We will offer a few counterpoints to this bullish view for stocks in a coming blog. As always, there are some clouds on the horizon.

Thursday, December 30, 2010

The Rising Tide May Keep Rising in 2011

We will offer a few counterpoints to this bullish view for stocks in a coming blog. As always, there are some clouds on the horizon.

The Rising Tide May Keep Rising

We will offer a few counterpoints to this bullish view for stocks in a coming blog. As always, there are some clouds on the horizon.

Thursday, December 23, 2010

Municipal Bonds: Apocalypse Now or Buying Opportunity?

We and other professional investors in municipal bonds have been aware of and monitoring the heightened municipal bond default risk for nearly three years. However, it took a segment on 60 Minutes featuring the photogenic, publicity-minded banking analyst, and newly-minted municipal bond expert Meredith Whitney to really light up the airwaves on this issue.

Whitney predicted: “Fifty to 100 sizeable defaults. More. This will amount to hundreds of billions of dollars’ worth of defaults.”

The one-year record for municipal defaults (2008) was just over $8 billion. So, Whitney’s prediction of “hundreds of billions” would be at minimum a 2,400% increase in the rate of municipal defaults. If she is wrong even by a factor of ten; however, it would still be a very bad year for municipal defaults.

We believe that there are serious deficit and debt problems in many cities, counties, and states across the country. We also believe that the relative risk of municipal defaults is, indeed, as high as it’s been in a long time. In this case, however, the word “relative” is critical. Let’s set the context for that higher relative risk with some data:

But all that is history. A recession, housing value collapse (think property taxes), credit crisis, and persistent near-10% unemployment all combine to cause real trouble for many states and municipalities across the nation. Also state Medicaid costs, unemployment compensation, and other social support costs all got bigger, not smaller, during this recession. So, Ms. Whitney is accurate in saying that today’s municipal bond market is not the sleepy, low risk market that most of us have come to know and trust over the years.

Yet we come back to the word relative in rebuttal to Ms. Whitney. Yes, there is more risk in today’s municipal bond market. But as we will show, it is a long way from more relative risk in municipal bonds to the long list of defaults Ms. Whitney is forecasting.

To better explain why we don’t see higher relative risk as meaning high absolute risk, review the following list of things states and municipalities can do that corporations cannot. Each serves to lower the absolute risk of municipal default:

There are still municipalities out there that are very bad credit risks. And, Ms. Whitney rightly says there is more risk in municipal bonds today than there has been over the last 70 years.

That being said, we do not agree with her forecast of imminent huge losses in municipal bonds. Indeed, we believe that few high quality municipalities will file bankruptcy and even fewer will actually default on their bonds.

Ms. Whitney’s 60 Minutes appearance has had the effect of shouting fire in a crowed room. Many people have panicked and sold bonds indiscriminately. As most of you know, during the past few weeks we have been buyers of selected municipal bond issues by municipalities and states that our research has shown to be low credit risks.

Our optimism about the prospects for municipal bonds is shared by most of the investment research firms that we have counted on for many years. Indeed, we note that the Pimco bond king, Bill Gross, is said to be buying municipal bonds for his personal account.

The judgment of a life-long professional bond investor putting his own money behind his opinion is to us the best evidence that the current drama is actually a buying opportunity.

Sources: Bloomberg BMO Capital, BCA Research, Moody's

Wednesday, December 15, 2010

GE's Second Dividend Hike: Good News or Bad News?

We all agreed that on the surface the news was good for GE and stocks in general, but several committee members voiced a surprising concern.

First let me share the positive implications we believe GE's dividend actions signal.

- Their loan loss ratios in GE Capital (35% of the company) must be improving faster than previously expected. This would be good news for both GE and the US economy.

- An up-tick in their long-cycle industrial sector (jet engines, healthcare electronics, and power generation) may be underway. Better news in these industries would be very good news for US trade balances with developing nations.

- Short-cycle businesses (appliances and electrical system equipment) may have bottomed. This would be modestly good news about US consumer spending.

The surprising concern that arose in our discussions was the possible negative implications of the dividend news. Two of us voiced the concern that because Jeffrey Immelt, GE CEO, has become so unpopular among many investors and analysts, the dividend hikes may only be his attempt to win favor with his constituents. This line of thinking didn't go far because one of the committee members reminded us that CEOs don't dictate dividend policy. That authority belongs to the board of directors.

