graph (most recent data at lower right) appears to be breaking down from its recent consolidation attempt. Small Caps have underperformed large caps by nearly 11% over the past three months. The chart makes clear that, at least over the last 3 months, big caps have overtaken small caps, and this trend looks pretty solid to me.

..................S&P 500 vs. S&P 500 Value................

If big cap stocks are outperforming, our next question is, is there a distinction between value and growth?

The second chart is of the large cap S&P 500 Value Index. The lower graph is comparing the Value Index with the S&P 500 itself. The S&P Value Index includes those stocks in the S&P 500 with lower price to book, price to earnings, and price to sales, and higher dividend yields. The growth sector(not shown) is the other half of the index.

Since we are dividing the S&P 500 into only two sectors, if the value sector is rising vs. the S&P 500, as it is on the bottom graph, that means that the growth sector is falling on a relative basis. The value sector's angle of ascent(shown on the lower graph) is very convincing. This means that not only is value outperforming growth, but the growth is in a freefall. This would corroborate the notion that investors are less willing to bet that high earnings growth will continue.

Thus far in our analysis, large-cap stocks are performing better in the near term than small caps, and among the large-cap stocks, the value sector is performing dramatically better than the growth sector.

The final part of the trilogy is a further "drilling down" to determine what type of large-cap, value stocks are doing the best in the near term. That answer is as you might expect: stocks with a higher than average dividend yield and consistent dividend growth, such as those contained in the Dow Jones Dividend Index.

..........DJ Dividend Index vs. S&P Value Index......

If big cap stocks are outperforming, our next question is, is there a distinction between value and growth?

The second chart is of the large cap S&P 500 Value Index. The lower graph is comparing the Value Index with the S&P 500 itself. The S&P Value Index includes those stocks in the S&P 500 with lower price to book, price to earnings, and price to sales, and higher dividend yields. The growth sector(not shown) is the other half of the index.

Since we are dividing the S&P 500 into only two sectors, if the value sector is rising vs. the S&P 500, as it is on the bottom graph, that means that the growth sector is falling on a relative basis. The value sector's angle of ascent(shown on the lower graph) is very convincing. This means that not only is value outperforming growth, but the growth is in a freefall. This would corroborate the notion that investors are less willing to bet that high earnings growth will continue.

Thus far in our analysis, large-cap stocks are performing better in the near term than small caps, and among the large-cap stocks, the value sector is performing dramatically better than the growth sector.

The final part of the trilogy is a further "drilling down" to determine what type of large-cap, value stocks are doing the best in the near term. That answer is as you might expect: stocks with a higher than average dividend yield and consistent dividend growth, such as those contained in the Dow Jones Dividend Index.

..........DJ Dividend Index vs. S&P Value Index......

There are two key features to this chart. The top graph shows that dividend stocks have broken to a new 12 month high in recent weeks. No other major indices has done this. Second, the lower graph shows that the relative strength, which had been heading in the wrong direction until April, has made a remarable u-turn and is now headed sharply higher.

Value stocks are doing better than almost all other major sectors, but on a relative basis, the Dow Jones Dividend Index is gaining ground almost daily. I expect this trend to continue.

Large over small, value over growth, dividend over all. That's the picture I see, and the evidence is clear that this trend has a way to go. I'll describe these trends in the weeks ahead.

Dividends are our world, and dividends have come to the forefront in these uncertain times. It is too simple to say that sooner or later they always do, but that says it about as well as we know how.

There are two key features to this chart. The top graph shows that dividend stocks have broken to a new 12 month high in recent weeks. No other major indices has done this. Second, the lower graph shows that the relative strength, which had been heading in the wrong direction until April, has made a remarable u-turn and is now headed sharply higher.

Value stocks are doing better than almost all other major sectors, but on a relative basis, the Dow Jones Dividend Index is gaining ground almost daily. I expect this trend to continue.

Large over small, value over growth, dividend over all. That's the picture I see, and the evidence is clear that this trend has a way to go. I'll describe these trends in the weeks ahead.

Dividends are our world, and dividends have come to the forefront in these uncertain times. It is too simple to say that sooner or later they always do, but that says it about as well as we know how.

Friday, August 04, 2006

Cash Is King

The chart is of the yield on a 30-Year T-Bond. The chart covers the last 12 months.

A year ago the yield stood at about 4.6%. Rates stayed in a narrow band through the end of '05, even though the Fed was raising short rates. As it became clear, that economic growth was taking off in early 2006, the yield on the 30-T-Bond began a steady rise to near 5.25%.

It was at this point that Fed chairman Bernanke started talking tough. The Fed does not control long rates, such as 30-Year T-Bonds; they are set by the market. Thus, the yield on the 30-year T-bond is a kind of monitor of how well investors believe the Fed is doing its job of fighting inflation. Rising rates on 30-year T-Bonds indicate the market believes the Fed is not tough enough; falling rates say just the opposite.

