The change in political leadership is not a great surprise to the market. The polls and various overseas betting lines showed such a possibility for months.

The momentum remains positive for stocks and, in my judgment, there is a clear valuation gap that is likely to close to some degree over the next year.

The change in political leadership is not a great surprise to the market. The polls and various overseas betting lines showed such a possibility for months.

The momentum remains positive for stocks and, in my judgment, there is a clear valuation gap that is likely to close to some degree over the next year.

Thursday, November 09, 2006

Stocks Are Still Undervalued

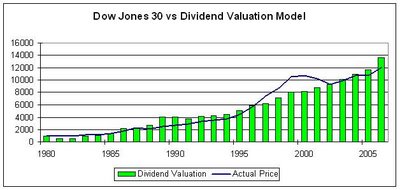

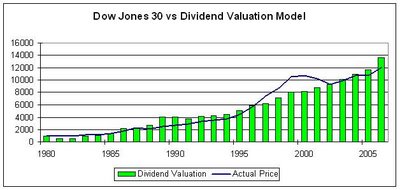

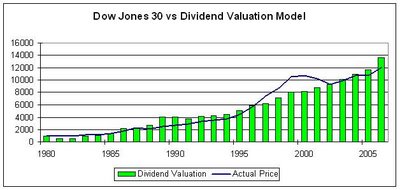

With stocks having staged a strong rally, and changes in political leadership stealing all the headlines, I thought it would be interesting to see an update of our Dow Jones Dividend Valuation Model. The model is a regression of dividend growth and changes in interest rates versus changes in the Dow's price over the last 45 years.

The model can best be understood by thinking of the green bars as valuation steps. The chart shows that as a result of very strong dividend growth and moderate changes in interest rate that stocks are more undervalued now than they were at the start of the year, even considering their solid price performance this year.

The model is being pushed higher by bond yields being lower than their long-term average and dividend growth being much higher than its long-term average. The Dividend Valuation Model is signaling that stocks are still nearly 10% undervalued, which would target a level above 13,000.

Another 10% move seems a bit ambitious, especially when considering the gains made so far this year and the uncertainties in the political arena.

The change in political leadership is not a great surprise to the market. The polls and various overseas betting lines showed such a possibility for months.

The momentum remains positive for stocks and, in my judgment, there is a clear valuation gap that is likely to close to some degree over the next year.

The change in political leadership is not a great surprise to the market. The polls and various overseas betting lines showed such a possibility for months.

The momentum remains positive for stocks and, in my judgment, there is a clear valuation gap that is likely to close to some degree over the next year.

The change in political leadership is not a great surprise to the market. The polls and various overseas betting lines showed such a possibility for months.

The momentum remains positive for stocks and, in my judgment, there is a clear valuation gap that is likely to close to some degree over the next year.

The change in political leadership is not a great surprise to the market. The polls and various overseas betting lines showed such a possibility for months.

The momentum remains positive for stocks and, in my judgment, there is a clear valuation gap that is likely to close to some degree over the next year.