Wednesday, November 29, 2006

Wachovia: Know Them by the Companies -- They Buy

Sometimes the best way to know someone is by observing the company they keep. I believe that is the case with Wachovia Bank. Wachovia(WB) became one of our largest holdings when it bought our favorite bank, Birmingham Al. based Southtrust. We owned Southtrust(SOTR) because we thought it was the best regional Sunbelt bank, which was largely the result of the leadership of chairman, Wallace Malone.

Malone was a straight-talking old fashioned banker who kept his costs low and never missed an opportunity to go where the the gettin' was good. I thought he understood the power of a bank and how to squeeze profits out of it as well as anyone.

When he sold Southtrust to Wachovia, I was shocked. Among the 4 or 5 big banks headquartered in Birmingham, I thought Southtrust would be the last to merge. But not only did he sell out to Wachovia, he sold at a modest premium to the banks market price, and well under what he could have received if he would have sold the bank at auction.

Wallace Malone is nobody's fool and the more I thought about it, the more I became convinced that Malone had concluded that bigger was better and that even though SOTR would not be the surviving bank, he wanted a "southern culture" and a commitment to maintain his cost control and entreprenerial beliefs. In short, Malone was not selling out as much as he was arranging a marriage where SOTR's unique culture would be honored and preserved.

The integration of the two companies went well and, indeed, Wachovia's increased emphasis on cost controls, combined with the strong Sunbelt economy, pushed the company's stock up nearly 30% through early 2006. Then the company announced it was buying another icon Oakland California's Golden West Financial(GDW).

GDW was as unique to the West as SOTR was to the South. It thrived in a very competitive leading market on incredibly nibble and flexible mortgage products and very tight cost controls. Husband and wife co-CEOs Herbert and Marion Sandler built Golden West from $38 million in assets to nearly 130 $billion in assets during their 40 years with the company.

Again when I saw the news that GDW had sold out, I was surprised. The Sandlers were getting older, but they had been so successful and GDW had reached a critical mass where it could have easily remained independent. The market did not like anything about Wachovia's purchase of Golden West. There were few economies of scale, GDW was heavy into California mortgages at a time when it was clear the housing market was softening, and WB appeared to pay a premium for the company. WB's stock fell by nearly 20% in the month after the announcement of the purchase.

WB's price is still under pressure but I think the GDW purchase will ultimately be seen as a brilliant move. GDW is, indeed, very heavy in California real estate, but they have among the most stringent credit controls of all lenders. This has kept their loan loss ratios very low, and the real estate market would have to get a lot worse than I see it getting for them to have any trouble. More importantly, WB has now taken a kind of watermelon rind approach to their geographic footprint. Beginning on the eastern seaboard their market extends to Florida; then continues through the Sunbelt and the Southwest before smiling up through California and the Nortwest. This watermelon rind market area includes most of the fastest growing markets in the United States. I think there will be few large banks that will be able to rival WB's earnings and dividend growth over the next decade.

Finally, and perhaps most importantly, two of the most impressive banking families that this country has produced over the last 40 years have thrown their lots in with Wachovia and now will be among its largest shareholders. In my judgment, neither of these deals was entirely about the money. And that speaks volumes about Wachovia. Mr. Malone and the Sandlers chose WB to act as stewards of everything that they have built. If the Malones and the Sandlers, who built multibillion dollar banks from scratch are confidant in WB's future, I feel like I am in good company in holding the stock.

This blog is for information only. Do not make buy and sell decisions based on the information contained here. Please consult your own financial advisor.

Wednesday, November 22, 2006

Are the REITS too High?

In most of our Dividend Valuation Models, the Real Estate Investment Trusts (REITs) have been slightly overvalued for months. We have cut back just a bit, but we have continued to hold the REITs, thinking that the fall in rates would continue to push them higher. That has been the case.

We are value investors, but in our years of watching the interplay between prices and values, we have noticed that stocks tend to stay overvalued and undervalued for long periods of time, often as long as three years.

Most REITS are only modestly overvalued and not worrisome to us, but a couple we own are starting to resemble tech stocks of old. Of these, the stock that is the most difficult to value is Prologis. PLD is an international logistics firm that provides warehousing to large multinational firms all over the world. A quick search indicates that PLD is the most international of all US REITs, and importantly, the most global of all warehousing REITs. It has been a prime benefactor of the global economy, and its price has reflected it, rising over 30% year to date.