The chart at the top of the page shows that GE is stair-stepping its way higher. The recent new, intermediate high signals the stock may attempt to move higher over the near term. If our notion that GE's business is improving starts showing up in their earnings, we could soon see GE take a run at a new 12-month high.

We own the stock. Do not make investment decisions based on this information. Please consult your personal financial advisor.

Monday, November 29, 2010

Becton Dickinson : A Dividend Star with a Lagging Price

Last time we showed research that revealed that dividend-paying stocks have outperformed non dividend-paying stocks over the last three years. Importantly, the research also showed that the higher the dividend growth of a stock, the higher its total rate of return, up to a point. That point of diminishing returns occurred in the quintile that included companies with the highest dividend growth rates. These companies did not perform as well, pricewise during the period, as did companies in the second quintile of dividend growth.

Last time we showed research that revealed that dividend-paying stocks have outperformed non dividend-paying stocks over the last three years. Importantly, the research also showed that the higher the dividend growth of a stock, the higher its total rate of return, up to a point. That point of diminishing returns occurred in the quintile that included companies with the highest dividend growth rates. These companies did not perform as well, pricewise during the period, as did companies in the second quintile of dividend growth.Saturday, November 13, 2010

Since the Subprime Crisis Began, Higher Dividend Growth Has Been Rewarded -- Up to A Point

We divided all dividend-paying companies in the S&P 500 Index into quintiles ranked according to their average annual dividend growth over the past three years. A sixth group consisted of those companies that do not pay dividends. We then computed the average total rate of return for each quintile over the three years.

The results are impressive and a bit surprising. The seventy companies with the highest average annual dividend growth rates over the past three years have outperformed 58% of all stocks in the S&P 500. By contrast, the companies with the lowest average annual dividend growth rate (actually a loss) only outperformed 28% of the stocks in the S&P 500. Here's the ranking for all dividend-paying quintiles and non-dividend payers:

- Quintile with the highest average 3-year dividend growth outperformed 58% of all S&P 500 stocks.

- Second highest quintile outperformed 61% of all stocks.

- Third highest quintile outperformed 53% of all stocks.

- Fourth highest quintile outperformed 51% of all stocks.

- Fifth highest quintile outperformed 28% of all stocks.

- Non dividend paying stocks outperformed 48% of all stocks.

- Quintile 1: 3-year average annual dividend growth rate of 21.8%

- Quintile 2: 11.3%

- Quintile 3: 6.1%

- Quintile 4: 0.0%

- Quintile 5: -28.0%

The surprise in the data is that quintile 2 stocks, with an average 3-year year dividend growth of 11.3%, outperformed quintile 1 stocks, which had a 3-year average annual growth rate of 21.8%.

We have two comments about this surprising asymmetrical result: 1) the very high dividend growth observed in quintile 1 stocks was influenced by many large one-time dividend increases among consumer cyclicals and industrial stocks; 2) In spite of this, we see a similar asymetrical result when comparing earnings growth versus price growth. The stocks in the quintile with the highest earnings growth did not outperform those in the second quintile.

Thus, in looking at both dividends and earnings we see that high growth has not been rewarded with proportionately higher price growth. This is the primary reason that we now believe the sweet spot of the stock market is in the high dividend and earnings growth companies.

We will review a few of these companies in the weeks ahead.

Bloomberg data was used for this analysis.

Friday, October 22, 2010

Channeling Ben Bernanke

Amid all the worries Ben carries on his shoulders about the viability of the US economy, he has to constantly be aware of the shifting moods of the players, consumers, and business people, in the current unfolding economic drama. Ben knows what he needs most right now is a catalyst to lift the "animal spirits" of the players so they will return to more normal consumption and investing patterns.

|

| Click to Enlarge |

There has, however, been lots of good news in the earnings reports of major corporations. But with all of the ill winds in the economic news, many investors have concluded that these earnings increases are the result of expense reductions and layoffs and will only make the US economy worse.

Ben is smiling because he knows the earnings are real, and that rising earnings will ultimately lead to job growth. He also knows that rising stock prices in the face of poor economic news are a good sign because it means that investors are beginning to look through the current malaise to better times.

