Thursday, September 28, 2006

Real Estate and the Tipping Point

I have traveled to many of the hot real estate areas of the country over the last two years. I am not an avid real estate investor, but it is such an important part of the economy that where ever I go for business or pleasure, I check out, as best I can, what' s going on in the local market.

One reason for my keen interest in real estate is that I have been convinced that the employment statistics, as measured by official government measures, have been undercounting self-employed real estate contractors. I described this phenomenon in 2004 when the naysayers were castigating the "jobless" recovery.

I said then there was no such thing as a jobless recovery, and I believe the events of the last two years have born me out. Unfortunately, I now believe that real estate in many parts of the country is much weaker than official statistics show. If I am right, this has big implications for the economy and employment.

The danger I see in real estate is in what I will call the "cool" areas of the US: Mountains, water, skylines, golf scapes, and the "in spots," in general, in many parts of the country just cannot sustain the prices at which properties have recently sold. The surest indication of this is the prices at which these same properties can command as rental units.

Whether one acknowleges it or not, in the recreational areas, the prices are, ultimately, set by the rental market. It was the rental market that drove prices higher in Florida, Arizona, California, Colorado, the Northwest, the upper Midwest, and New England. Property values shot up because the prices that long and short-term leases could command went up. But, now rental prices are softening even faster than housing prices in many of these areas.

I have a place in Central Oregon. My family I are great fans of Oregon and the great people of the eastern slopes of the Cascade Mountains. Unfortunately, I see things going on in one of my favorite places on earth that portend a contraction in real estate prices. Long-term rental prices in central Oregon are a fraction of the underlying values of the properties. In my recent visits, I have seen condos valued at $400,000 advertised for lease at $1500 per month for a a 24 month term. That level of monthly lease represents less than half the underlying value of the property. This phenomenon is not isolated to Oregon.

The speculators day of reckoning is near. A person can keep lots of real estate afloat as long as prices are rising, but if prices start to fall, the banks get grouchy quickly. I believe that time is very near, and for that reason, I believe lots of real estate in the recreational areas of the country will soon be coming on the market. In my judgment, when that happens, there will be few buyers because speculators have been selling to speculators for quite a while now.

Banks never handle these secular slow downs very well because they have been speculating in real estate along with everyone else. Bonuses, profit sharing, stock prices, and promotions have all become dependent upon rising real estate prices. Some banks will figure out quickly that the true economic value of properties in their portfolios are dramatically lower than the price of the last sale, and they will call in their loans quickly. They will loose a lot of public relations points, but they will escape serious trouble. Other banks will try to ride it out. It won't work. They have loaned up to 95% of the property value, but even as I write this, these properties are only worth 75%-80% of their selling prices if a lot of properties hit the market. Banks who try to ride it out are in for a lot of headaches, losses, and bad press.

I want to close by repeating that I am not a real estate expert, so don't follow what I am saying here blindly. However, I am a student of human nature and of the economy.

In 1999, our money management firm stopped taking new clients because we believed that speculation in tech stocks had reached the tipping point. That was one of the best decisions of my life. One of the worst decisions of my life was in my not having had the courage to put my foot down and say that the tech bubble was about to burst and sell not only the tech stocks but everything that was trading for more than 30 times earnings.

I cannot see the future and there are those who know the forces of real estate much better than I. I am sharing my thoughts because my views of the future are colored by the past and there is a shape and form to bubbles that has become very familiar to me. In my mind, there is a bubble in residential real estate in many parts of the country and the bubble is not sustainable.

I will stop here. This is a complex subject and there are hundreds if not thousands who will read what I am saying. I have one suggestion. If you are holding more real estate than you can live in, please talk to someone you trust in the real estate business other than the person who sold you the property. You may think that you can catch the falling knife, but let me remind you that Procter and Gamble sold at 60x earnings in 1999. Today it sells for 20 times earnings.

.

Sunday, September 24, 2006

Dow Jones Industrials New High -- About Time

By the time you read this, the Dow Jones Industrial Average may be sitting at a new all-time high. At the close today, the Dow was within 50 points of its old high and the momentum feels like it will carry us beyond the previous high, which was set in early 2000.

As usual the market has been climbing a wall of worry, and the 30% of American's who believe the US economy is in bad shape -- including many on Wall Street -- are going to have a heck of a time trying to figure out how stocks can be hitting new highs in the face of such a "lousy" economy. There must be a conspiracy here somewhere.

Our stock market model indicates that the "fair value" of the Dow Jones Industrials is closer to 13,000, so from a valuation perspective, the market would seem to have a long way to go.