Attempting to value PLD is tough because it is among a handful of REITs that are self funding. Being able fund growth from internal cash flow, has allowed PLD to grow funds from operations at 10% per year over the last 10 years, which is much higher than the average REIT.

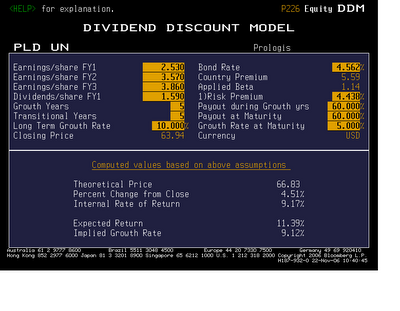

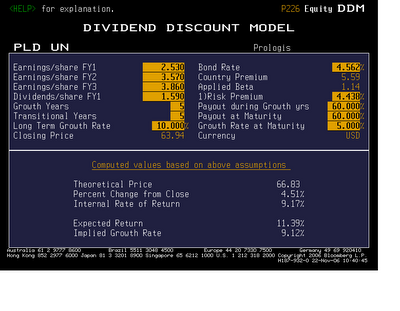

In attempting to determine a value for PLD, I resorted to Bloomberg's Dividend Discount Model and entered funds from operations data, which is much more reflective of PLD's business that are earnings.

..................Prologis Dividend Discount Model...............

I estimated that the Funds From Operations and dividends would grow at 10% per year over the next 5 years and then decline over the next 5 years to 5% long-term growth. I used a discount factor of 9%, which I think is about right with 10-year T-bonds at 4.5%.

Using these data points, the model --click to enlarge the table -- shows that PLD's theoretical value is $66.83. With the price about $64 that means that PLD is, actually, about fairly valued. If that is the case, I would expect it to go sideways from here. If it continues going straight up, and anyone starts using those dangerous words, "It's different this time," I would run for the hills.

This blog is for information purposes only. Do not make buy and sell decisions based on what you read here. Please consult your own financial advisor.

I estimated that the Funds From Operations and dividends would grow at 10% per year over the next 5 years and then decline over the next 5 years to 5% long-term growth. I used a discount factor of 9%, which I think is about right with 10-year T-bonds at 4.5%.

Using these data points, the model --click to enlarge the table -- shows that PLD's theoretical value is $66.83. With the price about $64 that means that PLD is, actually, about fairly valued. If that is the case, I would expect it to go sideways from here. If it continues going straight up, and anyone starts using those dangerous words, "It's different this time," I would run for the hills.

This blog is for information purposes only. Do not make buy and sell decisions based on what you read here. Please consult your own financial advisor.

I estimated that the Funds From Operations and dividends would grow at 10% per year over the next 5 years and then decline over the next 5 years to 5% long-term growth. I used a discount factor of 9%, which I think is about right with 10-year T-bonds at 4.5%.

Using these data points, the model --click to enlarge the table -- shows that PLD's theoretical value is $66.83. With the price about $64 that means that PLD is, actually, about fairly valued. If that is the case, I would expect it to go sideways from here. If it continues going straight up, and anyone starts using those dangerous words, "It's different this time," I would run for the hills.

This blog is for information purposes only. Do not make buy and sell decisions based on what you read here. Please consult your own financial advisor.

I estimated that the Funds From Operations and dividends would grow at 10% per year over the next 5 years and then decline over the next 5 years to 5% long-term growth. I used a discount factor of 9%, which I think is about right with 10-year T-bonds at 4.5%.

Using these data points, the model --click to enlarge the table -- shows that PLD's theoretical value is $66.83. With the price about $64 that means that PLD is, actually, about fairly valued. If that is the case, I would expect it to go sideways from here. If it continues going straight up, and anyone starts using those dangerous words, "It's different this time," I would run for the hills.

This blog is for information purposes only. Do not make buy and sell decisions based on what you read here. Please consult your own financial advisor.

Wednesday, November 15, 2006

About Bonds

If you have been following the economic fundamentals over the past year, you have been worried about higher long-term interest rates. Unemployment is at a 5-year low; GDP and CPI, year over year, are high; the operating capacity of US manufacturers is near 82%; and the stock market is on a run.

