It has been a complete mystery to us why

Pepsico has had such a flat year

price wise when their earnings and dividend growth has been so outstanding.

Over the past 12 months price growth

for PEP has only risen just over 5%, while earnings have grown nearly 13% and dividends have grown 18%.

We always caution clients that even though there is a tight correlation between dividend growth and price growth for many stocks, that it may take two to three years for price growth and dividend growth to come together.

In the case of PEP, however, the last twelve months seemed primed for the second-largest soft drink company in the world to be a big winner. It has been gaining market share from long-time rival Coke; it has

benefited from the weak dollar; it is the leader in non-carbonated beverages, the fastest growing segment of the soft drink business; its Frito-Lay division is continuing to extend its brand; and the Quaker Oats division, which was a part of the Gatorade purchase, has been adding new products at a rapid pace.

The only reason I can see for the lacklustre performance was the

retirement of Chairman Steven

Reinemund. Everyone remembers that when Coke's Chairman Roberto

Goizueta died in the late 1990s, the company would flounder for nearly a decade before finding a leader that the Coke army would follow.

Will the story repeat itself with

Pepsico? I'm betting it won't.

Pepsico is a much more decentralized company with many powerful brands contributing to the overall success of the company. Coke was much narrower in its product line and much more centralized in its management style.

Goizueta became a bigger-than-life Wall Street CEO, and the admiring-analysts drove Coke's price to the moon, even though the evidence was clear that

Pepsico was catching them in many key parts of the world.

Indra

Nooyi is the new CEO of

Pepsico. She has had a string of successes at Pepsi, and her management style will come more into view in the years ahead, but

Reinemund built a very deep bench of potential replacements should she not be able to lead the charges.

Now that the management change has been made, Wall Street appears to want to sit on it hands and wait for Ms.

Nooyi to impress them. I think that will be a mistake because Pepsi's brands and deep pool of

management talent will continue to propel them almost no matter who is the nominal CEO of the firm.

This may sound like I have some doubts about Ms.

Nooyi. I do not. I have studied her resume, and it is impressive, but I have no idea how she will do in her new job. There are always risks in top management changes, but I think the risks are diminished when a company has the positive momentum that Pepsi has.

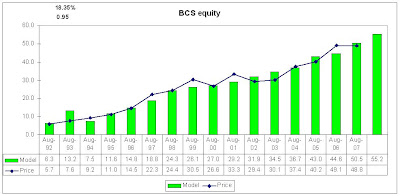

The Dividend Valuation Chart above shows that PEP is undervalued. Our model's best guess for the year ahead price is shown in the green striped bar at the far right. That price is nearly $80 per share, which is nearly 20% higher than the current price. You know that I can't see the future, but I would not be surprised if PEP reached $80 in the year ahead. With all of the worries about real estate,

subprime loans, and the strength of the US banking system, Pepsi's worldwide presence selling a relatively inexpensive product, which has remarkable profitability just might be the "right thing."

The chart at the right shows the model going back to 1975. The blue line is the average annual price of the Dow and the green bars are the model's predicted values. The model uses only the dividends paid by the 30 companies in the Dow and long-term high-quality bonds.

The chart at the right shows the model going back to 1975. The blue line is the average annual price of the Dow and the green bars are the model's predicted values. The model uses only the dividends paid by the 30 companies in the Dow and long-term high-quality bonds.