Unfortunately, we also have an inflation model that suggests a little different story. With the 30-year T-Bond at a yield of 4.75%, our model calculates that core inflation should now be slightly under under 2%. With the core inflation rate running at 2.7%, getting down to even 2% in the next 12 months would seem to be a tall order. The only way I can see such a fall is on the back of housing. One reason for this is that food and energy are excluded from the core CPI, so falling oil prices won't help much. Since housing is one of the largest components of the core CPI, if current bond yields are correct, it would seem to presuppose that housing is going to be a bigger problem over the next 12 months than the market now thinks.

Since housing is directly tied to banking and since banking and finance are nearly 23% of the S&P 500, it is very difficult to project a continuation of the recent record pace for the S&P. Ahh, but here is were the compositions of the Dow Jones 30 and the S&P 500 come into stark contrast. Financials represent only about 15% of the Dow, with none of the companies being a mortgage driven regional bank or a pure mortgage broker. The S&P 500, on the contrary, is loaded with mortgage driven regional banks, mortgage brokers, mortgage insurers and many more companies tied directly to housing. In this regard, as it relates to housing, the Dow is much less sensitive to the unwinding of the housing bubble than is the S&P 500.

Having split this hair, I believe it is quite possible that the Dow will continue to move higher over the next few months, while the S&P 500 may not do as well.

This is not idle mental castle building, we have sold almost all of our regional banks and cut back modestly on some money center banks with big mortgage holdings. This is a significant action because Sunbelt regional banks were our largest holdings at the beginning of the year. We still like banking, but US money center banks and strong foreign banks look like better values to us over the next couple of years. Their portfolios are diversified worldwide, and their investment banking divisions are minting money with all the mergers and private-equity buy outs.

It will be good for the Dow to take out the old high. In my mind, it should have happened a long time ago. The values have been there to support much higher prices. But let's face it, the psychology has been lousy. Today, I believe the value are so compelling that, even in the face of lots of unknowns, the path of least resistance is up.

Thursday, September 21, 2006

Sam Would Be Proud -- Wal-Mart

From Bentonville Arkansas, Sam Walton built one of the most remarkable businesses the US has ever seen. He delivered on the greatest selling pitch of all time:"I can get it for you wholesale." The rest of the retailing world could get it for you "wholesale" during "White sales," "President Day sales," "Inventory reduction sales," and "Lost our lease sales," but Sam and his disciples offered it to us every day. Sam did not "give it to us" in the sense that his detractors charge. He became our "buyer" and he was remarkable at passing along his volume discounts. My mother thinks Wal-Mart (WMT) is one of the greatest inventions of her 86 years. She does not understand that it is not politically correct to think that Wal-Mart does anything good.

There are those who think that the blood has run a little thin at WMT since Sam died. Who knows maybe Sam has felt the same way, but not today. Today, Sam is looking down on the firm he started on that dusty parking lot in Bentonville so many years ago and he is happy. He is happy because his disciples have come up bold. And Sam knows destiny favors the bold.

Today Wal-Mart announced that they will begin offering generic drugs at sharply discounted prices. Starting first in the Tampa area, they will offer nearly 300 generic drugs for a flat $4.00 per month. That news took about $5 billion out of Walgreen,CVS, and other drug retailers, but drew no response in WMT's price.

I think this news is about as big a strategic move as I have seen a company make in a long time. Wall Street probably won't like the deal because it does not seem to drive very much to the bottom line. The Wal-Mart haters won't like it, well, because they know that Americans will love it, and their jobs just got tougher. California won't like it because this will likely clutter up their pristine streets with noisy, smelly cars going to Wal-Mart.

But the bottom line is my mom is going to love it. The way I figure it, she will save about a hundred dollars per month when the program comes to Indiana. And speaking of Indiana, I would like to make the following plea to Wal-Mart:

Dear Mr. Scott,

Indiana is a big fan of Wal-Mart. We don't hang you in effigy; file countless nuisance lawsuits against your company; or fight you every time you want to open a store in the Hoosier state. Do my mom and other Hoosiers a favor and bring your new generic drug pricing program to Indiana after its rolling in Florida. My mom said she would cook dumplings for you if you want to stop by.

Our model shows that WMT is about 20% underpriced and the biggest reason for the undervaluation is the incredible negative public relations battle that has been waged against the company. In my mind, with this discount generic drug pricing initiative, WMT, at least for the near term, has regained the high ground against their detractors.