According to my regression model, the current confluence of economic data is consistent with 30-year Treasury bond yields near 5.9% -- approximately a 3% premium over the Core CPI. So what is the rationale for 30-year Treasury yields at 4.6%? The answer can be defined in three words: inverse yield curve. An inverse yield curve is when short-term interest rates are higher than long term interest rates.

At a very basic level, an inverse yield curve is the bond market betting that the trend of long-term inflation will be less than the current rate. For an inverse yield curve to be correct, the forces of inflation must be diminishing. That can only come through a slowing of the economy.

I have long thought that long-term bond traders are the most accurate readers of the economic tea leaves. With 30-year Treasuries yielding 4.6% and overnight Fed Funds trading at 5.25%, the bond traders are clearly saying--betting-- that inflation will fall. Indeed, according to my models, a 4.6% long-term bond yield implies that Core CPI would need to fall to under 2% during the coming 12 months to be in equilibrium with its normal yield spreads.

Therein lies the proverbial rub. Core CPI is now at 2.9%, and since Core CPI does not include food and energy, it will get little help from falling energy prices. There are two paths to a Core CPI under 2%: 1. A sharp slowing of the economy that might result in a recession, and 2. A protracted period of sub 3% GDP (driven by weak housing), perhaps lasting for 12 months or more.

The long and short of the present level of interest rates is that the economy will be tepid for the next 12 months. This will almost certainly dampen corporate profits during this time. With corporate earnings growth having blown away estimates quarter after quarter this past year, I believe the market is being set up for disappointments in the year ahead.

Having said this, as I have been repeating, I believe the disappointments will be mainly in the small and mid cap sectors whose businesses are tied primarily to the US domestic economy. Blue chips, which are much more international in scope, will be only modestly affected by the slowing US economy, and will increasingly be seen as the place to be by investors.

Bond buyers have a very difficult decision. Do you keep rolling over the higher yielding short-term bonds or do you extend your maturities and take a lesser yield, in the hopes that the bond traders are right and both short and long-term interest rates will be lower in 12 months?

I think you can guess my answer -- don't bet against the long-term bond traders.

This blog is for information purposes only. Do not make buy and sell decisions based on the information contained here. Please consult your own financial advisor.

Thursday, November 09, 2006

Stocks Are Still Undervalued

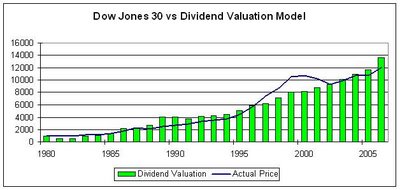

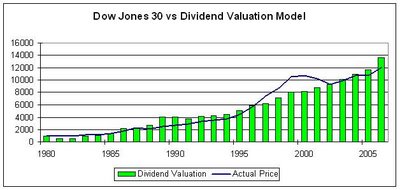

With stocks having staged a strong rally, and changes in political leadership stealing all the headlines, I thought it would be interesting to see an update of our Dow Jones Dividend Valuation Model. The model is a regression of dividend growth and changes in interest rates versus changes in the Dow's price over the last 45 years.

The model can best be understood by thinking of the green bars as valuation steps. The chart shows that as a result of very strong dividend growth and moderate changes in interest rate that stocks are more undervalued now than they were at the start of the year, even considering their solid price performance this year.

The model is being pushed higher by bond yields being lower than their long-term average and dividend growth being much higher than its long-term average. The Dividend Valuation Model is signaling that stocks are still nearly 10% undervalued, which would target a level above 13,000.

Another 10% move seems a bit ambitious, especially when considering the gains made so far this year and the uncertainties in the political arena.

The change in political leadership is not a great surprise to the market. The polls and various overseas betting lines showed such a possibility for months.

The momentum remains positive for stocks and, in my judgment, there is a clear valuation gap that is likely to close to some degree over the next year.

The change in political leadership is not a great surprise to the market. The polls and various overseas betting lines showed such a possibility for months.

The momentum remains positive for stocks and, in my judgment, there is a clear valuation gap that is likely to close to some degree over the next year.

