The fourth column under Corn is the price. To transpose it into dollars per bushel, just put the decimal point after the first digit, ie. the price for the contract for Sep '06, which reads 225'0, would mean $2.25 per bushel.

As you go down the table; you will notice that prices go up every year until we reach a high price of $3.30 for the Dec '09 contract.

For a speculator to make a profit on the Dec '09 contract, the price of corn will have to exceed $3.30 per bushel. That is nearly 50% higher than today's price, and much higher than would ordinarily be expected.

Why are commodity traders so bullish on corn? Do they know something about the weather that we don't know? That is possible because they can now trade the weather, but I think the reason corn futures are so high is contained in one word: ethanol.

Lots of big money believe, as I do, that changes are coming in the way we power our machines. In this case, they are betting that corn (ethanol) will have an increasing role as a fuel for our cars, trucks, and tractors.

To me the growing use of ethanol ( no matter its actual energy efficiency) is a forgone conclusion among the big players in both the agricultural as well as the automotive industries. As shown here, this will drive up corn prices (you might want to hoard some corn flakes for the kids and some whiskey for yourself), but it will give Americans some feeling of greater control over their energy needs.

But, in my judgment, the greater use of ethanol and biodiesels are just the beginning. There are scores of hybrid engines on the way that will get up to 50 miles per gallon and more. They will cost more, but what is given up in dollars will be more than made up in a growing sense of prudence.

Prudence may seem like an old fashion word, but billions of dollars are spent annually on prudence called by another name: insurance.

Archer Daniel Midland -- ADM -- is the way most people are playing ethanol and biodiesel. I'm kind of a "picks and shovels" guy. I like Deere. Ethanol and biodiesel will mean fence row to fence row planting throughout the world. Deere is dominant between the fence rows.

Donaldson Capital nor I own either of the stocks, although we are evaluating Deere. Both companies are first rate, even in the absence of ethanol and biodiesel opportunities.

The fourth column under Corn is the price. To transpose it into dollars per bushel, just put the decimal point after the first digit, ie. the price for the contract for Sep '06, which reads 225'0, would mean $2.25 per bushel.

As you go down the table; you will notice that prices go up every year until we reach a high price of $3.30 for the Dec '09 contract.

For a speculator to make a profit on the Dec '09 contract, the price of corn will have to exceed $3.30 per bushel. That is nearly 50% higher than today's price, and much higher than would ordinarily be expected.

Why are commodity traders so bullish on corn? Do they know something about the weather that we don't know? That is possible because they can now trade the weather, but I think the reason corn futures are so high is contained in one word: ethanol.

Lots of big money believe, as I do, that changes are coming in the way we power our machines. In this case, they are betting that corn (ethanol) will have an increasing role as a fuel for our cars, trucks, and tractors.

To me the growing use of ethanol ( no matter its actual energy efficiency) is a forgone conclusion among the big players in both the agricultural as well as the automotive industries. As shown here, this will drive up corn prices (you might want to hoard some corn flakes for the kids and some whiskey for yourself), but it will give Americans some feeling of greater control over their energy needs.

But, in my judgment, the greater use of ethanol and biodiesels are just the beginning. There are scores of hybrid engines on the way that will get up to 50 miles per gallon and more. They will cost more, but what is given up in dollars will be more than made up in a growing sense of prudence.

Prudence may seem like an old fashion word, but billions of dollars are spent annually on prudence called by another name: insurance.

Archer Daniel Midland -- ADM -- is the way most people are playing ethanol and biodiesel. I'm kind of a "picks and shovels" guy. I like Deere. Ethanol and biodiesel will mean fence row to fence row planting throughout the world. Deere is dominant between the fence rows.

Donaldson Capital nor I own either of the stocks, although we are evaluating Deere. Both companies are first rate, even in the absence of ethanol and biodiesel opportunities.

Sunday, August 27, 2006

Energy: The New Y2K: Investing in Prudence

A few weeks ago, I said that energy is the new Y2k. That is, people who do any kind of planning realize that our present sources of petroleum are largely in the hands of people who are not our friends. Prudence dictates alternatives. I mentioned that new energy-saving technologies for automobiles, the home, and corporations will make obsolete many of today's propulsion machines and a lot sooner than most people think.

