Think of the green bars as "value" steps, or intrinsic value. For the 7 years from 1986 through 1993, Coke's market price (blue line) consistently sold below its intrinsic value. Beginning in 1995, things changed and under valuation was replaced with over valuation, as Coke appeared to be climbing a stairway to heaven.

By 1998, with Coke levitating 40% above its DVM, there was no shortage of buy recommendations by Wall Street analysts.

Coke's downtrend over the last 7 years has been caused by a combination of a normal correction back to its intrinsic value, and its own abysmal performance.

Two years ago, Coke finally appeared to correct their leadership problem by promoting Irishman Neville Isdell to CEO. By most accounts, he has the support of Coke employees and bottlers. In recent quarters, sales and earnings have bottomed and begun to firm.

Recently, the company reported much better than expected earnings, which push the stock higher. I noticed that the consensus ranking by Wall Street analysts did not budge with the good news on earnings. They still rank the stock as an average performer for the coming year. With the stock undervalued and big cap blue chip stocks back in favor, to ignore the progress that Coke has made is shortsighted. Besides seven years is a long time for Wall Street to hold a grudge.

Look for Coke to begin a long slow climb as more and more Wall Street types forgive the company for past missteps and admit that there is no such thing as an idiot proof company.

The Dividend Valuation Model says we are in the first year of an upturn. I wonder if that means, we can count on 6 more years of price gains? Stay tuned.

This blog is for information purposes only. Do not make buy and sell decisions based on what I have said here. Clients, Employees, and Principals of Donaldson Capital Management may own shares of Coke.

Think of the green bars as "value" steps, or intrinsic value. For the 7 years from 1986 through 1993, Coke's market price (blue line) consistently sold below its intrinsic value. Beginning in 1995, things changed and under valuation was replaced with over valuation, as Coke appeared to be climbing a stairway to heaven.

By 1998, with Coke levitating 40% above its DVM, there was no shortage of buy recommendations by Wall Street analysts.

Coke's downtrend over the last 7 years has been caused by a combination of a normal correction back to its intrinsic value, and its own abysmal performance.

Two years ago, Coke finally appeared to correct their leadership problem by promoting Irishman Neville Isdell to CEO. By most accounts, he has the support of Coke employees and bottlers. In recent quarters, sales and earnings have bottomed and begun to firm.

Recently, the company reported much better than expected earnings, which push the stock higher. I noticed that the consensus ranking by Wall Street analysts did not budge with the good news on earnings. They still rank the stock as an average performer for the coming year. With the stock undervalued and big cap blue chip stocks back in favor, to ignore the progress that Coke has made is shortsighted. Besides seven years is a long time for Wall Street to hold a grudge.

Look for Coke to begin a long slow climb as more and more Wall Street types forgive the company for past missteps and admit that there is no such thing as an idiot proof company.

The Dividend Valuation Model says we are in the first year of an upturn. I wonder if that means, we can count on 6 more years of price gains? Stay tuned.

This blog is for information purposes only. Do not make buy and sell decisions based on what I have said here. Clients, Employees, and Principals of Donaldson Capital Management may own shares of Coke.

Thursday, November 02, 2006

Coke Bubbles Up

Few stocks has been more disappointing over he last few years than Coke. After the death of Robert Goizeuta in 1997, the company elevated a series of men to CEO whom the troops refused to follow. The absence of a strong leader for this most multinational of all US companies caused the unthinkable to happen: the company whose brand was thought to be so powerful that an idiot could run it, buckled under ill-conceived new products, frequent quality issues, and internal struggles that bordered on mutiny.

Nowhere has the disappointment been more visceral than between the company and old-line Wall Street analysts. In short, Wall Street believes that Coke has managed to tarnish the single most recognized brand on the planet. Bloomberg research shows that few of the largest Wall Street firms have "buy" recommendations on the company, even though Coke's business appears to have turned.

Our Dividend Valuation Model (DVM) is suggesting that the old-line analysts might be judging the company from the rear view mirror. If Coke's prospects have turned, as I believe they have, then we should have plenty of fresh money pouring into the stock over the next few years as Wall Street is forced to admit that Coke is, indeed, The Real Thing -- again

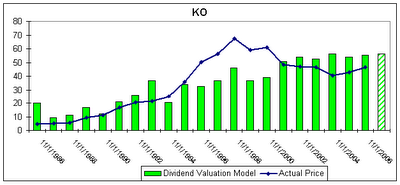

The chart below shows that the correlation between Coke and its DVM is not high. But, interestingly, it does show that the market has a history of mispricing Coke in regular patterns.

...............Coke Dividend Valuation Model...............

Think of the green bars as "value" steps, or intrinsic value. For the 7 years from 1986 through 1993, Coke's market price (blue line) consistently sold below its intrinsic value. Beginning in 1995, things changed and under valuation was replaced with over valuation, as Coke appeared to be climbing a stairway to heaven.

By 1998, with Coke levitating 40% above its DVM, there was no shortage of buy recommendations by Wall Street analysts.

Coke's downtrend over the last 7 years has been caused by a combination of a normal correction back to its intrinsic value, and its own abysmal performance.

Two years ago, Coke finally appeared to correct their leadership problem by promoting Irishman Neville Isdell to CEO. By most accounts, he has the support of Coke employees and bottlers. In recent quarters, sales and earnings have bottomed and begun to firm.

Recently, the company reported much better than expected earnings, which push the stock higher. I noticed that the consensus ranking by Wall Street analysts did not budge with the good news on earnings. They still rank the stock as an average performer for the coming year. With the stock undervalued and big cap blue chip stocks back in favor, to ignore the progress that Coke has made is shortsighted. Besides seven years is a long time for Wall Street to hold a grudge.

