I estimated that the Funds From Operations and dividends would grow at 10% per year over the next 5 years and then decline over the next 5 years to 5% long-term growth. I used a discount factor of 9%, which I think is about right with 10-year T-bonds at 4.5%.

Using these data points, the model --click to enlarge the table -- shows that PLD's theoretical value is $66.83. With the price about $64 that means that PLD is, actually, about fairly valued. If that is the case, I would expect it to go sideways from here. If it continues going straight up, and anyone starts using those dangerous words, "It's different this time," I would run for the hills.

This blog is for information purposes only. Do not make buy and sell decisions based on what you read here. Please consult your own financial advisor.

I estimated that the Funds From Operations and dividends would grow at 10% per year over the next 5 years and then decline over the next 5 years to 5% long-term growth. I used a discount factor of 9%, which I think is about right with 10-year T-bonds at 4.5%.

Using these data points, the model --click to enlarge the table -- shows that PLD's theoretical value is $66.83. With the price about $64 that means that PLD is, actually, about fairly valued. If that is the case, I would expect it to go sideways from here. If it continues going straight up, and anyone starts using those dangerous words, "It's different this time," I would run for the hills.

This blog is for information purposes only. Do not make buy and sell decisions based on what you read here. Please consult your own financial advisor.

Wednesday, November 22, 2006

Are the REITS too High?

In most of our Dividend Valuation Models, the Real Estate Investment Trusts (REITs) have been slightly overvalued for months. We have cut back just a bit, but we have continued to hold the REITs, thinking that the fall in rates would continue to push them higher. That has been the case.

We are value investors, but in our years of watching the interplay between prices and values, we have noticed that stocks tend to stay overvalued and undervalued for long periods of time, often as long as three years.

Most REITS are only modestly overvalued and not worrisome to us, but a couple we own are starting to resemble tech stocks of old. Of these, the stock that is the most difficult to value is Prologis. PLD is an international logistics firm that provides warehousing to large multinational firms all over the world. A quick search indicates that PLD is the most international of all US REITs, and importantly, the most global of all warehousing REITs. It has been a prime benefactor of the global economy, and its price has reflected it, rising over 30% year to date.

Attempting to value PLD is tough because it is among a handful of REITs that are self funding. Being able fund growth from internal cash flow, has allowed PLD to grow funds from operations at 10% per year over the last 10 years, which is much higher than the average REIT.

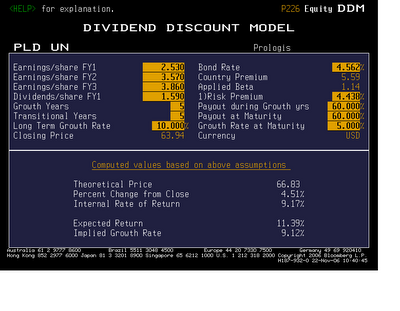

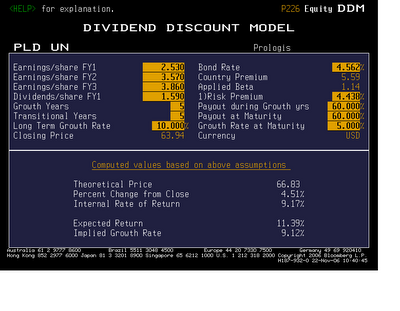

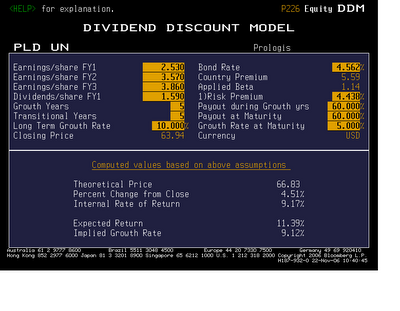

In attempting to determine a value for PLD, I resorted to Bloomberg's Dividend Discount Model and entered funds from operations data, which is much more reflective of PLD's business that are earnings.

..................Prologis Dividend Discount Model...............

I estimated that the Funds From Operations and dividends would grow at 10% per year over the next 5 years and then decline over the next 5 years to 5% long-term growth. I used a discount factor of 9%, which I think is about right with 10-year T-bonds at 4.5%.

Using these data points, the model --click to enlarge the table -- shows that PLD's theoretical value is $66.83. With the price about $64 that means that PLD is, actually, about fairly valued. If that is the case, I would expect it to go sideways from here. If it continues going straight up, and anyone starts using those dangerous words, "It's different this time," I would run for the hills.

This blog is for information purposes only. Do not make buy and sell decisions based on what you read here. Please consult your own financial advisor.

I estimated that the Funds From Operations and dividends would grow at 10% per year over the next 5 years and then decline over the next 5 years to 5% long-term growth. I used a discount factor of 9%, which I think is about right with 10-year T-bonds at 4.5%.

Using these data points, the model --click to enlarge the table -- shows that PLD's theoretical value is $66.83. With the price about $64 that means that PLD is, actually, about fairly valued. If that is the case, I would expect it to go sideways from here. If it continues going straight up, and anyone starts using those dangerous words, "It's different this time," I would run for the hills.

This blog is for information purposes only. Do not make buy and sell decisions based on what you read here. Please consult your own financial advisor.

I estimated that the Funds From Operations and dividends would grow at 10% per year over the next 5 years and then decline over the next 5 years to 5% long-term growth. I used a discount factor of 9%, which I think is about right with 10-year T-bonds at 4.5%.

Using these data points, the model --click to enlarge the table -- shows that PLD's theoretical value is $66.83. With the price about $64 that means that PLD is, actually, about fairly valued. If that is the case, I would expect it to go sideways from here. If it continues going straight up, and anyone starts using those dangerous words, "It's different this time," I would run for the hills.

This blog is for information purposes only. Do not make buy and sell decisions based on what you read here. Please consult your own financial advisor.

I estimated that the Funds From Operations and dividends would grow at 10% per year over the next 5 years and then decline over the next 5 years to 5% long-term growth. I used a discount factor of 9%, which I think is about right with 10-year T-bonds at 4.5%.

Using these data points, the model --click to enlarge the table -- shows that PLD's theoretical value is $66.83. With the price about $64 that means that PLD is, actually, about fairly valued. If that is the case, I would expect it to go sideways from here. If it continues going straight up, and anyone starts using those dangerous words, "It's different this time," I would run for the hills.

This blog is for information purposes only. Do not make buy and sell decisions based on what you read here. Please consult your own financial advisor.