Thursday, August 31, 2006

BAC's Dividend Growth and the Cure for Jim Cramer

CDs yield about 4.5%, 10-yr T-bonds yield near 4.7%, and 30 year T-bonds yield 4.8%. Bond investors all over the world move and shake for the best deals they can get, but at the end of the day, almost everything they buy begins with a 4.

They go home at night, kiss their spouses, and watch the mad mad world of CNBC's Jim Cramer for laughs (If you haven't seen him, he's a kick). They think Cramer is bad for their profession. They think Cramer's antics might cause the investing public to get the idea that investment people are clowns at best, or deranged, at worst.

Cramer, indeed, does acts like a cross between the Hunchback of Notre Dame and Knute Rockne. He twists himself into contortions while shouting gibberish, pounds on circus horns, and chews out callers for dumb questions. But then, in the persona of Knute Rockne, gives his take on 25 stocks in 10 minutes with a lucidity and passion that the Gipper would envy.

The bottom line is you can call him crazy but Jim Cramer "ain't" buying nothing with a 4 on the front of it.

I can debate a lot of issues with Mr. Cramer, and his style is not my style ( although I do like the circus horns), but I share his aversion to bond yields beginning with a 4. While he shoots for 20%ers in stocks of every stripe, I see many good prospects for 10%ers in good old dividend paying stocks. Let me give you one idea.

Our old friend Bank of America is currently yielding 4.35%. There's that 4 again, but this is a different kind of 4. With modest success, this 4 can grow into a 10 over the next few years. Here's how to look at it:

BAC is as close to a nationwide bank as we have in this country, so their growth, at the very least, ought to mirror the economic growth of the United States. The US economy has grown at a nominal rate of between 6% and 7% for decades. Let's estimate, then, that BAC can grow earnings at least at 6% per year over the next decade. BAC's earnings and dividends have grown at about the same rate for the past decade, so let's assume that the dividend will also grow at 6%. Finally, even though BAC's current dividend yield at 4.35% is higher than its 10-year average, let's assume that ten years from now it will still yield 4.35%.

Using these assumptions, the 10 year internal rate of return for BAC would be approximately the current yield of 4.35% plus the dividend growth of 6% or 10.35%.

Jim Cramer might be in and out of BAC a dozen times a year, and he might make a whole lot more than 10.35%, but then again, just as he "ain't" looking for nothing with a 4 on the front of it, he probably "ain't" looking at BAC's dividend yield and dividend growth the way that we are. And who knows, if he did look at the solid long-term prospects of many dividend-paying stocks, he might sleep better. This improvement is his sleep habits could diminish his hyper-activity and affinity for horns and shouting at inanimate objects. He might even stop shouting altogether, which would add a more professional demeanor to his program. With any kind of luck, he might raise the level of his program to, say, that of Lou Dobbs.

Forget that I said that. Lou Dobbs has become so sane and serious that he has moved from the business of analyzing investments to the world of analyzing politics. Now that's crazy.

Honk the horn all you like, Jim, I lose myself in your antics everytime I watch you. And in these days, all of us need something to take us away from the latest episode of man's inhumanity to man that we see stretched across the globe.

Sunday, August 27, 2006

Energy: The New Y2K: Investing in Prudence

A few weeks ago, I said that energy is the new Y2k. That is, people who do any kind of planning realize that our present sources of petroleum are largely in the hands of people who are not our friends. Prudence dictates alternatives. I mentioned that new energy-saving technologies for automobiles, the home, and corporations will make obsolete many of today's propulsion machines and a lot sooner than most people think.

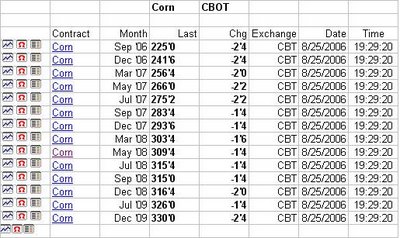

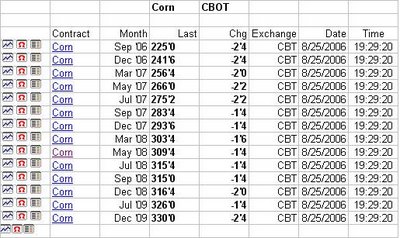

If you do not believe me that something big is going on, then maybe you'll believe the big commodities traders. The table below is from The Wall Street Journal's commodity page. It shows the price of corn futures through 2009.

