Friday, October 27, 2006

Slowing Economy, Rising Stocks

Friday's announcement of 1.6% GDP growth for third quarter is slightly weaker than I was looking for, and it is a very real indicator of just how weak real estate is. The good news is the inflation data in the release fell to 1.8%, much lower than the consensus estimate of 2.8%. That is very good news to the Fed.

Even in the face of the slowing economy, I believe that the S&P 500 and the Dow Jones Industrials, which both contain blue chip multi-national stocks, will continue to perform well over the next year to 18 months. The slowing economy will not be good for smaller domestic stocks, and I believe their performance will likely lag that of the blue chips. I also believe that blue chip international stocks will continue to perform well.

This divergence between stock market performance and economic performance will be the opposite of what happened in the previous 24 months, when the US economy was strong and US blue chip stocks were flat.

The reason for the unfolding divergence is two fold: (1) The stocks in the major blue chip indices produce nearly 50% of their earnings outside the US, and for the first time in many years, in 2007, the rest of the world will be growing faster than the US. (2.) Blue Chips were poor performers in 2004 and 2005, even though earnings were strong, and because of this , they are underowned on Wall Street.

As it becomes increasingly clear that the rest of the world is growing faster than the US, big money will pile back into US blue chips. Finally, according to S&P analysts, blue chip stocks are as cheap as they have been in years and 2007 S&P 500 Index earnings estimates are still expected to reach double digits.

Markets seldom feel right because we human beings have a habit of projecting today's headlines onto tomorrows stock performance. Remember, the stock market is not a democracy. Prices move in the direction that big money pushes it. Fortunately, big money is normally rational and understands economic cycles and the power of the Fed to slow and speed up the economy.

Big money has a problem. The places where it has been treated well over the past few years are all rolling over. Treasury bonds yield are under 5% in most of the major industrialized nations of the world. Bonds simply are not competition to stocks. Real Estate and commodities are no longer competing effectively for investors against stocks because they are now in downtrends.

Blue Chip stocks, alone, stand out as a value now that bonds, real estate, and commodities have become over owned and over valued. Finally, blue chip stocks are in an uptrend. This positive momentum is a rarity in today's world's financial markets. As long as earnings growth holds near 10%, stocks will continue their strong advance.

This blog is for information purposes only. Do not make purchase and sell decions on the basis on what is discussed here.

Tuesday, October 24, 2006

The Pigs Are Flying

When you look into the portfolios of almost any large mutual funds, you will likely see Johnson and Johnson, Coca-Cola, and Wal-Mart. They will be present, but in many cases, they will be significantly under-owned in relationship to their representation in the S&P 500. This is what I call benign neglect; the manager really does not like the stocks but owns them in some small measure -- just in case. Just in case, their fortunes change and their prices begin to rise, which, in the mind of the manager, will be about the same time that pigs fly.

The question might be asked: why do the managers even bother with these exercises in benign neglect? The answer is simple, even though the aforementioned companies are often a drag on performance, they look good in the annual report; they denote a conservative philosophy, and a respect for companies that have stood the test of time -- in some instances, even a bold contrary view.

There is always the thought in the manager's mind that he or she can quickly raise the weighting of an under-owned company, when, as, and if it gets its act together. The reality is different. Because the manager may have 300-500 stocks in his or her portfolio, the under-owned big cap stocks fall off the radar screen because the manager thinks he or she knows them.

One day Mr. or Mrs. Portfolio Manager wakes up and realizes that they don't know the benignly neglected companies at all. That is what has happened for JNJ, KO, and WMT in recent days, and sure enough, the pigs took flight.

There is another well-honed exercise on Wall Street. It is called flying pig catching. This happens when the neglected stocks come to life and Mr. or Mrs. Portfolio manager engages in a pitched battle to buy the stocks competing against the like-minded crowd that is trying to cover their shorts. It is a beautiful sight if you own the stocks when this happens.

Johnson and Johnson, Coke, and Wal-Mart have all reported strong earnings, or earnings guidance in recent days. The market has rewarded all three with sharply higher prices. I have discussed in previous blogs that these companies were undervalued and that their businesses were improving. In addition, our models show that all three are still undervalued, even after their recent spikes.

There is another thing about flying pigs that Mr. and Mrs. Portfolio Manager know all too well: They can fly higher and farther than a rational person would think possible.

The link to Yahoo shows the last 12 months prices for all three stocks and the recent spikes higher.

Yahoo Charts

Clients and employees of Donaldson Capital may own one or all three of these stocks, depending on their investment styles. This site is for information purposes only. Do not use it to make investment decisions based on what you have read here. If you are not a client of DCM, please consult your own financial advisor.

