stocks were too cheap.

stocks were too cheap.The chart at the right shows that both stocks have recovered smartly over the last two weeks, as it has become clear that, indeed, neither is likely to take big losses. As we write this, however, we believe both stocks may be still as much as 15% undervalued based on the long-term relationships between their dividend growth, interest rates, and their stock prices.

We want to add another stock to the list of banks that we believe has been unfairly punished by the recent liquidity crisis. Barclays Bank is a London-based bank with offices spanning the globe. They have three world-class divisions: banking, capital markets, and asset management (ishares Exchange Traded Funds).

The stock has fallen by nearly 20% over the last 60 days on fears of Barclay's involvement with sub-prime loans, private equity, and hedge funds. There is no way for us to know their precise exposure to these groups, but the company has repeatedly stated that they are not experiencing any large scale losses.

Barclays recently raised their dividend by nearly 18%. A dividend hike of that magnitude is real money since they now yield over 5%.

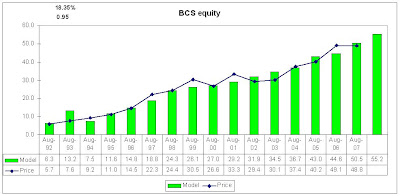

The chart at the right is Barclay's Dividend Valuation Model. The blue line is the actual annual price over the last 15 years, and the green bars are the model's predicted values. The chart shows a close association between the model and prices over the last 15 years and a predicted 2008 value of just over $55.

From today's price of approximately $49, including the dividend, our model is suggesting that Barclay's may be even more undervalued than BAC or WFC.

Barclays has been in business since 1736. With that kind of longevity, we believe they might know a thing or two about how to navigate financial storms. Their AA bond ratings ensures access to the capital markets and minimizes liquidity issues.

The bank has been in a pitched battle with the Royal Bank of Scotland to acquire ABN Amro, a Dutch banking giant. We believe that the market is worried that Barclays may be dragged into a bidding war. In our minds, Barclays had done a lot of things right over the past 270 years. We're inclined to follow with their judgment with ABN Amro.