................................Corn Futures...................

The fourth column under Corn is the price. To transpose it into dollars per bushel, just put the decimal point after the first digit, ie. the price for the contract for Sep '06, which reads 225'0, would mean $2.25 per bushel.

As you go down the table; you will notice that prices go up every year until we reach a high price of $3.30 for the Dec '09 contract.

For a speculator to make a profit on the Dec '09 contract, the price of corn will have to exceed $3.30 per bushel. That is nearly 50% higher than today's price, and much higher than would ordinarily be expected.

Why are commodity traders so bullish on corn? Do they know something about the weather that we don't know? That is possible because they can now trade the weather, but I think the reason corn futures are so high is contained in one word: ethanol.

Lots of big money believe, as I do, that changes are coming in the way we power our machines. In this case, they are betting that corn (ethanol) will have an increasing role as a fuel for our cars, trucks, and tractors.

To me the growing use of ethanol ( no matter its actual energy efficiency) is a forgone conclusion among the big players in both the agricultural as well as the automotive industries. As shown here, this will drive up corn prices (you might want to hoard some corn flakes for the kids and some whiskey for yourself), but it will give Americans some feeling of greater control over their energy needs.

But, in my judgment, the greater use of ethanol and biodiesels are just the beginning. There are scores of hybrid engines on the way that will get up to 50 miles per gallon and more. They will cost more, but what is given up in dollars will be more than made up in a growing sense of prudence.

Prudence may seem like an old fashion word, but billions of dollars are spent annually on prudence called by another name: insurance.

Archer Daniel Midland -- ADM -- is the way most people are playing ethanol and biodiesel. I'm kind of a "picks and shovels" guy. I like Deere. Ethanol and biodiesel will mean fence row to fence row planting throughout the world. Deere is dominant between the fence rows.

Donaldson Capital nor I own either of the stocks, although we are evaluating Deere. Both companies are first rate, even in the absence of ethanol and biodiesel opportunities.

The fourth column under Corn is the price. To transpose it into dollars per bushel, just put the decimal point after the first digit, ie. the price for the contract for Sep '06, which reads 225'0, would mean $2.25 per bushel.

As you go down the table; you will notice that prices go up every year until we reach a high price of $3.30 for the Dec '09 contract.

For a speculator to make a profit on the Dec '09 contract, the price of corn will have to exceed $3.30 per bushel. That is nearly 50% higher than today's price, and much higher than would ordinarily be expected.

Why are commodity traders so bullish on corn? Do they know something about the weather that we don't know? That is possible because they can now trade the weather, but I think the reason corn futures are so high is contained in one word: ethanol.

Lots of big money believe, as I do, that changes are coming in the way we power our machines. In this case, they are betting that corn (ethanol) will have an increasing role as a fuel for our cars, trucks, and tractors.

To me the growing use of ethanol ( no matter its actual energy efficiency) is a forgone conclusion among the big players in both the agricultural as well as the automotive industries. As shown here, this will drive up corn prices (you might want to hoard some corn flakes for the kids and some whiskey for yourself), but it will give Americans some feeling of greater control over their energy needs.

But, in my judgment, the greater use of ethanol and biodiesels are just the beginning. There are scores of hybrid engines on the way that will get up to 50 miles per gallon and more. They will cost more, but what is given up in dollars will be more than made up in a growing sense of prudence.

Prudence may seem like an old fashion word, but billions of dollars are spent annually on prudence called by another name: insurance.

Archer Daniel Midland -- ADM -- is the way most people are playing ethanol and biodiesel. I'm kind of a "picks and shovels" guy. I like Deere. Ethanol and biodiesel will mean fence row to fence row planting throughout the world. Deere is dominant between the fence rows.

Donaldson Capital nor I own either of the stocks, although we are evaluating Deere. Both companies are first rate, even in the absence of ethanol and biodiesel opportunities.

The fourth column under Corn is the price. To transpose it into dollars per bushel, just put the decimal point after the first digit, ie. the price for the contract for Sep '06, which reads 225'0, would mean $2.25 per bushel.

