Please click to enlarge.

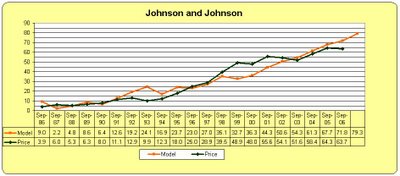

Very simply, the model is saying that based on JNJ's 20-year average relationships between price growth, dividend growth, and changes in interest rates its stock is cheap. Furthermore, 2007 earnings are expected to rise sharply over 2006.

There are a lot of cheap drug stocks, and they deserve to be cheap because they are not the companies today that they were a decade ago. That is not the case with JNJ. Almost alone among US drug stocks, JNJ has weaved its way through the land mines of drug recalls, patent battles, and mind-boggling lawsuits that have blown up so many heretofore great companies.

JNJ's reliance on block buster drugs is much less than many of the pharmaceuticals, and they have developed a solid line of OTC drugs that were formerly only available by prescription.

Our model says JNJ is significantly undervalued. That does not guarantee success. It is just an indication that JNJ's current earnings and dividends are not as highly prized as they have been on average over the las 20 years. My belief is that JNJ's accelerating earnings in 2007 will look very good compared to the many earnings disappointments I expect during the coming year.

A lot of traders are avoiding the drug stocks like the plague because the drugs are having so much trouble. But for longer term investors, buying stocks that are out of favor yet whose prospects appear to be improving makes good sense.

The model shows that buying JNJ when its "fair value" line (gold) has been higher than its price line (green) has always worked out. I can't see the future, and I'm sure you know that the past is no gurantee of the future, but I would not be surprised to see JNJ trading in the mid 70s sometime in the next year or two.

You guessed it. I own the stock.

Please click to enlarge.

Very simply, the model is saying that based on JNJ's 20-year average relationships between price growth, dividend growth, and changes in interest rates its stock is cheap. Furthermore, 2007 earnings are expected to rise sharply over 2006.

There are a lot of cheap drug stocks, and they deserve to be cheap because they are not the companies today that they were a decade ago. That is not the case with JNJ. Almost alone among US drug stocks, JNJ has weaved its way through the land mines of drug recalls, patent battles, and mind-boggling lawsuits that have blown up so many heretofore great companies.

JNJ's reliance on block buster drugs is much less than many of the pharmaceuticals, and they have developed a solid line of OTC drugs that were formerly only available by prescription.

Our model says JNJ is significantly undervalued. That does not guarantee success. It is just an indication that JNJ's current earnings and dividends are not as highly prized as they have been on average over the las 20 years. My belief is that JNJ's accelerating earnings in 2007 will look very good compared to the many earnings disappointments I expect during the coming year.

A lot of traders are avoiding the drug stocks like the plague because the drugs are having so much trouble. But for longer term investors, buying stocks that are out of favor yet whose prospects appear to be improving makes good sense.

The model shows that buying JNJ when its "fair value" line (gold) has been higher than its price line (green) has always worked out. I can't see the future, and I'm sure you know that the past is no gurantee of the future, but I would not be surprised to see JNJ trading in the mid 70s sometime in the next year or two.

You guessed it. I own the stock.

Saturday, September 16, 2006

Johnson and Johnson -- Ready for A Turn?

Positive market breadth has widened over the past two weeks as more cyclical sectors have ticked higher, betting that the Fed has likely finished hiking rates. I agree that the Fed is on the sidelines, but I believe the optimism about prospects for the average stock are premature.

Recent data clearly show that the economy is slowing, and wages are now rising faster than prices, as was revealed by Friday's CPI report. Indeed, Friday's tame CPI release, which the markets interpreted as good news, is probably strong evidence that corporate profit growth has peaked and is now trending lower. Taken together, recent data strongly suggest that profits will likely disappoint in the year ahead.

In this scenario, I continue to believe that high quality consumer defensive stocks offer compelling values. Our research shows that Johnson and Johnson, a leader in the healthcare sector, is continuing to put up good results, which are being ignored by the market.

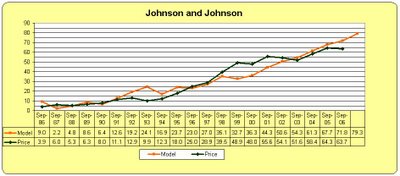

The chart below is of our proprietary Dividend Valuation Model for JNJ.

...................Johnson and Johnson............

Please click to enlarge.

Very simply, the model is saying that based on JNJ's 20-year average relationships between price growth, dividend growth, and changes in interest rates its stock is cheap. Furthermore, 2007 earnings are expected to rise sharply over 2006.

There are a lot of cheap drug stocks, and they deserve to be cheap because they are not the companies today that they were a decade ago. That is not the case with JNJ. Almost alone among US drug stocks, JNJ has weaved its way through the land mines of drug recalls, patent battles, and mind-boggling lawsuits that have blown up so many heretofore great companies.

JNJ's reliance on block buster drugs is much less than many of the pharmaceuticals, and they have developed a solid line of OTC drugs that were formerly only available by prescription.

Our model says JNJ is significantly undervalued. That does not guarantee success. It is just an indication that JNJ's current earnings and dividends are not as highly prized as they have been on average over the las 20 years. My belief is that JNJ's accelerating earnings in 2007 will look very good compared to the many earnings disappointments I expect during the coming year.