Thursday, October 19, 2006

Healthcare Sector: In the Pink?

The chart below shows the Healthcare Sector Ishares going back to 1999. It is easy enough to say it, but more difficult to believe it, but this past week, Healthcare broke to a new 7 year high. This is completely contrary to the plethora of bad news that has surrounded this sector. The Healthcare sector is dominated by the drug stocks and, let's face it, the drugs, in some quarters, are held in as low esteem as their namesakes of the illegal variety.

................................S&P Healthcare........................

So what is the sector doing making new highs when sales and earnings growth are still so meager and lawsuits are as common and curable as a cold? When I showed this to Mike Hull, the first thing he said was: go long the Republicans. By that I think he means that since the Democrats have led the attacks against the drug companies, a break to a new high by the sector would mean that big investors are betting that the Republicans are going to remain in power in the November elections. That is a completely counterintuitive thought because the main stream media has virtually ceded control of at least the House of Representatives to the Democrats.

On the other hand, since the break out is coming so near the elections and the Democrats are leading in the polls, the market may be saying that the drug companies can cut a better deal under new political leadership. Unfortunately, that is neither easy to say or believe.

I prefer to believe that the agony of the past 7 years, has provided the drug companies with a new model that investors believe is viable and sustainable. That model is based much more on cost savings and a more focused approach to research and development.

Even though sales gains have been tough in the sector, many of the main players such as JNJ and PFE have reported earnings growth much higher than Wall Street estimates.

From a valuation perspective, the drugs are about as cheap on a relative basis as any group. In our September 16th edition, we showed JNJ was nearly 20% undervalued. That is probably about the average of the stocks in the sector.

Having negotiated all these "what ifs," I think the Healthcare breakout should be seen as good news for stocks, in general, because it is such an important sector in the S&P 500. In addition, with the drugs so out of favor among big investors, there is good reason to believe that this breakout will likely get a lot of attention and draw in fresh money. I'll keep you updated as we go.

So what is the sector doing making new highs when sales and earnings growth are still so meager and lawsuits are as common and curable as a cold? When I showed this to Mike Hull, the first thing he said was: go long the Republicans. By that I think he means that since the Democrats have led the attacks against the drug companies, a break to a new high by the sector would mean that big investors are betting that the Republicans are going to remain in power in the November elections. That is a completely counterintuitive thought because the main stream media has virtually ceded control of at least the House of Representatives to the Democrats.

On the other hand, since the break out is coming so near the elections and the Democrats are leading in the polls, the market may be saying that the drug companies can cut a better deal under new political leadership. Unfortunately, that is neither easy to say or believe.

I prefer to believe that the agony of the past 7 years, has provided the drug companies with a new model that investors believe is viable and sustainable. That model is based much more on cost savings and a more focused approach to research and development.

Even though sales gains have been tough in the sector, many of the main players such as JNJ and PFE have reported earnings growth much higher than Wall Street estimates.

From a valuation perspective, the drugs are about as cheap on a relative basis as any group. In our September 16th edition, we showed JNJ was nearly 20% undervalued. That is probably about the average of the stocks in the sector.

Having negotiated all these "what ifs," I think the Healthcare breakout should be seen as good news for stocks, in general, because it is such an important sector in the S&P 500. In addition, with the drugs so out of favor among big investors, there is good reason to believe that this breakout will likely get a lot of attention and draw in fresh money. I'll keep you updated as we go.

So what is the sector doing making new highs when sales and earnings growth are still so meager and lawsuits are as common and curable as a cold? When I showed this to Mike Hull, the first thing he said was: go long the Republicans. By that I think he means that since the Democrats have led the attacks against the drug companies, a break to a new high by the sector would mean that big investors are betting that the Republicans are going to remain in power in the November elections. That is a completely counterintuitive thought because the main stream media has virtually ceded control of at least the House of Representatives to the Democrats.

On the other hand, since the break out is coming so near the elections and the Democrats are leading in the polls, the market may be saying that the drug companies can cut a better deal under new political leadership. Unfortunately, that is neither easy to say or believe.

I prefer to believe that the agony of the past 7 years, has provided the drug companies with a new model that investors believe is viable and sustainable. That model is based much more on cost savings and a more focused approach to research and development.

Even though sales gains have been tough in the sector, many of the main players such as JNJ and PFE have reported earnings growth much higher than Wall Street estimates.

From a valuation perspective, the drugs are about as cheap on a relative basis as any group. In our September 16th edition, we showed JNJ was nearly 20% undervalued. That is probably about the average of the stocks in the sector.