This company is growing 2-3 times as fast as most utilities, but is trading at a PE 30% less than the average utility. Sam would be buying.

Blessings,

Clients and employees of Donaldson Capital own WMT.

Saturday, September 16, 2006

Johnson and Johnson -- Ready for A Turn?

Positive market breadth has widened over the past two weeks as more cyclical sectors have ticked higher, betting that the Fed has likely finished hiking rates. I agree that the Fed is on the sidelines, but I believe the optimism about prospects for the average stock are premature.

Recent data clearly show that the economy is slowing, and wages are now rising faster than prices, as was revealed by Friday's CPI report. Indeed, Friday's tame CPI release, which the markets interpreted as good news, is probably strong evidence that corporate profit growth has peaked and is now trending lower. Taken together, recent data strongly suggest that profits will likely disappoint in the year ahead.

In this scenario, I continue to believe that high quality consumer defensive stocks offer compelling values. Our research shows that Johnson and Johnson, a leader in the healthcare sector, is continuing to put up good results, which are being ignored by the market.

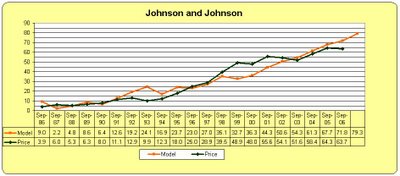

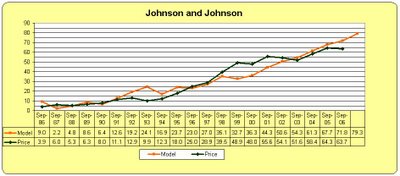

The chart below is of our proprietary Dividend Valuation Model for JNJ.

...................Johnson and Johnson............

Please click to enlarge.

Very simply, the model is saying that based on JNJ's 20-year average relationships between price growth, dividend growth, and changes in interest rates its stock is cheap. Furthermore, 2007 earnings are expected to rise sharply over 2006.

There are a lot of cheap drug stocks, and they deserve to be cheap because they are not the companies today that they were a decade ago. That is not the case with JNJ. Almost alone among US drug stocks, JNJ has weaved its way through the land mines of drug recalls, patent battles, and mind-boggling lawsuits that have blown up so many heretofore great companies.

JNJ's reliance on block buster drugs is much less than many of the pharmaceuticals, and they have developed a solid line of OTC drugs that were formerly only available by prescription.

Our model says JNJ is significantly undervalued. That does not guarantee success. It is just an indication that JNJ's current earnings and dividends are not as highly prized as they have been on average over the las 20 years. My belief is that JNJ's accelerating earnings in 2007 will look very good compared to the many earnings disappointments I expect during the coming year.

A lot of traders are avoiding the drug stocks like the plague because the drugs are having so much trouble. But for longer term investors, buying stocks that are out of favor yet whose prospects appear to be improving makes good sense.

The model shows that buying JNJ when its "fair value" line (gold) has been higher than its price line (green) has always worked out. I can't see the future, and I'm sure you know that the past is no gurantee of the future, but I would not be surprised to see JNJ trading in the mid 70s sometime in the next year or two.

You guessed it. I own the stock.

Please click to enlarge.

Very simply, the model is saying that based on JNJ's 20-year average relationships between price growth, dividend growth, and changes in interest rates its stock is cheap. Furthermore, 2007 earnings are expected to rise sharply over 2006.

There are a lot of cheap drug stocks, and they deserve to be cheap because they are not the companies today that they were a decade ago. That is not the case with JNJ. Almost alone among US drug stocks, JNJ has weaved its way through the land mines of drug recalls, patent battles, and mind-boggling lawsuits that have blown up so many heretofore great companies.

JNJ's reliance on block buster drugs is much less than many of the pharmaceuticals, and they have developed a solid line of OTC drugs that were formerly only available by prescription.

Our model says JNJ is significantly undervalued. That does not guarantee success. It is just an indication that JNJ's current earnings and dividends are not as highly prized as they have been on average over the las 20 years. My belief is that JNJ's accelerating earnings in 2007 will look very good compared to the many earnings disappointments I expect during the coming year.

A lot of traders are avoiding the drug stocks like the plague because the drugs are having so much trouble. But for longer term investors, buying stocks that are out of favor yet whose prospects appear to be improving makes good sense.

The model shows that buying JNJ when its "fair value" line (gold) has been higher than its price line (green) has always worked out. I can't see the future, and I'm sure you know that the past is no gurantee of the future, but I would not be surprised to see JNJ trading in the mid 70s sometime in the next year or two.