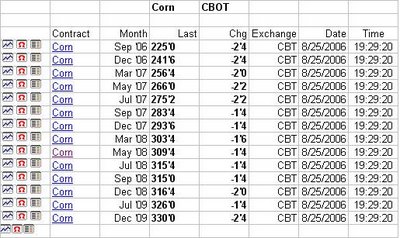

If you do not believe me that something big is going on, then maybe you'll believe the big commodities traders. The table below is from The Wall Street Journal's commodity page. It shows the price of corn futures through 2009.

................................Corn Futures...................

The fourth column under Corn is the price. To transpose it into dollars per bushel, just put the decimal point after the first digit, ie. the price for the contract for Sep '06, which reads 225'0, would mean $2.25 per bushel.

As you go down the table; you will notice that prices go up every year until we reach a high price of $3.30 for the Dec '09 contract.

For a speculator to make a profit on the Dec '09 contract, the price of corn will have to exceed $3.30 per bushel. That is nearly 50% higher than today's price, and much higher than would ordinarily be expected.

Why are commodity traders so bullish on corn? Do they know something about the weather that we don't know? That is possible because they can now trade the weather, but I think the reason corn futures are so high is contained in one word: ethanol.

Lots of big money believe, as I do, that changes are coming in the way we power our machines. In this case, they are betting that corn (ethanol) will have an increasing role as a fuel for our cars, trucks, and tractors.

To me the growing use of ethanol ( no matter its actual energy efficiency) is a forgone conclusion among the big players in both the agricultural as well as the automotive industries. As shown here, this will drive up corn prices (you might want to hoard some corn flakes for the kids and some whiskey for yourself), but it will give Americans some feeling of greater control over their energy needs.

But, in my judgment, the greater use of ethanol and biodiesels are just the beginning. There are scores of hybrid engines on the way that will get up to 50 miles per gallon and more. They will cost more, but what is given up in dollars will be more than made up in a growing sense of prudence.

Prudence may seem like an old fashion word, but billions of dollars are spent annually on prudence called by another name: insurance.

Archer Daniel Midland -- ADM -- is the way most people are playing ethanol and biodiesel. I'm kind of a "picks and shovels" guy. I like Deere. Ethanol and biodiesel will mean fence row to fence row planting throughout the world. Deere is dominant between the fence rows.

Donaldson Capital nor I own either of the stocks, although we are evaluating Deere. Both companies are first rate, even in the absence of ethanol and biodiesel opportunities.

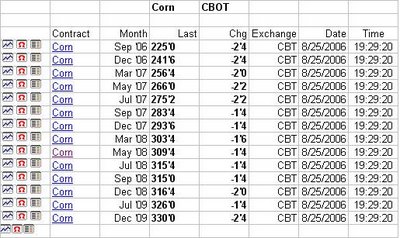

The fourth column under Corn is the price. To transpose it into dollars per bushel, just put the decimal point after the first digit, ie. the price for the contract for Sep '06, which reads 225'0, would mean $2.25 per bushel.

As you go down the table; you will notice that prices go up every year until we reach a high price of $3.30 for the Dec '09 contract.

For a speculator to make a profit on the Dec '09 contract, the price of corn will have to exceed $3.30 per bushel. That is nearly 50% higher than today's price, and much higher than would ordinarily be expected.

Why are commodity traders so bullish on corn? Do they know something about the weather that we don't know? That is possible because they can now trade the weather, but I think the reason corn futures are so high is contained in one word: ethanol.

Lots of big money believe, as I do, that changes are coming in the way we power our machines. In this case, they are betting that corn (ethanol) will have an increasing role as a fuel for our cars, trucks, and tractors.

To me the growing use of ethanol ( no matter its actual energy efficiency) is a forgone conclusion among the big players in both the agricultural as well as the automotive industries. As shown here, this will drive up corn prices (you might want to hoard some corn flakes for the kids and some whiskey for yourself), but it will give Americans some feeling of greater control over their energy needs.

But, in my judgment, the greater use of ethanol and biodiesels are just the beginning. There are scores of hybrid engines on the way that will get up to 50 miles per gallon and more. They will cost more, but what is given up in dollars will be more than made up in a growing sense of prudence.

Prudence may seem like an old fashion word, but billions of dollars are spent annually on prudence called by another name: insurance.

Archer Daniel Midland -- ADM -- is the way most people are playing ethanol and biodiesel. I'm kind of a "picks and shovels" guy. I like Deere. Ethanol and biodiesel will mean fence row to fence row planting throughout the world. Deere is dominant between the fence rows.