Having negotiated all these "what ifs," I think the Healthcare breakout should be seen as good news for stocks, in general, because it is such an important sector in the S&P 500. In addition, with the drugs so out of favor among big investors, there is good reason to believe that this breakout will likely get a lot of attention and draw in fresh money. I'll keep you updated as we go.

So what is the sector doing making new highs when sales and earnings growth are still so meager and lawsuits are as common and curable as a cold? When I showed this to Mike Hull, the first thing he said was: go long the Republicans. By that I think he means that since the Democrats have led the attacks against the drug companies, a break to a new high by the sector would mean that big investors are betting that the Republicans are going to remain in power in the November elections. That is a completely counterintuitive thought because the main stream media has virtually ceded control of at least the House of Representatives to the Democrats.

On the other hand, since the break out is coming so near the elections and the Democrats are leading in the polls, the market may be saying that the drug companies can cut a better deal under new political leadership. Unfortunately, that is neither easy to say or believe.

I prefer to believe that the agony of the past 7 years, has provided the drug companies with a new model that investors believe is viable and sustainable. That model is based much more on cost savings and a more focused approach to research and development.

Even though sales gains have been tough in the sector, many of the main players such as JNJ and PFE have reported earnings growth much higher than Wall Street estimates.

From a valuation perspective, the drugs are about as cheap on a relative basis as any group. In our September 16th edition, we showed JNJ was nearly 20% undervalued. That is probably about the average of the stocks in the sector.

Having negotiated all these "what ifs," I think the Healthcare breakout should be seen as good news for stocks, in general, because it is such an important sector in the S&P 500. In addition, with the drugs so out of favor among big investors, there is good reason to believe that this breakout will likely get a lot of attention and draw in fresh money. I'll keep you updated as we go.

Saturday, October 14, 2006

What's Berkshire Hathaway Worth, Anyway?

This past week Berkshire Hathaway Class A common stocks briefly traded above $100,000 per share. Yes, indeed, 10 shares of Warren Buffett's pride and joy makes you a millionaire. Mr. Buffett the, "Oracle of Omaha" has given us professorial lectures for 30 years in his annual reports as to how to value the stock of Berkshire Hathaway. For 30 years, Wall Street has ignored him. According to Zacks, only two analysts make earnings estimates for the stock and both are very wide of the mark.

From time to time, someone will value Berkshire Hathaway Class A stock by valuing the sum of its parts. Berkshire is essentially a holding company of many disparate and independent companies. By individually valuing each company relative to like companies that trade in the open market, one should be able to get a reasonably good idea what the stock is worth. I think there is a better way.

Berkshire Hathaway is the only non-dividend paying stock that we have bought in years. (See our general dividend theory) The reason is simple: even though Buffett eschews dividends (we've asked him to change)by listening to his annual-report lectures, we believe he's right about how to value the stock: book value.

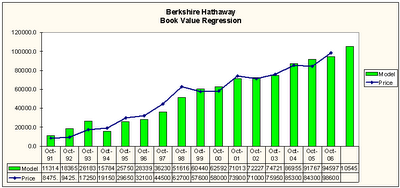

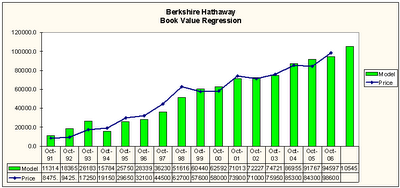

BRK/A almost defies normal valuation because of the complexity of the wide range of companies it owns and the lumpiness of its results, as a result of its insurance business. But Buffett's insistance on high quality companies with strong cash flows lends itself to valuing the stock using book value and interest rates. The chart below is a multiple regression of BRK's book value and long-term interest rates versus it price.

....................Berkshire Hathaway Valuation.............

Click to enlarge

The last green bar (far right) shows the expected value of BRK/A based on projected year-end 2006 book value and current interest rates. Our model suggests that the fair value of Berkshire is over $105,000. We would expect that book value will grow by low double digits in 2007. That would push its fair value even higher. In our judgment, the close fit between BRK/A and our regression model suggest Mr. Buffett's net worth will be rising in the year ahead.

We own the Class B stock of Berkshire Hathaway in our Blue Chip Growth investment style. Clients, employees, and principals of our firm own the stock.

We offer this analysis for information purposes only. Do not make buy and sell decisions based on this blog.

Click to enlarge

The last green bar (far right) shows the expected value of BRK/A based on projected year-end 2006 book value and current interest rates. Our model suggests that the fair value of Berkshire is over $105,000. We would expect that book value will grow by low double digits in 2007. That would push its fair value even higher. In our judgment, the close fit between BRK/A and our regression model suggest Mr. Buffett's net worth will be rising in the year ahead.