From March through May of this year, the market was saying that the economy was growing too fast and ran the risk of pushing inflation higher, which drove rates higher. After Bernanke and other Fed members began to talk tough, bond investors were relieved and bond yields fell. But two straight higher-than-expected inflation reports at mid-year pushed rates back toward their 12-month highs.

In July, as bond yields returned to their May highs, Israel and Hezbollah began bombing each other. Unexpectedly, bond yields began to fall and have continued to trend lower. At first, this may seem counterintuitive. After all, the war in the Middle East has pushed oil prices higher and rising oil prices will surely mean higher inflation, won't it?

That line of thinking would conclude that interest rates should have risen when the shooting began. But thinking about it more broadly, falling rates make sense. Bond yield are falling primarily because of a flight to safety(T-Bonds are considered to be among the safest bonds on earth). Additionally, I believe, bond yields are now falling because of recent economic data that suggest the economy is slowing, and the recognition that $3.00 a gallon gasoline will extract a lot of money from consumers' wallets.

Here's the bottom line: Bond yields look like they have peaked. That's good news, but what is even more important is the relative strength graph at the bottom of the chart. For most of the last year, the rise in T-Bond yields has been greater than the growth in stock prices. Since June, however, the S&P 500 has been outperforming bonds. This can be seen in the downward slope of the lower graph since that time.

I believe the rally in dividend-paying stocks and the rally in bonds has the same root: The Fed is nearing the end of its rate hikes. That is the good news, but there is also a bit of bad news. If the Fed is ending its rate hikes, it must be convinced the economy is slowing, and a slowing economy will result in slowing earnings growth. The risks of earnings disappointments in the coming year are now on the rise.

The rally in quality dividend-paying stocks and bonds in the face of all of the uncertainties is natural. Money always goes where it is treated the best, and history shows that in times of turmoil and slowing economic growth "cash is king." Dividend-paying stocks and T-Bonds are the best sources of high and predictable cash flow and they will continue to rally until the uncertainties subside.

The chart is of the yield on a 30-Year T-Bond. The chart covers the last 12 months.

A year ago the yield stood at about 4.6%. Rates stayed in a narrow band through the end of '05, even though the Fed was raising short rates. As it became clear, that economic growth was taking off in early 2006, the yield on the 30-T-Bond began a steady rise to near 5.25%.

It was at this point that Fed chairman Bernanke started talking tough. The Fed does not control long rates, such as 30-Year T-Bonds; they are set by the market. Thus, the yield on the 30-year T-bond is a kind of monitor of how well investors believe the Fed is doing its job of fighting inflation. Rising rates on 30-year T-Bonds indicate the market believes the Fed is not tough enough; falling rates say just the opposite.

From March through May of this year, the market was saying that the economy was growing too fast and ran the risk of pushing inflation higher, which drove rates higher. After Bernanke and other Fed members began to talk tough, bond investors were relieved and bond yields fell. But two straight higher-than-expected inflation reports at mid-year pushed rates back toward their 12-month highs.

In July, as bond yields returned to their May highs, Israel and Hezbollah began bombing each other. Unexpectedly, bond yields began to fall and have continued to trend lower. At first, this may seem counterintuitive. After all, the war in the Middle East has pushed oil prices higher and rising oil prices will surely mean higher inflation, won't it?

That line of thinking would conclude that interest rates should have risen when the shooting began. But thinking about it more broadly, falling rates make sense. Bond yield are falling primarily because of a flight to safety(T-Bonds are considered to be among the safest bonds on earth). Additionally, I believe, bond yields are now falling because of recent economic data that suggest the economy is slowing, and the recognition that $3.00 a gallon gasoline will extract a lot of money from consumers' wallets.

Here's the bottom line: Bond yields look like they have peaked. That's good news, but what is even more important is the relative strength graph at the bottom of the chart. For most of the last year, the rise in T-Bond yields has been greater than the growth in stock prices. Since June, however, the S&P 500 has been outperforming bonds. This can be seen in the downward slope of the lower graph since that time.

I believe the rally in dividend-paying stocks and the rally in bonds has the same root: The Fed is nearing the end of its rate hikes. That is the good news, but there is also a bit of bad news. If the Fed is ending its rate hikes, it must be convinced the economy is slowing, and a slowing economy will result in slowing earnings growth. The risks of earnings disappointments in the coming year are now on the rise.

The rally in quality dividend-paying stocks and bonds in the face of all of the uncertainties is natural. Money always goes where it is treated the best, and history shows that in times of turmoil and slowing economic growth "cash is king." Dividend-paying stocks and T-Bonds are the best sources of high and predictable cash flow and they will continue to rally until the uncertainties subside.

