My research shows that stocks spend very little time at "fair value." They wiggle and wobble around and through "fair value," but the animal spirits of momentum investors seem to preclude long stays there. As we have been saying for many months, the economy is slowing and money has been moving from cyclical and smaller companies to larger more defensive stocks. Many of the defensive stocks have had strong moves, prompting the question, "Do they have anything left."

To answer that question, I will analyze Procter and Gamble - PG, one of the key stocks in the consumer staples sector, which is at the heart of the defensive group.

Our Dividend Correlation Model and Bloomberg's Dividend Discount Model both are saying PG is cheap. Not only relative to itself, but relative to other big cap stocks.

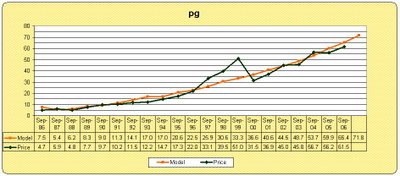

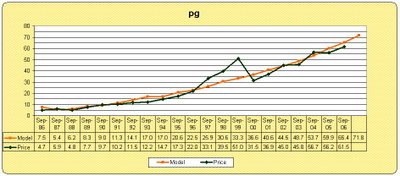

Chart I shows our DCM valuation of PG over the past 20 years.

.............................Procter and Gamble.............................

To see the model more clearly please click the image.

The green line (dark) shows PG's annual price since 1986. The gold line (light) is our Dividend Valuation Model's indicated "fair value" for each year. You will note a lot of wiggling and wobbling between the two lines, but they are clearly highly correlated, and, as we have shown previously, price does most of the wiggling and wobbling.

The model currently says that the expected "fair value" for 2007 is 71.80, or about 17% above the current price of $61.50. Our model says PG is very cheap.

..............................Procter and Gamble...........................

Chart II shows Bloomberg's Dividend Discount Model valuation of PG. A Dividend Discount analysis is a forward looking computation of the discounted present value of PG's future dividend payments.

Looking at the lower half of the table you can see that the Theoretical Price of PG, as computed by the Dividend Discount Model, is $77.04, or 25% higher than the current price.

I'll leave for another time a wider discussion of the table.

Here's the last word. The slowing economy will cause many stock groups to either go flat or fall. The consumer staples sector is not likely to be affected much by the slowing economy because the products they sell are modestly priced and we use them everyday. As the economic slowdown becomes more apparent, I believe the consistent earnings and dividend growth of PG (and many of the other stocks in the consumer staples sector) will become more highly prized by Wall Street, and the momentum players will drive PG's price higher.

The valuation models shown here suggest that PG has a ways to go just to reach "fair value," and as I said in the beginning, stocks don't spend much time fairly valued. I would argue that PG might see a time during the next 18 months when the momentum players will push it above fair value. You do the math.

Blessings,

Donaldson Capital clients, employees, and I own PG. This is not a buy recommendation, it is an example of valuation models and macro-economic analysis. In addition, we may sell PG in the future without notice.

To see the model more clearly please click the image.

The green line (dark) shows PG's annual price since 1986. The gold line (light) is our Dividend Valuation Model's indicated "fair value" for each year. You will note a lot of wiggling and wobbling between the two lines, but they are clearly highly correlated, and, as we have shown previously, price does most of the wiggling and wobbling.

The model currently says that the expected "fair value" for 2007 is 71.80, or about 17% above the current price of $61.50. Our model says PG is very cheap.

..............................Procter and Gamble...........................

To see the model more clearly please click the image.

The green line (dark) shows PG's annual price since 1986. The gold line (light) is our Dividend Valuation Model's indicated "fair value" for each year. You will note a lot of wiggling and wobbling between the two lines, but they are clearly highly correlated, and, as we have shown previously, price does most of the wiggling and wobbling.

The model currently says that the expected "fair value" for 2007 is 71.80, or about 17% above the current price of $61.50. Our model says PG is very cheap.

..............................Procter and Gamble...........................

Chart II shows Bloomberg's Dividend Discount Model valuation of PG. A Dividend Discount analysis is a forward looking computation of the discounted present value of PG's future dividend payments.

Looking at the lower half of the table you can see that the Theoretical Price of PG, as computed by the Dividend Discount Model, is $77.04, or 25% higher than the current price.

I'll leave for another time a wider discussion of the table.

Here's the last word. The slowing economy will cause many stock groups to either go flat or fall. The consumer staples sector is not likely to be affected much by the slowing economy because the products they sell are modestly priced and we use them everyday. As the economic slowdown becomes more apparent, I believe the consistent earnings and dividend growth of PG (and many of the other stocks in the consumer staples sector) will become more highly prized by Wall Street, and the momentum players will drive PG's price higher.

The valuation models shown here suggest that PG has a ways to go just to reach "fair value," and as I said in the beginning, stocks don't spend much time fairly valued. I would argue that PG might see a time during the next 18 months when the momentum players will push it above fair value. You do the math.

Blessings,

Donaldson Capital clients, employees, and I own PG. This is not a buy recommendation, it is an example of valuation models and macro-economic analysis. In addition, we may sell PG in the future without notice.

Chart II shows Bloomberg's Dividend Discount Model valuation of PG. A Dividend Discount analysis is a forward looking computation of the discounted present value of PG's future dividend payments.

Looking at the lower half of the table you can see that the Theoretical Price of PG, as computed by the Dividend Discount Model, is $77.04, or 25% higher than the current price.

I'll leave for another time a wider discussion of the table.

Here's the last word. The slowing economy will cause many stock groups to either go flat or fall. The consumer staples sector is not likely to be affected much by the slowing economy because the products they sell are modestly priced and we use them everyday. As the economic slowdown becomes more apparent, I believe the consistent earnings and dividend growth of PG (and many of the other stocks in the consumer staples sector) will become more highly prized by Wall Street, and the momentum players will drive PG's price higher.

The valuation models shown here suggest that PG has a ways to go just to reach "fair value," and as I said in the beginning, stocks don't spend much time fairly valued. I would argue that PG might see a time during the next 18 months when the momentum players will push it above fair value. You do the math.

Blessings,

Donaldson Capital clients, employees, and I own PG. This is not a buy recommendation, it is an example of valuation models and macro-economic analysis. In addition, we may sell PG in the future without notice.