As you go down the table; you will notice that prices go up every year until we reach a high price of $3.30 for the Dec '09 contract.

For a speculator to make a profit on the Dec '09 contract, the price of corn will have to exceed $3.30 per bushel. That is nearly 50% higher than today's price, and much higher than would ordinarily be expected.

Why are commodity traders so bullish on corn? Do they know something about the weather that we don't know? That is possible because they can now trade the weather, but I think the reason corn futures are so high is contained in one word: ethanol.

Lots of big money believe, as I do, that changes are coming in the way we power our machines. In this case, they are betting that corn (ethanol) will have an increasing role as a fuel for our cars, trucks, and tractors.

To me the growing use of ethanol ( no matter its actual energy efficiency) is a forgone conclusion among the big players in both the agricultural as well as the automotive industries. As shown here, this will drive up corn prices (you might want to hoard some corn flakes for the kids and some whiskey for yourself), but it will give Americans some feeling of greater control over their energy needs.

But, in my judgment, the greater use of ethanol and biodiesels are just the beginning. There are scores of hybrid engines on the way that will get up to 50 miles per gallon and more. They will cost more, but what is given up in dollars will be more than made up in a growing sense of prudence.

Prudence may seem like an old fashion word, but billions of dollars are spent annually on prudence called by another name: insurance.

Archer Daniel Midland -- ADM -- is the way most people are playing ethanol and biodiesel. I'm kind of a "picks and shovels" guy. I like Deere. Ethanol and biodiesel will mean fence row to fence row planting throughout the world. Deere is dominant between the fence rows.

Donaldson Capital nor I own either of the stocks, although we are evaluating Deere. Both companies are first rate, even in the absence of ethanol and biodiesel opportunities.

The fourth column under Corn is the price. To transpose it into dollars per bushel, just put the decimal point after the first digit, ie. the price for the contract for Sep '06, which reads 225'0, would mean $2.25 per bushel.

As you go down the table; you will notice that prices go up every year until we reach a high price of $3.30 for the Dec '09 contract.

For a speculator to make a profit on the Dec '09 contract, the price of corn will have to exceed $3.30 per bushel. That is nearly 50% higher than today's price, and much higher than would ordinarily be expected.

Why are commodity traders so bullish on corn? Do they know something about the weather that we don't know? That is possible because they can now trade the weather, but I think the reason corn futures are so high is contained in one word: ethanol.

Lots of big money believe, as I do, that changes are coming in the way we power our machines. In this case, they are betting that corn (ethanol) will have an increasing role as a fuel for our cars, trucks, and tractors.

To me the growing use of ethanol ( no matter its actual energy efficiency) is a forgone conclusion among the big players in both the agricultural as well as the automotive industries. As shown here, this will drive up corn prices (you might want to hoard some corn flakes for the kids and some whiskey for yourself), but it will give Americans some feeling of greater control over their energy needs.

But, in my judgment, the greater use of ethanol and biodiesels are just the beginning. There are scores of hybrid engines on the way that will get up to 50 miles per gallon and more. They will cost more, but what is given up in dollars will be more than made up in a growing sense of prudence.

Prudence may seem like an old fashion word, but billions of dollars are spent annually on prudence called by another name: insurance.

Archer Daniel Midland -- ADM -- is the way most people are playing ethanol and biodiesel. I'm kind of a "picks and shovels" guy. I like Deere. Ethanol and biodiesel will mean fence row to fence row planting throughout the world. Deere is dominant between the fence rows.

Donaldson Capital nor I own either of the stocks, although we are evaluating Deere. Both companies are first rate, even in the absence of ethanol and biodiesel opportunities.

Wednesday, August 23, 2006

Welcome to Normal

From a pure statistical perspective, stocks, bonds,inflation and the economy are all about normal. Three years of terrific earnings growth and lackluster price growth from large caps have driven PEs back to historical norms. Based on 2006 earnings, both the S&P 500 and the Dow Jones 30 are trading at about 14.5X earnings, which is near their 80 year averages (Down from 30+ PE in 2000).

Inflation, on a year over year basis, is about 4%, again at approximately the long-term average of inflation. The 30 year Treasury bond is about yielding 5%, just under the long-term average of 5.5%.

Annual GDP growth is approximately 3.5%, you guessed it, near the long-term average.