Friday, July 28, 2006

A Thousand Words

The chart is of the Dow Jones Select Dividend Index. This is collection of companies that meet specific requirements for dividend yield, dividend growth, and dividend payout. While this index is not a carbon copy of our Rising Dividend style of investing, it is comparable its industry mix and strategy.

The top of the chart shows the index's price graph over the last 12 months. The bottom of the chart shows the relative strength graph of the dividend index vs. the S&P 500 index. Both charts are eye popping.

The top graph shows that dividend-oriented stocks have broken out of a year-long trading range. Actually, the trading range was more like 18 months. The new 12 month high price for the dividend index may be a bit counter intuitive at first. There is a war in the Middle East, isn't their? Oil prices keep moving higher. Commodity prices keep moving higher. The Fed just raised rates for the umpteenth time. Everyone knows the mood on Wall Street is cool at best. Yet, in this "fog of war" and "fog of feelings" the dividend index has risen to a new high. This is important!!

In addition, the lower graph tells an even more interesting story. The graph shows that from about September of last year through April of this year, the dividend index consistently underperformed the S&P 500. At its nadir, the difference reached almost 7%. In my years in the business, I have seldom seen quality stocks so ignored -- shunned. I say quality stocks here because the dividend index, as constructed by Dow Jones, has a credit rating much higher than the average stock in the S&P 500.

But in April, things began to change and the dividend index began to show solid relative strength improvement, indicated by the graph turning up. The turn was sharp and strong but was interrupted by the Federal Reserves' tough talk and fears of inflation in June. The short downtrend changed directions again with the outbreak of the Middle East war. This time investors, in my mind, correctly saw that dividend-paying companies were a safer vehicle to ride out not only the fog of war, but also the slowing economy.

Now the dividend index has come all the way back to nearly catch the S&P Index for the year on a relative strength basis. To my way of thinking, the break out to a new high for the top graph (price) suggests that this pattern of outperformance by the dividend index will continue.

Our own model Rising Dividend Portfolio has had similar relative performance in the last three months versus the S&P 500 and has modestly outperformed the dividend index during this time on a median return basis.

In my judgment, a very big worm has turned, and big worms don't do much zig zagging, so I believe the swing back to high quality dividend-paying stocks will continue. They are cheap vs. growth-oriented stocks and now the momentum in in their favor. In the ways of Wall Street that is a tough combination to beat.

The chart is of the Dow Jones Select Dividend Index. This is collection of companies that meet specific requirements for dividend yield, dividend growth, and dividend payout. While this index is not a carbon copy of our Rising Dividend style of investing, it is comparable its industry mix and strategy.

The top of the chart shows the index's price graph over the last 12 months. The bottom of the chart shows the relative strength graph of the dividend index vs. the S&P 500 index. Both charts are eye popping.

The top graph shows that dividend-oriented stocks have broken out of a year-long trading range. Actually, the trading range was more like 18 months. The new 12 month high price for the dividend index may be a bit counter intuitive at first. There is a war in the Middle East, isn't their? Oil prices keep moving higher. Commodity prices keep moving higher. The Fed just raised rates for the umpteenth time. Everyone knows the mood on Wall Street is cool at best. Yet, in this "fog of war" and "fog of feelings" the dividend index has risen to a new high. This is important!!

In addition, the lower graph tells an even more interesting story. The graph shows that from about September of last year through April of this year, the dividend index consistently underperformed the S&P 500. At its nadir, the difference reached almost 7%. In my years in the business, I have seldom seen quality stocks so ignored -- shunned. I say quality stocks here because the dividend index, as constructed by Dow Jones, has a credit rating much higher than the average stock in the S&P 500.

But in April, things began to change and the dividend index began to show solid relative strength improvement, indicated by the graph turning up. The turn was sharp and strong but was interrupted by the Federal Reserves' tough talk and fears of inflation in June. The short downtrend changed directions again with the outbreak of the Middle East war. This time investors, in my mind, correctly saw that dividend-paying companies were a safer vehicle to ride out not only the fog of war, but also the slowing economy.

Now the dividend index has come all the way back to nearly catch the S&P Index for the year on a relative strength basis. To my way of thinking, the break out to a new high for the top graph (price) suggests that this pattern of outperformance by the dividend index will continue.

Our own model Rising Dividend Portfolio has had similar relative performance in the last three months versus the S&P 500 and has modestly outperformed the dividend index during this time on a median return basis.

In my judgment, a very big worm has turned, and big worms don't do much zig zagging, so I believe the swing back to high quality dividend-paying stocks will continue. They are cheap vs. growth-oriented stocks and now the momentum in in their favor. In the ways of Wall Street that is a tough combination to beat.

Enough said.