You guessed it. I own the stock.

Please click to enlarge.

Very simply, the model is saying that based on JNJ's 20-year average relationships between price growth, dividend growth, and changes in interest rates its stock is cheap. Furthermore, 2007 earnings are expected to rise sharply over 2006.

There are a lot of cheap drug stocks, and they deserve to be cheap because they are not the companies today that they were a decade ago. That is not the case with JNJ. Almost alone among US drug stocks, JNJ has weaved its way through the land mines of drug recalls, patent battles, and mind-boggling lawsuits that have blown up so many heretofore great companies.

JNJ's reliance on block buster drugs is much less than many of the pharmaceuticals, and they have developed a solid line of OTC drugs that were formerly only available by prescription.

Our model says JNJ is significantly undervalued. That does not guarantee success. It is just an indication that JNJ's current earnings and dividends are not as highly prized as they have been on average over the las 20 years. My belief is that JNJ's accelerating earnings in 2007 will look very good compared to the many earnings disappointments I expect during the coming year.

A lot of traders are avoiding the drug stocks like the plague because the drugs are having so much trouble. But for longer term investors, buying stocks that are out of favor yet whose prospects appear to be improving makes good sense.

The model shows that buying JNJ when its "fair value" line (gold) has been higher than its price line (green) has always worked out. I can't see the future, and I'm sure you know that the past is no gurantee of the future, but I would not be surprised to see JNJ trading in the mid 70s sometime in the next year or two.

You guessed it. I own the stock.

Please click to enlarge.

Very simply, the model is saying that based on JNJ's 20-year average relationships between price growth, dividend growth, and changes in interest rates its stock is cheap. Furthermore, 2007 earnings are expected to rise sharply over 2006.

There are a lot of cheap drug stocks, and they deserve to be cheap because they are not the companies today that they were a decade ago. That is not the case with JNJ. Almost alone among US drug stocks, JNJ has weaved its way through the land mines of drug recalls, patent battles, and mind-boggling lawsuits that have blown up so many heretofore great companies.

JNJ's reliance on block buster drugs is much less than many of the pharmaceuticals, and they have developed a solid line of OTC drugs that were formerly only available by prescription.

Our model says JNJ is significantly undervalued. That does not guarantee success. It is just an indication that JNJ's current earnings and dividends are not as highly prized as they have been on average over the las 20 years. My belief is that JNJ's accelerating earnings in 2007 will look very good compared to the many earnings disappointments I expect during the coming year.

A lot of traders are avoiding the drug stocks like the plague because the drugs are having so much trouble. But for longer term investors, buying stocks that are out of favor yet whose prospects appear to be improving makes good sense.

The model shows that buying JNJ when its "fair value" line (gold) has been higher than its price line (green) has always worked out. I can't see the future, and I'm sure you know that the past is no gurantee of the future, but I would not be surprised to see JNJ trading in the mid 70s sometime in the next year or two.

You guessed it. I own the stock.

Friday, September 08, 2006

Is Procter and Gamble Fairly Valued?

My research shows that stocks spend very little time at "fair value." They wiggle and wobble around and through "fair value," but the animal spirits of momentum investors seem to preclude long stays there. As we have been saying for many months, the economy is slowing and money has been moving from cyclical and smaller companies to larger more defensive stocks. Many of the defensive stocks have had strong moves, prompting the question, "Do they have anything left."

To answer that question, I will analyze Procter and Gamble - PG, one of the key stocks in the consumer staples sector, which is at the heart of the defensive group.

Our Dividend Correlation Model and Bloomberg's Dividend Discount Model both are saying PG is cheap. Not only relative to itself, but relative to other big cap stocks.

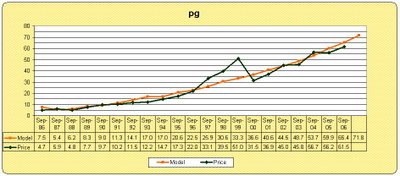

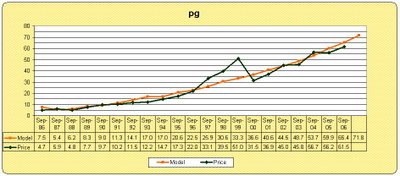

Chart I shows our DCM valuation of PG over the past 20 years.

.............................Procter and Gamble............................. To see the model more clearly please click the image.

The green line (dark) shows PG's annual price since 1986. The gold line (light) is our Dividend Valuation Model's indicated "fair value" for each year. You will note a lot of wiggling and wobbling between the two lines, but they are clearly highly correlated, and, as we have shown previously, price does most of the wiggling and wobbling.