The utility index breaking to a new 12-month high is important because, as we have said before, utilities are generally considered to be bond substitutes. Their dividend yields are more than double that of the average stock; they usually operate with some kind of monopoly power, and their financial ratings are higher than the average stock.

History shows us that almost all major turn-arounds in stocks have been led by the utilities. As investors become more confident and begin to move out of bonds, their first landing place is usually in the stock sector they consider to be the safest. For most people that is the utilities. Thus, it is not surprising that in the recent uptick in stocks, utilities have broken above their 12-month highs, while the S&P 500 Index is still nearly 3% under its 12-month high. We would expect that the S&P 500 will follow the utilities lead and break to a new intermediate high by the end of the year.

This move will be driven by the recognition that stocks are cheap compared to bonds and that Ben will see to it that bond yields won't be rising anytime soon.

Saturday, October 16, 2010

Railroads May Soon Lose Some Steam

The rail stocks today are certainly not your grandfather's bloated, broken-down companies. Today railroads are key players in the inter-modal freight handling business. Importantly, they are widely seen as the most economical and environmentally friendly mode of hauling goods over long distances.. But there is little question that Mr. Buffett's purchase of Burlington Northern has added a shine to the appeal of railroad stocks that wasn't there before.

That shine may be in the process of dulling a bit. Our Dividend Valuation model for Union Pacific (UNP) shows an interesting feature that we have seldom seen for any stock since the beginning subprime crisis: overvaluation.

The chart shows that UNP's current price (red line) is just over $85 per share, more than 15% above our model's current predicted value, and nearly 8% above next year's predicted price. (The other major rail stocks show similar overvaluations)

As we have said before, overvaluation and undervaluation are not precise fall-off-the-cliff events. Stocks can stay overvalued or undervalued for a long time. But a look at UNP's valuation model shows that it has rarely been significantly overvalued: only 4 times in 20 years. Each time it became overvalued its price ultimately fell back to its valuation bar.

We doubt if the current momentum in the rail stocks gives a hoot about our valuation models, but we don't have to remind anyone that stocks get undervalued and overvalued and eventually they return to their value tracks.

A relative of the author owns UNP. Please do not use this blog for investment decisions. Please consult a licensed investment professional.

Thursday, October 07, 2010

Utility Watch: Still Waiting For The Breakout

- History shows us that they usually lead stocks out of bear markets and corrections.

- They are in the category of bond-like stocks that has been doing very well in recent months.

If the utilities keep moving higher and break above their old high, it would not stretch the imagination to think that they might continue to move higher than most people now believe. The reason is simple: There are not many sectors of the stock market that have treated long-term investors very well in recent years. The old favorites, health care and banks, have both let investors down over the last decade. Only the utilties have provided a solid return during this time.

Our Dividend Valuation models are suggesting that utilities are as much as 25% undervalued. Maybe just maybe, this industry has it affairs enough in order that they will pierce their 2009 highs and break into new territory. That is what we are counting on.

Thursday, September 30, 2010

Watch the Utilities for Clues About the Future Direction of the Market

|

| Standard and Poors 500 |

|

| Utilities IShares XLU |

At the right is a chart of XLU, the Utilities exchange traded fund. We use XLU as a proxy for the average utility stock. You will notice that its recent price is attempting to break above its December 2009 high. If it is successful, we believe the whole stock market will make an assault on old intermediate highs.

Here's the reason. Utilities are a prime example of "bond-like" stocks that we have been extolling in numerous blogs. Most Utilities have solid balance sheets, a dividend yield higher than the yield on a 10-year US Treasury bond, and a long history of paying and increasing their dividends. Utilities also possess an additional feature that makes them potentially safer than the average stock: most have a monopoly or near monopoly over their product offering in a geographical area.

We have seen an incredible rally in Treasury bonds that has spread progressively to corporate bonds, municipals bonds, and junk bonds. When I saw junk bonds rallying, I knew to start watching Utilities. The Utility sector has led us out of almost every major sell off in stocks since the 1970s. I think they will do it again.

Moreover, as it becomes clear that the Utilities are breaking out, I believe you will see many other bond-like stocks also lead the way higher.

Talk of the positive qualities of dividend stocks is literally so thick you can cut it with a knife. Since we have been praising dividend stocks for 20 years, we are gratified that they are getting so much attention in the media, but we would add a caveat. Do no play dividend stocks just for the bounce. Do yourself a favor, invest in high quality dividend-paying companies for the rest of your life. Dividend investing is a way of life, not a trading strategy.