Since we all know there is no such thing as an average market, what do all these reversions to the mean, mean?

You can think about this for a few minutes or a few weeks and you will come to the same conclusion: both the stock and bond markets are signaling slow growth and a fair amount of confusion.

If we extend all of the normalcy we have identified here, the market appears to be saying that we cannot expect any more earnings growth for the next several years than the 80-year average of 7%.

If this is the case, then my recent mantra of big over small, value over growth, and dividends over all makes more sense. If 7% earnings growth is about all we can expect from the average stock, why not take the less risky route of high quality, dividend-paying banks, utilities, and REITs that yield 4% or more with secure dividend growth of 3%-9%, and selected energy,industrial, and consumer staples companies that offer 2%-4% dividend yields and 7%-12% dividend growth?

Tech is anybodies guess, basic materials don't work well in slowing economies, consumer cyclicals have housing weakness and energy cost headwinds; and telecommunications are running in place. With the US economy slowing, doesn't that put question marks on China and the emerging markets?

Finally, why do I want to pay near 18X earnings for small and midcap stocks that pay little or no dividends and take the chance that they can dodge the slowing economy. Things can always be different this time, but will they?

Big money goes where it is treated the best. It has been in cyclical, international, and riskier small and mid caps for the last 4 years and has been rewarded handsomely. However, the flight path of the economy over the next two years appears to be down and, as earnings accidents become more widespread among the more economically sensitive sectors, the move to large, quality, dividend-paying companies will accelerate.

That is what normally happens, and it's a hard to argue that things will not be "normal" this time.

Sunday, August 20, 2006

Don't Count Your Shekels

The stock market turned in a very strong performance last week, ostensibly on the back of the peace accord between Israel and "Leb-bollah" (I hope this is not a bad word in either language). If peace in the Middle East is a prerequisite for higher stock prices, then hit the "undo" arrow on your spreadsheet because this peace is not likely to hold. Israel got nothing of what it wanted in the skirmish, and Hezbollah got everything they could have hoped for.

Israel certainly won the battle in Lebanon, but Hezbollah won the war for the hearts and minds of their benefactors in Iran and their faithful among the Islamists of the world by putting up a good fight. Neither entity will give the current peace a chance. Hezbollah does not want peace with Israel, and Israel cannot live with the situation as it is.

Fighting will inevitably break out again, and when it does, the market will give up some of its gains. The reason that I say this is that last week's rally was broadbased, indicating, at a minimum, better times ahead for earnings. In my mind, for the average stock, that is many months away. Even in the absence of bullets flying in the Middle East, the economy is slowing and earnings are going to start to disappoint (See Lowes).

This is not a market for the average stock. This is a market for large caps over small caps, and higher quality over lower quality, and dividend-paying over non-dividend paying. That is not what we saw in last week's rally, and, therefore, the rally is likely to be undone as the tensions in he Middle East flare up again.

Tuesday, August 15, 2006

The Y2K Effect, Here It Comes Again

In 1995, I left a large capital management firm and started Donaldson Capital Management. I had lots of contacts among investment company vendors, and a software company did me a big favor by selling me a state of the art investment management software package for $15,000. It did everything but tie your shoes. In 1998, I received a letter from the company saying that the software may not be Y2K compliant. I brought up the fact that I had just bought the software three years earlier, and I would have expected it would be Y2K compliant. They were so sorry, but no one knew what effect the year '00 was going to have on computers and software the world over. They said they were working on a new software package with many new features and guaranteed that it would be Y2K compliant. The cost $80,000.

Needless to say I had many conversations with "my friends" from California, but they always said something to the effect that they did not know for sure whether or not my software would work after 12-31-1999. They believed that it would but could not guarantee that it would. They apologized in the humblest of language, but in the end, directed me to language in the contract that dealt with Y2k issues.

I was stuck. Investment management software is the lifeblood of an investment firm. It is impossible to operate without it. I had no choice but to move to another software package. I did show my unhappiness with the situation by moving to another firm, but I spent another $20,000 in 1999 and moved to another software vendor. I had no choice and neither did millions of companies across the globe who got the same letters from their vendors--no matter who they were. No one knew for sure if there would be a problem with Y2K or not. But prudence mandated action. That prudence manifested itself in the biggest technological boom the world has ever seen, as individuals, companies, and governments around the world "upgraded."