The model currently says that the expected "fair value" for 2007 is 71.80, or about 17% above the current price of $61.50. Our model says PG is very cheap.

..............................Procter and Gamble...........................

To see the model more clearly please click the image.

The green line (dark) shows PG's annual price since 1986. The gold line (light) is our Dividend Valuation Model's indicated "fair value" for each year. You will note a lot of wiggling and wobbling between the two lines, but they are clearly highly correlated, and, as we have shown previously, price does most of the wiggling and wobbling.

The model currently says that the expected "fair value" for 2007 is 71.80, or about 17% above the current price of $61.50. Our model says PG is very cheap.

..............................Procter and Gamble...........................

Chart II shows Bloomberg's Dividend Discount Model valuation of PG. A Dividend Discount analysis is a forward looking computation of the discounted present value of PG's future dividend payments.

Looking at the lower half of the table you can see that the Theoretical Price of PG, as computed by the Dividend Discount Model, is $77.04, or 25% higher than the current price.

I'll leave for another time a wider discussion of the table.

Here's the last word. The slowing economy will cause many stock groups to either go flat or fall. The consumer staples sector is not likely to be affected much by the slowing economy because the products they sell are modestly priced and we use them everyday. As the economic slowdown becomes more apparent, I believe the consistent earnings and dividend growth of PG (and many of the other stocks in the consumer staples sector) will become more highly prized by Wall Street, and the momentum players will drive PG's price higher.

The valuation models shown here suggest that PG has a ways to go just to reach "fair value," and as I said in the beginning, stocks don't spend much time fairly valued. I would argue that PG might see a time during the next 18 months when the momentum players will push it above fair value. You do the math.

Blessings,

Donaldson Capital clients, employees, and I own PG. This is not a buy recommendation, it is an example of valuation models and macro-economic analysis. In addition, we may sell PG in the future without notice.

Chart II shows Bloomberg's Dividend Discount Model valuation of PG. A Dividend Discount analysis is a forward looking computation of the discounted present value of PG's future dividend payments.

Looking at the lower half of the table you can see that the Theoretical Price of PG, as computed by the Dividend Discount Model, is $77.04, or 25% higher than the current price.

I'll leave for another time a wider discussion of the table.

Here's the last word. The slowing economy will cause many stock groups to either go flat or fall. The consumer staples sector is not likely to be affected much by the slowing economy because the products they sell are modestly priced and we use them everyday. As the economic slowdown becomes more apparent, I believe the consistent earnings and dividend growth of PG (and many of the other stocks in the consumer staples sector) will become more highly prized by Wall Street, and the momentum players will drive PG's price higher.

The valuation models shown here suggest that PG has a ways to go just to reach "fair value," and as I said in the beginning, stocks don't spend much time fairly valued. I would argue that PG might see a time during the next 18 months when the momentum players will push it above fair value. You do the math.

Blessings,

Donaldson Capital clients, employees, and I own PG. This is not a buy recommendation, it is an example of valuation models and macro-economic analysis. In addition, we may sell PG in the future without notice.

To see the model more clearly please click the image.

The green line (dark) shows PG's annual price since 1986. The gold line (light) is our Dividend Valuation Model's indicated "fair value" for each year. You will note a lot of wiggling and wobbling between the two lines, but they are clearly highly correlated, and, as we have shown previously, price does most of the wiggling and wobbling.

The model currently says that the expected "fair value" for 2007 is 71.80, or about 17% above the current price of $61.50. Our model says PG is very cheap.

..............................Procter and Gamble...........................

To see the model more clearly please click the image.

The green line (dark) shows PG's annual price since 1986. The gold line (light) is our Dividend Valuation Model's indicated "fair value" for each year. You will note a lot of wiggling and wobbling between the two lines, but they are clearly highly correlated, and, as we have shown previously, price does most of the wiggling and wobbling.

The model currently says that the expected "fair value" for 2007 is 71.80, or about 17% above the current price of $61.50. Our model says PG is very cheap.

..............................Procter and Gamble...........................

Chart II shows Bloomberg's Dividend Discount Model valuation of PG. A Dividend Discount analysis is a forward looking computation of the discounted present value of PG's future dividend payments.

Looking at the lower half of the table you can see that the Theoretical Price of PG, as computed by the Dividend Discount Model, is $77.04, or 25% higher than the current price.

I'll leave for another time a wider discussion of the table.