A lot of traders are avoiding the drug stocks like the plague because the drugs are having so much trouble. But for longer term investors, buying stocks that are out of favor yet whose prospects appear to be improving makes good sense.

The model shows that buying JNJ when its "fair value" line (gold) has been higher than its price line (green) has always worked out. I can't see the future, and I'm sure you know that the past is no gurantee of the future, but I would not be surprised to see JNJ trading in the mid 70s sometime in the next year or two.

You guessed it. I own the stock.

Please click to enlarge.

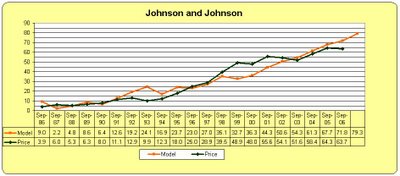

Very simply, the model is saying that based on JNJ's 20-year average relationships between price growth, dividend growth, and changes in interest rates its stock is cheap. Furthermore, 2007 earnings are expected to rise sharply over 2006.

There are a lot of cheap drug stocks, and they deserve to be cheap because they are not the companies today that they were a decade ago. That is not the case with JNJ. Almost alone among US drug stocks, JNJ has weaved its way through the land mines of drug recalls, patent battles, and mind-boggling lawsuits that have blown up so many heretofore great companies.

JNJ's reliance on block buster drugs is much less than many of the pharmaceuticals, and they have developed a solid line of OTC drugs that were formerly only available by prescription.

Our model says JNJ is significantly undervalued. That does not guarantee success. It is just an indication that JNJ's current earnings and dividends are not as highly prized as they have been on average over the las 20 years. My belief is that JNJ's accelerating earnings in 2007 will look very good compared to the many earnings disappointments I expect during the coming year.

A lot of traders are avoiding the drug stocks like the plague because the drugs are having so much trouble. But for longer term investors, buying stocks that are out of favor yet whose prospects appear to be improving makes good sense.

The model shows that buying JNJ when its "fair value" line (gold) has been higher than its price line (green) has always worked out. I can't see the future, and I'm sure you know that the past is no gurantee of the future, but I would not be surprised to see JNJ trading in the mid 70s sometime in the next year or two.

You guessed it. I own the stock.

Please click to enlarge.

Very simply, the model is saying that based on JNJ's 20-year average relationships between price growth, dividend growth, and changes in interest rates its stock is cheap. Furthermore, 2007 earnings are expected to rise sharply over 2006.

There are a lot of cheap drug stocks, and they deserve to be cheap because they are not the companies today that they were a decade ago. That is not the case with JNJ. Almost alone among US drug stocks, JNJ has weaved its way through the land mines of drug recalls, patent battles, and mind-boggling lawsuits that have blown up so many heretofore great companies.

JNJ's reliance on block buster drugs is much less than many of the pharmaceuticals, and they have developed a solid line of OTC drugs that were formerly only available by prescription.

Our model says JNJ is significantly undervalued. That does not guarantee success. It is just an indication that JNJ's current earnings and dividends are not as highly prized as they have been on average over the las 20 years. My belief is that JNJ's accelerating earnings in 2007 will look very good compared to the many earnings disappointments I expect during the coming year.

A lot of traders are avoiding the drug stocks like the plague because the drugs are having so much trouble. But for longer term investors, buying stocks that are out of favor yet whose prospects appear to be improving makes good sense.

The model shows that buying JNJ when its "fair value" line (gold) has been higher than its price line (green) has always worked out. I can't see the future, and I'm sure you know that the past is no gurantee of the future, but I would not be surprised to see JNJ trading in the mid 70s sometime in the next year or two.

You guessed it. I own the stock.

Please click to enlarge.

Very simply, the model is saying that based on JNJ's 20-year average relationships between price growth, dividend growth, and changes in interest rates its stock is cheap. Furthermore, 2007 earnings are expected to rise sharply over 2006.

There are a lot of cheap drug stocks, and they deserve to be cheap because they are not the companies today that they were a decade ago. That is not the case with JNJ. Almost alone among US drug stocks, JNJ has weaved its way through the land mines of drug recalls, patent battles, and mind-boggling lawsuits that have blown up so many heretofore great companies.

JNJ's reliance on block buster drugs is much less than many of the pharmaceuticals, and they have developed a solid line of OTC drugs that were formerly only available by prescription.

Our model says JNJ is significantly undervalued. That does not guarantee success. It is just an indication that JNJ's current earnings and dividends are not as highly prized as they have been on average over the las 20 years. My belief is that JNJ's accelerating earnings in 2007 will look very good compared to the many earnings disappointments I expect during the coming year.

A lot of traders are avoiding the drug stocks like the plague because the drugs are having so much trouble. But for longer term investors, buying stocks that are out of favor yet whose prospects appear to be improving makes good sense.

The model shows that buying JNJ when its "fair value" line (gold) has been higher than its price line (green) has always worked out. I can't see the future, and I'm sure you know that the past is no gurantee of the future, but I would not be surprised to see JNJ trading in the mid 70s sometime in the next year or two.

You guessed it. I own the stock.