Another Y2K is upon us and soon every member of the "global village" will get the message: We don't know what energy will cost in the future, but it may be more than you can imagine. Oh, no one will say it exactly like that, but the body language and the "hems" and "haws" will say it loud and clear -- prudence dictates a change in your energy consumption patterns and devices.

For individuals, the pressure to move to a more energy efficient automobile will become a mania. In three years, if you have the means, you won't dare show up at church in a vehicle that gets under 20 miles to the gallon. To do so would be like killing baby seals. You will be a pariah. New home heating systems will be like the aluminum siding boom of the 1960s. There will be "heating and cooling" consultants going door to door all over the country, proclaiming the good news of energy savings.

Companies will face the same juggernaut of self doubt and public recriminations for their energy profligacy. The environmentalists will web sites that will show the amount of energy that every company consumes per employee, per dollar of sales, per % of GDP, per. . . you know the rest. Few corporate brass will have the guts to stand up to the public "dis"-relations that the "main street media" will lay on them if they have an unfavorable Energy Activity Ratio (EAR -- get it?). This means more efficient automobiles, heating and cooling systems, people movement and handling systems, technologies, lighting, and air transportation.

Darn the cost-benefit analysis, oil prices are going nothing but up, and we must control what we can control. We must cut back our use of energy, and we can do so by "unconserving" our capital budgets.

All across America at breakfast tables and in board rooms, the mantra will be the same: "The majority of the world's oil is controlled by people who hate us. We cannot sit idly by any longer. We must act, and we must act now."

I am not a doom sayer. I do not share these words to scare anyone, and no one should think the worst from what I have said here. What I am saying is that the question of the supply of energy has reached the consciousness of the American consumer. The flare up in Lebanon was the final straw. Is there anyone who does not know that the next flare up will probably involve Iran and its 17% of the world's energy supply?

I see a new car and a new heating and airconditioning system in your future. The same goes for corporate American, but add elevators, computer systems, and airplanes.

The good news is this: there are three companies in the world that stand to be the biggest benefactors of the energy uncertainties: Toyota, United Technologies, and Boeing. In my judgment all of these companies have multi-year head starts over their competition when it comes to producing energy efficient products. Toyota with its high-mileage and hybrid cars, United Tech with its Carrier high efficiency heating ventilation and airconditioning systems for the home and commercial use, also its Otis Elevator division for commercial and government people moving systems, and Boeing for its fuel efficient fleet of new generation jet aircraft.

You don't need to rush out and do anything tomorrow or even next month, but over the next few years, increasingly, the world is going to Y2K these companies. That is in an act of prudence, people, corporations, and governments are going to choose doing something to conserve energy over conserving dollars.

I predict that in the next few years table talk among friends will center around the family's EAR as opposed to how much their house has risen in value.

Notes: I made up EAR (Energy Activity Ratio) This will be an index using year 2000 (pre 9-11) btu per capital consumption and costs. Even though I made this up, you can be sure such an index is in your future.

Employees (including me) and clients of Donaldson Capital Management own Toyota and United Technologies. One day we may own Boeing, but not today. Also one day we may sell any or all of the aforementioned companies without advertising it on this blog. That day might or might not occur when I read in the Wall Street Journal that the government has initiated an EAR index and that Toyota, United Technologies, and Boeing are the likely beneficiaries of such an action.

There are many other companies that will benefit from the energy Y2K that I see unfolding. I will discuss them in the weeks and months ahead.

Final Note: The software system I bought in 1995 still works. Go figure.

Wednesday, August 09, 2006

Big Over Small, Dividends Over All

In a recent Blog, I showed that the Dow Jones Dividend Index, which is comprised of quality, large-cap companies with high and growing dividends, has made a very sharp turn and in recent weeks has broken to a new high. I said this action signaled a flight to safety, as well as a search for predictable income. In a second blog, I detailed the fall in 30-year Treasury bond yields, which I described as signaling a top in interest rates and providing additional evidence that investors' concerns for safety have become paramount. Let me complete the trilogy by working backwards among capitalization, growth vs. value, and security types to show how powerful this shift in investment momentum has become and how long it is likely to last.

