The main reason the model is so undervalued is the very low level of interest rates combined with higher than average dividend growth. I think the odds of these two trends continuing are very high. For that reason, I see valuation creation growing above historical long-term trends for the next several quarters.

There are certainly issues in the economy and the geopolitical arena, but in my estimation, they are amply discounted in the current prices of the Dow.

If there is a surprise, it is that high quality Blue Chip stocks will continue to rise even as the economy slows. More on that later.

The main reason the model is so undervalued is the very low level of interest rates combined with higher than average dividend growth. I think the odds of these two trends continuing are very high. For that reason, I see valuation creation growing above historical long-term trends for the next several quarters.

There are certainly issues in the economy and the geopolitical arena, but in my estimation, they are amply discounted in the current prices of the Dow.

If there is a surprise, it is that high quality Blue Chip stocks will continue to rise even as the economy slows. More on that later.

Friday, October 06, 2006

Still Room to Go

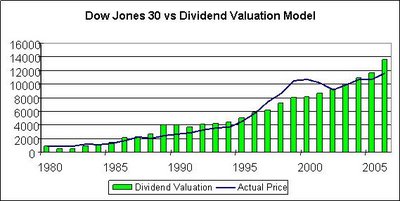

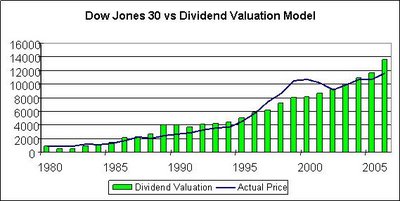

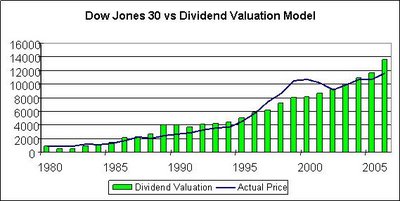

Blue Chip stocks have had a very strong 45 day run and eventually some profit taking will occur. An updated look at our Dividend Valuation Model, however, shows that there is still plenty of value left in the Dow Jones 30 stocks. The model is currently saying that based on year-end 2006 projected dividends and interest rates that the Dow Jones 30's "fair value" is near 13500.

As I have noted in other blogs and shown on the chart, the model became "undervalued" in 2005 and the undervaluation has widened in 2006, even though stock prices have risen. The reason is simple. Dividends have grown faster than prices over the last 24 months.

The model, as with any model, is not something you can take to the bank, it does provide a kind of order of magnitude of how the Dow Jones would be priced today if it were priced in accordance with long term averages.

The main reason the model is so undervalued is the very low level of interest rates combined with higher than average dividend growth. I think the odds of these two trends continuing are very high. For that reason, I see valuation creation growing above historical long-term trends for the next several quarters.

There are certainly issues in the economy and the geopolitical arena, but in my estimation, they are amply discounted in the current prices of the Dow.

If there is a surprise, it is that high quality Blue Chip stocks will continue to rise even as the economy slows. More on that later.

The main reason the model is so undervalued is the very low level of interest rates combined with higher than average dividend growth. I think the odds of these two trends continuing are very high. For that reason, I see valuation creation growing above historical long-term trends for the next several quarters.

There are certainly issues in the economy and the geopolitical arena, but in my estimation, they are amply discounted in the current prices of the Dow.

If there is a surprise, it is that high quality Blue Chip stocks will continue to rise even as the economy slows. More on that later.

The main reason the model is so undervalued is the very low level of interest rates combined with higher than average dividend growth. I think the odds of these two trends continuing are very high. For that reason, I see valuation creation growing above historical long-term trends for the next several quarters.

There are certainly issues in the economy and the geopolitical arena, but in my estimation, they are amply discounted in the current prices of the Dow.

If there is a surprise, it is that high quality Blue Chip stocks will continue to rise even as the economy slows. More on that later.

The main reason the model is so undervalued is the very low level of interest rates combined with higher than average dividend growth. I think the odds of these two trends continuing are very high. For that reason, I see valuation creation growing above historical long-term trends for the next several quarters.

There are certainly issues in the economy and the geopolitical arena, but in my estimation, they are amply discounted in the current prices of the Dow.

If there is a surprise, it is that high quality Blue Chip stocks will continue to rise even as the economy slows. More on that later.