We'll keep an eye on the Utilities in the days and weeks ahead.

We own lots of Utilities. See the term of use of this site on the right sidebar.

Thursday, September 23, 2010

Donaldson Barnyard Forecast is Positive for Stocks

This is a video/audio webcast. If you are unable to view this post, click here.

Rising Dividend Investing

http://www.blogcatalog.com/directory/business/investing/stocks/

Wednesday, September 22, 2010

Reprising Jimmy Chitwood

This is not a new story. Indeed, it is remarkable how consistently off the mark the crowd in Washington has been toward business. The following is a blog I wrote July 14, 2009. In it I explain why the government's attempt to stimulate the economy will fail and what it will take to create job growth. I am presenting the blog just as I wrote it 14 months ago, but with just a few brackets [ ] to add additional insight.

I am also reprising the blog to persuade you to contact your Congressional representatives to advocate that the Bush Tax cuts be extended for at least two years for all income levels, not just those below $250,000. In addition that the taxes on dividends remain at the same rate as capital gains. In my judgment, these actions on taxes would go a long way toward the President building a bridge to the business community. It would signal that the President would be backing off of his "soak the rich" mantra and realizing that this country needs its brightest and best business minds to take the risks necessary to create the jobs that the country and our citizens so desperately need. It does absolutely no good for our country to take money from the rich and create government jobs. Surely Greece, Spain, Ireland, and Portugal have clearly shown us that a country dependent on government jobs is a country headed for the rocks.

Here's the blog from last year.

Tuesday, July 14, 2009

Capitalism Means Giving the Ball to Jimmy Chitwood

Whatever your political persuasion, the truth is, capitalistic principles that have served humanity well are currently under attack in the halls of Congress. Yesterday's Wall Street Journal sounded the alarm that the highest tax bracket may soon rise 11%, from 35% to 46% [as high as 58% with state taxes], by the time the Democrats in Congress are done.

"Soak the rich! Soak the rich!" can be heard in stereophonic surround sound if you drive by the Capitol these days. Indeed, the most important allocators of capital are no longer found on Wall Street, they now reside on Capitol Hill.

The Administration and the Democratic leadership have declared war on the business class. In doing so, they are dooming the country's hopes for a strong economic turnaround. Here's why. The very people who know best how to create jobs, the business class, are being tied up in a never ending barrage of new taxes, regulations, and anti-business rhetoric and legislation.

But just as the Law of Gravity still holds, so do the laws of economic growth, even if House Ways and Means Chairman, Charles Rangel, says they don't [Mr. Rangel has other problems understanding laws and is no longer Chairman]. I have no doubts that he will find a return to normal economic growth increasingly difficult to accomplish should his tax hikes become law.

Let me take a different tack to explain the problem, [Professional] basketball, for example. Isn't the objective to win, not just allow every player on the team equal playing time, regardless of their ability? Further, say we're down to the wire with only 10 seconds left on the clock. The object is to win, not to make heroes, not to please parents, or sponsors, or girlfriends. The object is to win. If you are the coach, would you call the team trainer off the bench and set up a play for him to take the last shot because it's his turn to shoot? Or would you get the ball into the hands of the best SCORER on your team? The answer is so simple children can figure this out. Get the ball to the guy or girl on the team who has a demonstrated gift for putting the ball in the basket. Do that and you will have a long career as a coach. Give it to a player with less ability and wins become losses, and you will be out of coaching.

This concept is graphically shown in the movie "Hoosiers." With just a few seconds left, Gene Hackman, who plays Hickory's coach, calls a time out. He wants to run the "picket fence" and that Jimmy Chitwood, the teams prolific scorer, will act as a decoy. The team is stunned and turn away from the fiery coach, but no one says anything. Every guy on the team knows the coach is wrong, but no one speaks. Finally, Jimmy, who has been almost stoic throughout the whole movie, says, "I'll make it." Hackman immediately agrees and says get the ball to Jimmy and give him room. You know what happens. See it here on this link.

http://www.youtube.com/watch?v=A0QTBAWc3tM

Coaches don't win games, trainers don't win games, equipment managers don't win games, and bench warmers don't win games. All these people are important contributors to success, but ultimately it is great players who win games.