This analysis of the relative strength of various kinds of stocks is key because small and mid cap stocks have outperformed large caps for the last six years, leaving many people muttering to themselves (including me) why the great fundamentals of high quality companies were being almost ignored. I have cited on at least two occasions in these blogs that by my calculations for the fair value of the Dow Jones Industrials is closer to 13,000 than it current fixation with 11,000.

......................S&P Small Cap Index............

The first chart is of the S&P 600 Small Cap Index vs. the S&P 500 index. The graph on the top of the chart shows the Index itself, while the lower graph shows the Index vs. the S&P 500. The index looks very toppy, but the lower graph shows a serious breakdown compared to the S&P 500. In other the words, small cap stocks are not only falling, they are falling at an accelerating pace relative to large cap stocks. Another blow to small caps may be near. Notice that the lower graph (most recent data at lower right) appears to be breaking down from its recent consolidation attempt. Small Caps have underperformed large caps by nearly 11% over the past three months. The chart makes clear that, at least over the last 3 months, big caps have overtaken small caps, and this trend looks pretty solid to me.

..................S&P 500 vs. S&P 500 Value................

The first chart is of the S&P 600 Small Cap Index vs. the S&P 500 index. The graph on the top of the chart shows the Index itself, while the lower graph shows the Index vs. the S&P 500. The index looks very toppy, but the lower graph shows a serious breakdown compared to the S&P 500. In other the words, small cap stocks are not only falling, they are falling at an accelerating pace relative to large cap stocks. Another blow to small caps may be near. Notice that the lower graph (most recent data at lower right) appears to be breaking down from its recent consolidation attempt. Small Caps have underperformed large caps by nearly 11% over the past three months. The chart makes clear that, at least over the last 3 months, big caps have overtaken small caps, and this trend looks pretty solid to me.

..................S&P 500 vs. S&P 500 Value................

If big cap stocks are outperforming, our next question is, is there a distinction between value and growth?

The second chart is of the large cap S&P 500 Value Index. The lower graph is comparing the Value Index with the S&P 500 itself. The S&P Value Index includes those stocks in the S&P 500 with lower price to book, price to earnings, and price to sales, and higher dividend yields. The growth sector(not shown) is the other half of the index.

Since we are dividing the S&P 500 into only two sectors, if the value sector is rising vs. the S&P 500, as it is on the bottom graph, that means that the growth sector is falling on a relative basis. The value sector's angle of ascent(shown on the lower graph) is very convincing. This means that not only is value outperforming growth, but the growth is in a freefall. This would corroborate the notion that investors are less willing to bet that high earnings growth will continue.

Thus far in our analysis, large-cap stocks are performing better in the near term than small caps, and among the large-cap stocks, the value sector is performing dramatically better than the growth sector.

The final part of the trilogy is a further "drilling down" to determine what type of large-cap, value stocks are doing the best in the near term. That answer is as you might expect: stocks with a higher than average dividend yield and consistent dividend growth, such as those contained in the Dow Jones Dividend Index.

..........DJ Dividend Index vs. S&P Value Index......

If big cap stocks are outperforming, our next question is, is there a distinction between value and growth?

The second chart is of the large cap S&P 500 Value Index. The lower graph is comparing the Value Index with the S&P 500 itself. The S&P Value Index includes those stocks in the S&P 500 with lower price to book, price to earnings, and price to sales, and higher dividend yields. The growth sector(not shown) is the other half of the index.

Since we are dividing the S&P 500 into only two sectors, if the value sector is rising vs. the S&P 500, as it is on the bottom graph, that means that the growth sector is falling on a relative basis. The value sector's angle of ascent(shown on the lower graph) is very convincing. This means that not only is value outperforming growth, but the growth is in a freefall. This would corroborate the notion that investors are less willing to bet that high earnings growth will continue.

Thus far in our analysis, large-cap stocks are performing better in the near term than small caps, and among the large-cap stocks, the value sector is performing dramatically better than the growth sector.

The final part of the trilogy is a further "drilling down" to determine what type of large-cap, value stocks are doing the best in the near term. That answer is as you might expect: stocks with a higher than average dividend yield and consistent dividend growth, such as those contained in the Dow Jones Dividend Index.

..........DJ Dividend Index vs. S&P Value Index......