Donaldson Capital nor I own either of the stocks, although we are evaluating Deere. Both companies are first rate, even in the absence of ethanol and biodiesel opportunities.

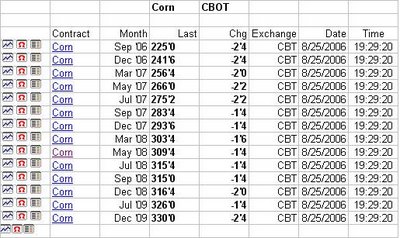

The fourth column under Corn is the price. To transpose it into dollars per bushel, just put the decimal point after the first digit, ie. the price for the contract for Sep '06, which reads 225'0, would mean $2.25 per bushel.

As you go down the table; you will notice that prices go up every year until we reach a high price of $3.30 for the Dec '09 contract.

For a speculator to make a profit on the Dec '09 contract, the price of corn will have to exceed $3.30 per bushel. That is nearly 50% higher than today's price, and much higher than would ordinarily be expected.

Why are commodity traders so bullish on corn? Do they know something about the weather that we don't know? That is possible because they can now trade the weather, but I think the reason corn futures are so high is contained in one word: ethanol.

Lots of big money believe, as I do, that changes are coming in the way we power our machines. In this case, they are betting that corn (ethanol) will have an increasing role as a fuel for our cars, trucks, and tractors.

To me the growing use of ethanol ( no matter its actual energy efficiency) is a forgone conclusion among the big players in both the agricultural as well as the automotive industries. As shown here, this will drive up corn prices (you might want to hoard some corn flakes for the kids and some whiskey for yourself), but it will give Americans some feeling of greater control over their energy needs.

But, in my judgment, the greater use of ethanol and biodiesels are just the beginning. There are scores of hybrid engines on the way that will get up to 50 miles per gallon and more. They will cost more, but what is given up in dollars will be more than made up in a growing sense of prudence.

Prudence may seem like an old fashion word, but billions of dollars are spent annually on prudence called by another name: insurance.

Archer Daniel Midland -- ADM -- is the way most people are playing ethanol and biodiesel. I'm kind of a "picks and shovels" guy. I like Deere. Ethanol and biodiesel will mean fence row to fence row planting throughout the world. Deere is dominant between the fence rows.

Donaldson Capital nor I own either of the stocks, although we are evaluating Deere. Both companies are first rate, even in the absence of ethanol and biodiesel opportunities.

The fourth column under Corn is the price. To transpose it into dollars per bushel, just put the decimal point after the first digit, ie. the price for the contract for Sep '06, which reads 225'0, would mean $2.25 per bushel.

As you go down the table; you will notice that prices go up every year until we reach a high price of $3.30 for the Dec '09 contract.

For a speculator to make a profit on the Dec '09 contract, the price of corn will have to exceed $3.30 per bushel. That is nearly 50% higher than today's price, and much higher than would ordinarily be expected.

Why are commodity traders so bullish on corn? Do they know something about the weather that we don't know? That is possible because they can now trade the weather, but I think the reason corn futures are so high is contained in one word: ethanol.

Lots of big money believe, as I do, that changes are coming in the way we power our machines. In this case, they are betting that corn (ethanol) will have an increasing role as a fuel for our cars, trucks, and tractors.

To me the growing use of ethanol ( no matter its actual energy efficiency) is a forgone conclusion among the big players in both the agricultural as well as the automotive industries. As shown here, this will drive up corn prices (you might want to hoard some corn flakes for the kids and some whiskey for yourself), but it will give Americans some feeling of greater control over their energy needs.

But, in my judgment, the greater use of ethanol and biodiesels are just the beginning. There are scores of hybrid engines on the way that will get up to 50 miles per gallon and more. They will cost more, but what is given up in dollars will be more than made up in a growing sense of prudence.

Prudence may seem like an old fashion word, but billions of dollars are spent annually on prudence called by another name: insurance.

Archer Daniel Midland -- ADM -- is the way most people are playing ethanol and biodiesel. I'm kind of a "picks and shovels" guy. I like Deere. Ethanol and biodiesel will mean fence row to fence row planting throughout the world. Deere is dominant between the fence rows.

Donaldson Capital nor I own either of the stocks, although we are evaluating Deere. Both companies are first rate, even in the absence of ethanol and biodiesel opportunities.