We own the Class B stock of Berkshire Hathaway in our Blue Chip Growth investment style. Clients, employees, and principals of our firm own the stock.

We offer this analysis for information purposes only. Do not make buy and sell decisions based on this blog.

Click to enlarge

The last green bar (far right) shows the expected value of BRK/A based on projected year-end 2006 book value and current interest rates. Our model suggests that the fair value of Berkshire is over $105,000. We would expect that book value will grow by low double digits in 2007. That would push its fair value even higher. In our judgment, the close fit between BRK/A and our regression model suggest Mr. Buffett's net worth will be rising in the year ahead.

We own the Class B stock of Berkshire Hathaway in our Blue Chip Growth investment style. Clients, employees, and principals of our firm own the stock.

We offer this analysis for information purposes only. Do not make buy and sell decisions based on this blog.

Click to enlarge

The last green bar (far right) shows the expected value of BRK/A based on projected year-end 2006 book value and current interest rates. Our model suggests that the fair value of Berkshire is over $105,000. We would expect that book value will grow by low double digits in 2007. That would push its fair value even higher. In our judgment, the close fit between BRK/A and our regression model suggest Mr. Buffett's net worth will be rising in the year ahead.

We own the Class B stock of Berkshire Hathaway in our Blue Chip Growth investment style. Clients, employees, and principals of our firm own the stock.

We offer this analysis for information purposes only. Do not make buy and sell decisions based on this blog.

Friday, October 06, 2006

Still Room to Go

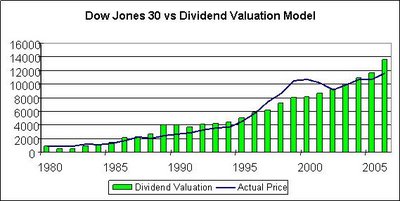

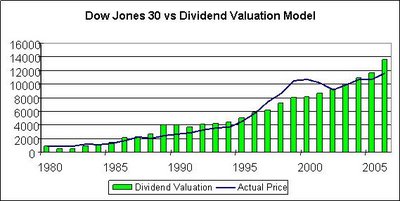

Blue Chip stocks have had a very strong 45 day run and eventually some profit taking will occur. An updated look at our Dividend Valuation Model, however, shows that there is still plenty of value left in the Dow Jones 30 stocks. The model is currently saying that based on year-end 2006 projected dividends and interest rates that the Dow Jones 30's "fair value" is near 13500.

As I have noted in other blogs and shown on the chart, the model became "undervalued" in 2005 and the undervaluation has widened in 2006, even though stock prices have risen. The reason is simple. Dividends have grown faster than prices over the last 24 months.

The model, as with any model, is not something you can take to the bank, it does provide a kind of order of magnitude of how the Dow Jones would be priced today if it were priced in accordance with long term averages.

The main reason the model is so undervalued is the very low level of interest rates combined with higher than average dividend growth. I think the odds of these two trends continuing are very high. For that reason, I see valuation creation growing above historical long-term trends for the next several quarters.

There are certainly issues in the economy and the geopolitical arena, but in my estimation, they are amply discounted in the current prices of the Dow.

If there is a surprise, it is that high quality Blue Chip stocks will continue to rise even as the economy slows. More on that later.

The main reason the model is so undervalued is the very low level of interest rates combined with higher than average dividend growth. I think the odds of these two trends continuing are very high. For that reason, I see valuation creation growing above historical long-term trends for the next several quarters.

There are certainly issues in the economy and the geopolitical arena, but in my estimation, they are amply discounted in the current prices of the Dow.

If there is a surprise, it is that high quality Blue Chip stocks will continue to rise even as the economy slows. More on that later.

The main reason the model is so undervalued is the very low level of interest rates combined with higher than average dividend growth. I think the odds of these two trends continuing are very high. For that reason, I see valuation creation growing above historical long-term trends for the next several quarters.

There are certainly issues in the economy and the geopolitical arena, but in my estimation, they are amply discounted in the current prices of the Dow.

If there is a surprise, it is that high quality Blue Chip stocks will continue to rise even as the economy slows. More on that later.

The main reason the model is so undervalued is the very low level of interest rates combined with higher than average dividend growth. I think the odds of these two trends continuing are very high. For that reason, I see valuation creation growing above historical long-term trends for the next several quarters.

There are certainly issues in the economy and the geopolitical arena, but in my estimation, they are amply discounted in the current prices of the Dow.

If there is a surprise, it is that high quality Blue Chip stocks will continue to rise even as the economy slows. More on that later.

Subscribe to:

Comments (Atom)