As it relates to business, businessmen and women produce economic growth, not politicians, regulators, or tax collectors. Until the Obama Administration grasps this basic truth, the economy will trudge along in low gear.

Over the weekend, Vice President Joe Biden and President Obama were both apologizing for still skyrocketing unemployment, even though they said it wouldn't happen if the Congress passed their $750 billion stimulus plan. After Congress finally passed the measure, I said it was actually 30% a stimulus plan and 70% a welfare plan. The money went to the wrong places and until it gets to the right places, the Administration is going to be apologizing, a lot, about unemployment.

A wide gulf has formed between business people and politicians. All business people are being painted with the ugly brush of the big banks and their subprime destruction. Ninety-five percent of business people had nothing to do with the subprime fiasco and don't deserve to be treated as villains. However, every business person in this country now knows that he or she will be picking up the tab for the health-care plans of the Obama Administration. We know that we will be paying for the Administration's ill-conceived "Cap and Trade" environmental programs. Finally, we know that we will be paying for the huge deficits that the Congress has saddled our country with as far as the eye can see.

Business people, particularly small business people, where most of the jobs have been created over the last decade, know that they are in the gun sights of Congress and the Administration. That will keep a lid on employment gains for the foreseeable future. The main reason for this is that all these new taxes and regulations require that a businessman or woman's first order of business is to cut costs to defend profitability. The truth about costs is that the biggest one is labor. In the back of most entrepreneurs' minds is the fact that, in the stroke of a pen, the government could at some future date make it very costly if not impossible to reduce employment.

The Soviet Union was full of big talk and government-created, five-year economic plans for growth. As the years wore on, the bigger the talk grew the more failures the five-year plans produced.

I would have thought that the complete collapse of the illusory workers' paradise that was the Soviet Union would have been proof enough for almost any politician of what does not work. But, what is going on in Washington [and Europe] today would make Karl Marx smile for the first time in a long time.

If you consider yourself a businessperson, I recommend that you start communicating regularly with your politicians. As the employment news gets worse, they might actually start to listen.

This is what I said a 14 months ago. If it sounds like the current situation in the country, get used to it, because unless the Obama Administration has an epiphany soon, this is a blog I can repeat each year at about this time and it will sound just as fresh. Like it or not, Washington is violating economic laws and our citizens will pay for it in a lower standard of living and higher unemployment for years to come.

This is not to say that I am bearish on the US stock market. US companies realize that the opportunities for sustainable growth are outside our borders. Company after company in the S+P 500 now produce over 50% of their earnings outside the United States. Stocks will do fine. It is Mr. and Mrs. America that I am worried about if the current anti-business environment continues.

Sunday, September 19, 2010

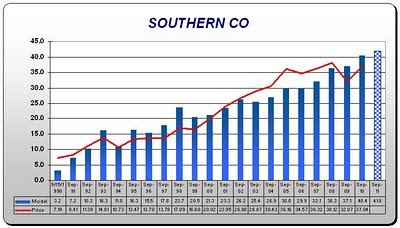

Southern Company Looks Undervalued

We believe many high quality, dividend-paying companies are very attractive compared to US Treasury bonds. We have previously described the concept we call "bond-like" stocks. Bond-like stocks to us mean companies that

We believe many high quality, dividend-paying companies are very attractive compared to US Treasury bonds. We have previously described the concept we call "bond-like" stocks. Bond-like stocks to us mean companies that- Have strong balance sheets

- Have a history of paying dividends

- Display a history of raising its dividends,and

- Possess dividend yields that are close to the yield on a 10-year US Treasury bond.

Our Dividend Valuation Model above (click to enlarge), which is based on the relationship between SO's price versus its dividend growth and the level of interest rates on long US Treasuries, suggests that the stock may be undervalued. Indeed, the model is projecting that the total return of SO over the next 12 months may approach 17%. As we always say, our model is based on historical relationships and thus is certainly not a guarantee of the future, but we are inclined to believe that SO is positioned to do well over the next year. Here's why:

- SO's bonds are A rated by both rating agencies, among the highest rated utilities in the US.

- It is the second largest utility in the US and the largest in the Sunbelt, where the population is still growing.

- SO has a near monopoly in its service areas and produces power through a diverse array of power sources from coal to nuclear power.

- SO has generated a 14% annualized return over the last 10 years, far outpacing the S+P.