Here's the last word. The slowing economy will cause many stock groups to either go flat or fall. The consumer staples sector is not likely to be affected much by the slowing economy because the products they sell are modestly priced and we use them everyday. As the economic slowdown becomes more apparent, I believe the consistent earnings and dividend growth of PG (and many of the other stocks in the consumer staples sector) will become more highly prized by Wall Street, and the momentum players will drive PG's price higher.

The valuation models shown here suggest that PG has a ways to go just to reach "fair value," and as I said in the beginning, stocks don't spend much time fairly valued. I would argue that PG might see a time during the next 18 months when the momentum players will push it above fair value. You do the math.

Blessings,

Donaldson Capital clients, employees, and I own PG. This is not a buy recommendation, it is an example of valuation models and macro-economic analysis. In addition, we may sell PG in the future without notice.

Chart II shows Bloomberg's Dividend Discount Model valuation of PG. A Dividend Discount analysis is a forward looking computation of the discounted present value of PG's future dividend payments.

Looking at the lower half of the table you can see that the Theoretical Price of PG, as computed by the Dividend Discount Model, is $77.04, or 25% higher than the current price.

I'll leave for another time a wider discussion of the table.

Here's the last word. The slowing economy will cause many stock groups to either go flat or fall. The consumer staples sector is not likely to be affected much by the slowing economy because the products they sell are modestly priced and we use them everyday. As the economic slowdown becomes more apparent, I believe the consistent earnings and dividend growth of PG (and many of the other stocks in the consumer staples sector) will become more highly prized by Wall Street, and the momentum players will drive PG's price higher.

The valuation models shown here suggest that PG has a ways to go just to reach "fair value," and as I said in the beginning, stocks don't spend much time fairly valued. I would argue that PG might see a time during the next 18 months when the momentum players will push it above fair value. You do the math.

Blessings,

Donaldson Capital clients, employees, and I own PG. This is not a buy recommendation, it is an example of valuation models and macro-economic analysis. In addition, we may sell PG in the future without notice.

Monday, September 04, 2006

DCM President, Mike Hull, Responds to a Client's Question

Mike --

I came across an interesting article this morning on the market and its prospects. It made a lot of sense to me and, therefore, I'm passing it on to you.

To link to the article, click here

What do you think?

Peace, my friend.

Bill

.........................................

Bill,

We may come at it through a slightly different angle, but our conclusion is pretty much the same -- a soft landing that the stock market will absolutely love. Corporate profit growth has been astounding while the Fed has been raising interest rates. Because the big money in the market never wants to "fight the Fed," we haven't seen stock prices respond to the ever-improving fundamentals of the companies. As the article described, that can happen even as the economy slows. We are already seeing it in our high-quality, dividend-paying companies. The stocks in your accounts have returned twice that of the Dow and five times better than the S&P 500 -- had to get that plug in there.

Specific areas to watch:

Oil -- the media is making far more of this than what is really going on (surprise). The members of OPEC do not want to see oil prices any higher than they are right now. Already, the US is making a serious effort to reduce our dependency on foreign oil. If you quesiton that, check out the price of corn futures.

Housing -- this could be a wild card. It very much appears to be a soft landing for the housing market. And, lower interest rates are helping that.

Interest Rates -- again the media doesn't tell the true story. No surprise that the media only shouts the bad news. The truth is that during the last month interest rates on the ten and thirty year treasury notes dove well below 5%. This will keep mortgage rates very attractive and keep the housing market from coming apart.

Interest Rates -- these low, long term rates also indicate the bond market has no worry about inflation.

Interest Rates -- these low interest rates, and the inverted yield curve, do seem perplexing, however. They also seem to be saying that the bond market is looking for a serious slow down, maybe not a recession, but a much slower economy than the stock market is indicating right now.

Seat of the pants -- Money has to go somewhere. Investment decisions are always relative. We have corporate bonds and government agencies yielding right around 5%. We have the steam coming out of the real estate market. And, we have high quality companies with dividend yields running between 3.5% and 4.5% , and those dividends are growing in double digits. Those same companies have been accumulating cash like crazy, buying back their own stock, and bolstering their balance sheets with cheaper debt.

Money has to go somewhere. I cannot see the big money ignoring the great values in blue chip stocks, at least until something in this scenario changes.

Good to hear from you. I'll try to get with you during the next couple of months on one of my trips to Indy.

Take care,

Mike

Donaldson Capital Management, LLC 800-321-7442 812-421-3200 mhull@dcmol.com

Subscribe to:

Comments (Atom)