The change in political leadership is not a great surprise to the market. The polls and various overseas betting lines showed such a possibility for months.

The momentum remains positive for stocks and, in my judgment, there is a clear valuation gap that is likely to close to some degree over the next year.

The change in political leadership is not a great surprise to the market. The polls and various overseas betting lines showed such a possibility for months.

The momentum remains positive for stocks and, in my judgment, there is a clear valuation gap that is likely to close to some degree over the next year.

Thursday, November 02, 2006

Coke Bubbles Up

Few stocks has been more disappointing over he last few years than Coke. After the death of Robert Goizeuta in 1997, the company elevated a series of men to CEO whom the troops refused to follow. The absence of a strong leader for this most multinational of all US companies caused the unthinkable to happen: the company whose brand was thought to be so powerful that an idiot could run it, buckled under ill-conceived new products, frequent quality issues, and internal struggles that bordered on mutiny.

Nowhere has the disappointment been more visceral than between the company and old-line Wall Street analysts. In short, Wall Street believes that Coke has managed to tarnish the single most recognized brand on the planet. Bloomberg research shows that few of the largest Wall Street firms have "buy" recommendations on the company, even though Coke's business appears to have turned.

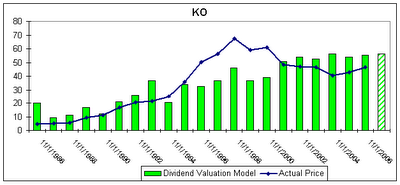

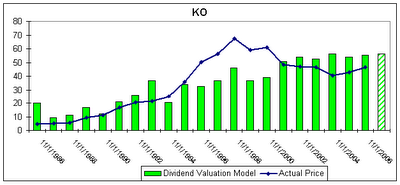

Our Dividend Valuation Model (DVM) is suggesting that the old-line analysts might be judging the company from the rear view mirror. If Coke's prospects have turned, as I believe they have, then we should have plenty of fresh money pouring into the stock over the next few years as Wall Street is forced to admit that Coke is, indeed, The Real Thing -- again

The chart below shows that the correlation between Coke and its DVM is not high. But, interestingly, it does show that the market has a history of mispricing Coke in regular patterns.

...............Coke Dividend Valuation Model...............

Think of the green bars as "value" steps, or intrinsic value. For the 7 years from 1986 through 1993, Coke's market price (blue line) consistently sold below its intrinsic value. Beginning in 1995, things changed and under valuation was replaced with over valuation, as Coke appeared to be climbing a stairway to heaven.

By 1998, with Coke levitating 40% above its DVM, there was no shortage of buy recommendations by Wall Street analysts.

Coke's downtrend over the last 7 years has been caused by a combination of a normal correction back to its intrinsic value, and its own abysmal performance.

Two years ago, Coke finally appeared to correct their leadership problem by promoting Irishman Neville Isdell to CEO. By most accounts, he has the support of Coke employees and bottlers. In recent quarters, sales and earnings have bottomed and begun to firm.

Recently, the company reported much better than expected earnings, which push the stock higher. I noticed that the consensus ranking by Wall Street analysts did not budge with the good news on earnings. They still rank the stock as an average performer for the coming year. With the stock undervalued and big cap blue chip stocks back in favor, to ignore the progress that Coke has made is shortsighted. Besides seven years is a long time for Wall Street to hold a grudge.

Look for Coke to begin a long slow climb as more and more Wall Street types forgive the company for past missteps and admit that there is no such thing as an idiot proof company.

The Dividend Valuation Model says we are in the first year of an upturn. I wonder if that means, we can count on 6 more years of price gains? Stay tuned.

This blog is for information purposes only. Do not make buy and sell decisions based on what I have said here. Clients, Employees, and Principals of Donaldson Capital Management may own shares of Coke.

Think of the green bars as "value" steps, or intrinsic value. For the 7 years from 1986 through 1993, Coke's market price (blue line) consistently sold below its intrinsic value. Beginning in 1995, things changed and under valuation was replaced with over valuation, as Coke appeared to be climbing a stairway to heaven.

By 1998, with Coke levitating 40% above its DVM, there was no shortage of buy recommendations by Wall Street analysts.

Coke's downtrend over the last 7 years has been caused by a combination of a normal correction back to its intrinsic value, and its own abysmal performance.