- The company has paid a dividend since 1948, and its current dividend yield is just under 5%.

- SO has raised its dividend for 9 consecutive years at an annual rate just over 4%.

SO sells a product necessary for our daily lives and is as well run as any utility in the US. It has a current dividend yield of nearly double that of the 10-year Treasury bond. SO's implied return of 9% (5% dividend yield plus 4% dividend growth) compares favorably to the 10-year Treasury yield of 2.75%.

We believe the recent aversion to risk that has gripped the markets can not last forever. As investors realize that they cannot live very well on CDs paying .3%, they will begin looking for quality alternatives, and the first place they will look will be the electric and natural gas utilities. When they start looking at the utilities, it will be hard to beat what they find in Southern Company.

Clients and principals of Donaldson Capital own SO. Please see Term and Conditions of this blogsite on the right sidebar.

Tuesday, September 14, 2010

More Answers to Your Questions: Bank Dividend Growth

Posted Question: When will banks begin paying dividends again?

Rising Dividend Investing

Thursday, September 02, 2010

More Answers to Your Questions: Why There Are so Many Widely Divergent Views of the Economy

Posted Question: How can the opinions of so many bright people be so far apart? Where is reality? Who do you listen to other than yourself?

People/Groups we listen to:

Ed Yardeni - http://www.yardeni.com/

Bank Credit Analyst - http://www.bcaresearch.com/

Standard and Poors - http://www.standardandpoors.com/

Value-Line - http://www.valueline.com/

Morningstar - http://www.morningstar.com/

Briefing.com - http://www.briefing.com/

Bloomberg Professional - various strategists and economists

Wall Street Professional

Argus Research - http://www.argusresearch.com/

We also have access to many investment research resources through our relationship with TD Ameritrade.

See all the DCM portfolio managers' bios on our website http://www.donaldsoncapitalmanagement.com/content/our-staff

Saturday, August 28, 2010

Answers to Your Questions: General Mills -- How Our Dividend Model Gives Buy and Sell Signals

|

| Dividend Valuation Model |

Let's look more broadly at GIS's valuation chart to see the various buy and sell signals it has made. Remember the actual price is the red line and the model's predicted price is the blue bar. Thus, simplistically, when the red line intersects a blue bar in a particular year, that would mean that price is below value, and it would signal that the stock is undervalued and a buy candidate. Conversely, if the red price line is higher than the top of a blue bar it is considered overvalued, and a sell candidate if owned.

According to the model, GIS was undervalued between 1993 and 1998, in 2000, 2005, 2009, and 2010. Simply speaking, if we were following the model without other considerations, we would have bought the stock in 1993 and sold it in 1999. We would have bought again in 2000 and sold in 2001; repurchased it in 2005 and sold again in 2006. Finally, we would have bought in 2009 and we would still be holding the stock.

In actual practice, we follow a more rigorous standard for buying and selling. In the case of a stock like GIS, we require that the stock be at least 10% undervalued or overvalued to trigger buy and sell signals. We find this provides about the same rate of return with far less turnover and capital gains taxes.

We do not currently own General Mills in any of our Rising Dividend models. We have looked at it many times over the years, but other stocks appeared to be more undervalued each time. Indeed, its current 12% undervaluation is not exceptional. Our models are suggesting that the average stock is nearly 25% undervalued. GIS is an outstanding company, and if it retreats in price or begins to grow its dividend at a higher rate than our model now projects, we would become much more interested in buying it.

We'll be tackling some of the questions about the economy and the Federal Reserve next week.

The author does not own General Mills.

Wednesday, August 25, 2010

We Would Like to Hear Your Questions

In recent posts, we have explained what we believe to be the best places to put money in these uncertain times. We believe now as much as ever in our rising dividend style of management, which primarily invests in companies paying ever-increasing dividends year after year. However, we realize that there are many questions and concerns that we have not addressed that you may wish to have answered.

We'd like to hear these questions that are on your mind. Over the next few weeks we are going to conduct an initiative to field as many of your concerns and questions related to the economy, investing, and the companies we invest in as we can. We invite you to write your questions in the box on the right side bar of the blog and click the submit button. This process will keep your identity completely anonymous. Please don't hesitate to ask away. We will combine the questions into similar groups and begin answering them with as much supporting data in the days and weeks to come.