Look for Coke to begin a long slow climb as more and more Wall Street types forgive the company for past missteps and admit that there is no such thing as an idiot proof company.

The Dividend Valuation Model says we are in the first year of an upturn. I wonder if that means, we can count on 6 more years of price gains? Stay tuned.

This blog is for information purposes only. Do not make buy and sell decisions based on what I have said here. Clients, Employees, and Principals of Donaldson Capital Management may own shares of Coke.

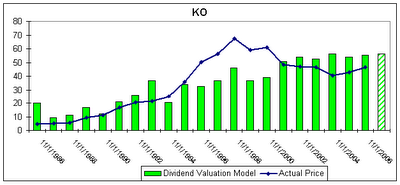

Think of the green bars as "value" steps, or intrinsic value. For the 7 years from 1986 through 1993, Coke's market price (blue line) consistently sold below its intrinsic value. Beginning in 1995, things changed and under valuation was replaced with over valuation, as Coke appeared to be climbing a stairway to heaven.

By 1998, with Coke levitating 40% above its DVM, there was no shortage of buy recommendations by Wall Street analysts.

Coke's downtrend over the last 7 years has been caused by a combination of a normal correction back to its intrinsic value, and its own abysmal performance.

Two years ago, Coke finally appeared to correct their leadership problem by promoting Irishman Neville Isdell to CEO. By most accounts, he has the support of Coke employees and bottlers. In recent quarters, sales and earnings have bottomed and begun to firm.

Recently, the company reported much better than expected earnings, which push the stock higher. I noticed that the consensus ranking by Wall Street analysts did not budge with the good news on earnings. They still rank the stock as an average performer for the coming year. With the stock undervalued and big cap blue chip stocks back in favor, to ignore the progress that Coke has made is shortsighted. Besides seven years is a long time for Wall Street to hold a grudge.

Look for Coke to begin a long slow climb as more and more Wall Street types forgive the company for past missteps and admit that there is no such thing as an idiot proof company.

The Dividend Valuation Model says we are in the first year of an upturn. I wonder if that means, we can count on 6 more years of price gains? Stay tuned.

This blog is for information purposes only. Do not make buy and sell decisions based on what I have said here. Clients, Employees, and Principals of Donaldson Capital Management may own shares of Coke.

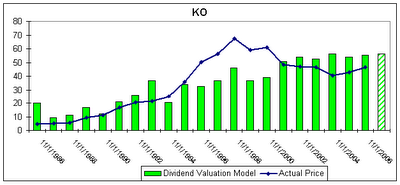

Think of the green bars as "value" steps, or intrinsic value. For the 7 years from 1986 through 1993, Coke's market price (blue line) consistently sold below its intrinsic value. Beginning in 1995, things changed and under valuation was replaced with over valuation, as Coke appeared to be climbing a stairway to heaven.

By 1998, with Coke levitating 40% above its DVM, there was no shortage of buy recommendations by Wall Street analysts.

Coke's downtrend over the last 7 years has been caused by a combination of a normal correction back to its intrinsic value, and its own abysmal performance.

Two years ago, Coke finally appeared to correct their leadership problem by promoting Irishman Neville Isdell to CEO. By most accounts, he has the support of Coke employees and bottlers. In recent quarters, sales and earnings have bottomed and begun to firm.

Recently, the company reported much better than expected earnings, which push the stock higher. I noticed that the consensus ranking by Wall Street analysts did not budge with the good news on earnings. They still rank the stock as an average performer for the coming year. With the stock undervalued and big cap blue chip stocks back in favor, to ignore the progress that Coke has made is shortsighted. Besides seven years is a long time for Wall Street to hold a grudge.

Look for Coke to begin a long slow climb as more and more Wall Street types forgive the company for past missteps and admit that there is no such thing as an idiot proof company.

The Dividend Valuation Model says we are in the first year of an upturn. I wonder if that means, we can count on 6 more years of price gains? Stay tuned.

This blog is for information purposes only. Do not make buy and sell decisions based on what I have said here. Clients, Employees, and Principals of Donaldson Capital Management may own shares of Coke.

Think of the green bars as "value" steps, or intrinsic value. For the 7 years from 1986 through 1993, Coke's market price (blue line) consistently sold below its intrinsic value. Beginning in 1995, things changed and under valuation was replaced with over valuation, as Coke appeared to be climbing a stairway to heaven.

By 1998, with Coke levitating 40% above its DVM, there was no shortage of buy recommendations by Wall Street analysts.

Coke's downtrend over the last 7 years has been caused by a combination of a normal correction back to its intrinsic value, and its own abysmal performance.

Two years ago, Coke finally appeared to correct their leadership problem by promoting Irishman Neville Isdell to CEO. By most accounts, he has the support of Coke employees and bottlers. In recent quarters, sales and earnings have bottomed and begun to firm.

Recently, the company reported much better than expected earnings, which push the stock higher. I noticed that the consensus ranking by Wall Street analysts did not budge with the good news on earnings. They still rank the stock as an average performer for the coming year. With the stock undervalued and big cap blue chip stocks back in favor, to ignore the progress that Coke has made is shortsighted. Besides seven years is a long time for Wall Street to hold a grudge.

Look for Coke to begin a long slow climb as more and more Wall Street types forgive the company for past missteps and admit that there is no such thing as an idiot proof company.

The Dividend Valuation Model says we are in the first year of an upturn. I wonder if that means, we can count on 6 more years of price gains? Stay tuned.

This blog is for information purposes only. Do not make buy and sell decisions based on what I have said here. Clients, Employees, and Principals of Donaldson Capital Management may own shares of Coke.