Two years ago, Coke finally appeared to correct their leadership problem by promoting Irishman Neville Isdell to CEO. By most accounts, he has the support of Coke employees and bottlers. In recent quarters, sales and earnings have bottomed and begun to firm.

Recently, the company reported much better than expected earnings, which push the stock higher. I noticed that the consensus ranking by Wall Street analysts did not budge with the good news on earnings. They still rank the stock as an average performer for the coming year. With the stock undervalued and big cap blue chip stocks back in favor, to ignore the progress that Coke has made is shortsighted. Besides seven years is a long time for Wall Street to hold a grudge.

Look for Coke to begin a long slow climb as more and more Wall Street types forgive the company for past missteps and admit that there is no such thing as an idiot proof company.

The Dividend Valuation Model says we are in the first year of an upturn. I wonder if that means, we can count on 6 more years of price gains? Stay tuned.

This blog is for information purposes only. Do not make buy and sell decisions based on what I have said here. Clients, Employees, and Principals of Donaldson Capital Management may own shares of Coke.

Think of the green bars as "value" steps, or intrinsic value. For the 7 years from 1986 through 1993, Coke's market price (blue line) consistently sold below its intrinsic value. Beginning in 1995, things changed and under valuation was replaced with over valuation, as Coke appeared to be climbing a stairway to heaven.

By 1998, with Coke levitating 40% above its DVM, there was no shortage of buy recommendations by Wall Street analysts.

Coke's downtrend over the last 7 years has been caused by a combination of a normal correction back to its intrinsic value, and its own abysmal performance.

Two years ago, Coke finally appeared to correct their leadership problem by promoting Irishman Neville Isdell to CEO. By most accounts, he has the support of Coke employees and bottlers. In recent quarters, sales and earnings have bottomed and begun to firm.

Recently, the company reported much better than expected earnings, which push the stock higher. I noticed that the consensus ranking by Wall Street analysts did not budge with the good news on earnings. They still rank the stock as an average performer for the coming year. With the stock undervalued and big cap blue chip stocks back in favor, to ignore the progress that Coke has made is shortsighted. Besides seven years is a long time for Wall Street to hold a grudge.

Look for Coke to begin a long slow climb as more and more Wall Street types forgive the company for past missteps and admit that there is no such thing as an idiot proof company.

The Dividend Valuation Model says we are in the first year of an upturn. I wonder if that means, we can count on 6 more years of price gains? Stay tuned.

This blog is for information purposes only. Do not make buy and sell decisions based on what I have said here. Clients, Employees, and Principals of Donaldson Capital Management may own shares of Coke.

Think of the green bars as "value" steps, or intrinsic value. For the 7 years from 1986 through 1993, Coke's market price (blue line) consistently sold below its intrinsic value. Beginning in 1995, things changed and under valuation was replaced with over valuation, as Coke appeared to be climbing a stairway to heaven.

By 1998, with Coke levitating 40% above its DVM, there was no shortage of buy recommendations by Wall Street analysts.

Coke's downtrend over the last 7 years has been caused by a combination of a normal correction back to its intrinsic value, and its own abysmal performance.

Two years ago, Coke finally appeared to correct their leadership problem by promoting Irishman Neville Isdell to CEO. By most accounts, he has the support of Coke employees and bottlers. In recent quarters, sales and earnings have bottomed and begun to firm.

Recently, the company reported much better than expected earnings, which push the stock higher. I noticed that the consensus ranking by Wall Street analysts did not budge with the good news on earnings. They still rank the stock as an average performer for the coming year. With the stock undervalued and big cap blue chip stocks back in favor, to ignore the progress that Coke has made is shortsighted. Besides seven years is a long time for Wall Street to hold a grudge.

Look for Coke to begin a long slow climb as more and more Wall Street types forgive the company for past missteps and admit that there is no such thing as an idiot proof company.

The Dividend Valuation Model says we are in the first year of an upturn. I wonder if that means, we can count on 6 more years of price gains? Stay tuned.

This blog is for information purposes only. Do not make buy and sell decisions based on what I have said here. Clients, Employees, and Principals of Donaldson Capital Management may own shares of Coke.

Subscribe to:

Comments (Atom)