Blessings,

The DCM Investment Committee

Randy Alsman

Rick Roop

Mike Hull

Greg Donaldson

Saturday, August 14, 2010

Royal Bank of Canada is the Epitome of a Bond-Like Stock

In these uncertain times, we are asked over and over by our clients : "How can I invest in the stock market with less volatility and more predictability?" Our answer is: "By investing in Bond-Like Stocks."

In these uncertain times, we are asked over and over by our clients : "How can I invest in the stock market with less volatility and more predictability?" Our answer is: "By investing in Bond-Like Stocks."Bond-Like stocks aren't for everyone, but once you get to know them, you might find they are just what you have been looking for. In our last audio blog (see link) we introduced the concept of Bond-Like stocks. These are stocks that have very high financial strength and credit ratings, a dividend yield higher than that of a 10-Year US Treasury bond, and a history of raising their dividends.

- RY is one of 5 AAA rated companies in the world.

- Its current dividend yield is 3.9%, much higher than the 2.8% yield on a 10-year T-bond.

- It has raised its dividend an average of 10% per annum over the last 10 years.

- Quarterly allowances for loan losses were 48% lower than a year ago.

- Shares outstanding were almost flat, very different from big US banks which increased shares by up to 35% to meet government mandated net capital requirements.

- Total loans grew modestly, again contrasting the shrinking loan balances at most US banks.

- Perhaps the most striking data point was RY's return on equity (ROE). ROE for its second quarter was near 17%, almost as high as its 10-year average and almost double that of the big US banks.

Thursday, August 12, 2010

Bond-Like Stocks

Donaldson Capital Management Clients and Principals own Procter and Gamble. We would like to get your impressions on this new series of audio blogs that we are doing. Just click on comments to give us your feedback.

Wednesday, July 28, 2010

Stocks are Cheap and Here's Why

Donaldson Capital Management Clients and Principals own Procter and Gamble.

Tuesday, July 27, 2010

Investment Policy Committee -- Weekly Outlook

- Q2 company earnings and revenues continue to surprise on the upside.

- The stock market is responding positively to more certainty around full-year 2010 earnings.

- Many investors are relying too much on popular media for their economic news. The media stories are superficial, shaded toward pessimism, and miss many key facts. This quarter’s client letter addresses that problem.

- Preferred stocks gained in value as the European bank stress test results made people feel better about the health of European banks and the global credit market.

The market reacted favorably last week to the positive results announced by the roughly 1/3 of S&P 500 companies that reported their 2nd quarter earnings. This holds with our view that a good earnings season would help reduce some of the uncertainty and anxiety that had been holding valuations below historical levels. (By valuation, we mean the price/earnings ratio, or P/E, which is calculated by dividing a company’s stock price by its earnings per share.)

The market continued to move higher yesterday in response to more positive earnings news and June new home sales that were higher than expected. This also continues to support our view that strong corporate earnings will eventually result in higher stock prices, and that despite the pessimistic economic news often heard in the popular media, companies could not have turned in 5 consecutive quarters of better-than-expected earnings unless the economy was strengthening.

More data have come in indicating that individual investors continue to keep their money either in cash or bonds, staying away from stocks. Institutional, or professional, investors however are increasing their holdings of common stocks. Clearly, one group is much more uncertain than the other. We wonder how much of this anxiety among individual investors (also called “retail investors”) is due to excessive influence from popular media.

This quarter’s DCM client letter tries to reduce that influence a bit by pointing out that partly out of necessity and partly by choice, the popular media can only tell a superficial story about something as huge and complex as a $14 trillion economy. Also, in order to gain viewers and sell advertising, whatever story they do tell is often written to be “newsworthy”, and unfortunately, bad news is often considered more newsworthy than good. As old newspapermen say: “If it bleeds, it leads”.

What retail investors may be missing is that they are not investing in the economy. They are investing in companies. And, some - even many - companies can do quite well even during weak economies. We do study the economies of the major countries here at DCM, but more to get a broad feel for general direction and to identify which economic sectors might have more or less favorable conditions for companies in those sectors. Choosing which companies to actually invest in, however, is about 95% the company’s individual potential for growth and 5% overall economic conditions.

On the fixed income side of the ledger, specific increasing or decreasing uncertainties are being felt lately. The uncertainty relates to future tax rates. The yields of 30-year, tax-exempt bonds have been steadily dropping over the past month. They are now about 0.4% lower than they were in May (~ 4.125% vs. 4.505%). This drop we believe is almost entirely due to concerns in the bond market that tax rates will move up in 2011. Higher income tax rates mean that tax-exempt municipal bonds become more valuable to high income individuals and corporations because they can achieve a better after-tax return than investing in taxable bonds. We hope this “bet” by the bond market is wrong. But, of course, no one will know until Congress takes action – or doesn’t - on the expiring Bush tax cuts.

For preferred stocks, less uncertainty about the health of European banks and the good earnings from US banks, has moved prices of preferred stocks higher. The European bank stress tests themselves and their results released last Friday were far from perfect. They did, however, make some additional data public and did reduce concerns about bank stability. This benefited European banks the most, but also U.S. and other banks since all would suffer from a major shock to European credit stability.

This increased confidence reduced the credit risk discounts that had been applied to the prices of many financial industry preferred stocks, pushing their prices higher and yields lower. This is a good sign and a development we can use to our clients’ advantage.

We remain optimistic about corporate earnings and, as a result, about stock prices over the remainder of the year. We continue to believe that inflation will remain muted, and that interest rates will trade in a narrow range. Stocks remain the most undervalued assets we can see and, we believe the path of least resistance for stocks is now up.

Randy Alsman, Editor

Mike Hull

Rick Roop

Greg Donaldson

Friday, July 23, 2010

A Look at the Second Week of the Earnings Season

Friday, July 16, 2010

Short Analysis of Earnings Results for the Second Quarter

Wednesday, July 07, 2010

We Still Believe Earnings Will Be Storng

DCM's Investment Policy Committee continued to examine the data in our meeting this week to try to determine whether we are experiencing a normal stock market correction, or a market that is signalling that something has gone wrong with the consensus view of the economy and corporate earnings.

(Note: Our discussion, summarized below, ended in a consensus view by the Committee that if the upcoming corporate earnings season confirms the current forecast of $82 for annual 2010 S&P 500 earnings, then the current market pullback will reverse itself, possibly dramatically, sometime over the next few months.)

The Committee reviewed economic data and outlooks around the world, corporate earnings guidance from S&P 500 companies, and many other data points.

This week, we looked at a multiple regression analysis that assessed the correlation of core CPI rates with earnings yield of the S&P 500 Index. Earnings Yield is just the flip of P/E. That is, it is E/P instead of P/E. We used this inverted P/E in order to better see the "fit" when charted on a line graph. (See below) Click the chart to enlarge

That analysis shows a tight correlation between core CPI and E/P, with an R2 of .71. The formula derived from the multiple regression indicates that the trailing P/E of the market with core CPI standing at .9% should be about 20X, not the current 14.8X.

If the market “should be” at a 20.2 P/E based on the historical statistical best fit between earnings yield and core CPI, then it is over 30% undervalued, excluding any contribution of earnings over the remainder of the year.

The economic recovery is definitely slowing. Our research, however, brings us to the belief that the economy is still expanding. It is not contracting. Further, during last year’s fourth quarter we, and many other forecasters, predicted that GDP growth in 2010 would slow down in the second half of the year. Everything we see, other than the stock market, is consistent with that forecast. The sharp sell off in stocks over the past three months is reflecting a more pessimistic view of the economy than we can envision at this time.

For the current P/E, and thus current S&P 500 stock price to be correct, earnings for the rest of this year would have to drop by 50% - 75%. A fall in earnings by that magnitude seems highly unlikely to us. Indeed, we believe earnings will continue to surprise to the upside.

We believe that the market sell off in recent weeks is the result of many factors, including: worries about the Administration's attitude toward business, low volume, bearish bets by short-term traders, emotion having greater influence on stock trades than facts, and some vague feelings of skepticism toward 2010 profits by some invesors.

As the earnings reports actually start coming out next week, we believe the market can regain its footing and take back some of the sell off that has so unnerved so many investors.

Having said this, the Committee will be watching and listening very closely to these announcements for any sign of significant earnings outlook deterioration.

Absent a pessimistic turn in earnings, it is hard for us to accept that overall market prices won’t begin turning up – possibly significantly up - before year end.

Randy Alsman, Editor

Mike Hull

Rick Roop

Greg Donaldson