There are two key features to this chart. The top graph shows that dividend stocks have broken to a new 12 month high in recent weeks. No other major indices has done this. Second, the lower graph shows that the relative strength, which had been heading in the wrong direction until April, has made a remarable u-turn and is now headed sharply higher.

Value stocks are doing better than almost all other major sectors, but on a relative basis, the Dow Jones Dividend Index is gaining ground almost daily. I expect this trend to continue.

Large over small, value over growth, dividend over all. That's the picture I see, and the evidence is clear that this trend has a way to go. I'll describe these trends in the weeks ahead.

Dividends are our world, and dividends have come to the forefront in these uncertain times. It is too simple to say that sooner or later they always do, but that says it about as well as we know how.

There are two key features to this chart. The top graph shows that dividend stocks have broken to a new 12 month high in recent weeks. No other major indices has done this. Second, the lower graph shows that the relative strength, which had been heading in the wrong direction until April, has made a remarable u-turn and is now headed sharply higher.

Value stocks are doing better than almost all other major sectors, but on a relative basis, the Dow Jones Dividend Index is gaining ground almost daily. I expect this trend to continue.

Large over small, value over growth, dividend over all. That's the picture I see, and the evidence is clear that this trend has a way to go. I'll describe these trends in the weeks ahead.

Dividends are our world, and dividends have come to the forefront in these uncertain times. It is too simple to say that sooner or later they always do, but that says it about as well as we know how.

The first chart is of the S&P 600 Small Cap Index vs. the S&P 500 index. The graph on the top of the chart shows the Index itself, while the lower graph shows the Index vs. the S&P 500. The index looks very toppy, but the lower graph shows a serious breakdown compared to the S&P 500. In other the words, small cap stocks are not only falling, they are falling at an accelerating pace relative to large cap stocks. Another blow to small caps may be near. Notice that the lower graph (most recent data at lower right) appears to be breaking down from its recent consolidation attempt. Small Caps have underperformed large caps by nearly 11% over the past three months. The chart makes clear that, at least over the last 3 months, big caps have overtaken small caps, and this trend looks pretty solid to me.

..................S&P 500 vs. S&P 500 Value................

The first chart is of the S&P 600 Small Cap Index vs. the S&P 500 index. The graph on the top of the chart shows the Index itself, while the lower graph shows the Index vs. the S&P 500. The index looks very toppy, but the lower graph shows a serious breakdown compared to the S&P 500. In other the words, small cap stocks are not only falling, they are falling at an accelerating pace relative to large cap stocks. Another blow to small caps may be near. Notice that the lower graph (most recent data at lower right) appears to be breaking down from its recent consolidation attempt. Small Caps have underperformed large caps by nearly 11% over the past three months. The chart makes clear that, at least over the last 3 months, big caps have overtaken small caps, and this trend looks pretty solid to me.

..................S&P 500 vs. S&P 500 Value................

If big cap stocks are outperforming, our next question is, is there a distinction between value and growth?

The second chart is of the large cap S&P 500 Value Index. The lower graph is comparing the Value Index with the S&P 500 itself. The S&P Value Index includes those stocks in the S&P 500 with lower price to book, price to earnings, and price to sales, and higher dividend yields. The growth sector(not shown) is the other half of the index.

Since we are dividing the S&P 500 into only two sectors, if the value sector is rising vs. the S&P 500, as it is on the bottom graph, that means that the growth sector is falling on a relative basis. The value sector's angle of ascent(shown on the lower graph) is very convincing. This means that not only is value outperforming growth, but the growth is in a freefall. This would corroborate the notion that investors are less willing to bet that high earnings growth will continue.

Thus far in our analysis, large-cap stocks are performing better in the near term than small caps, and among the large-cap stocks, the value sector is performing dramatically better than the growth sector.

The final part of the trilogy is a further "drilling down" to determine what type of large-cap, value stocks are doing the best in the near term. That answer is as you might expect: stocks with a higher than average dividend yield and consistent dividend growth, such as those contained in the Dow Jones Dividend Index.

..........DJ Dividend Index vs. S&P Value Index......

If big cap stocks are outperforming, our next question is, is there a distinction between value and growth?

The second chart is of the large cap S&P 500 Value Index. The lower graph is comparing the Value Index with the S&P 500 itself. The S&P Value Index includes those stocks in the S&P 500 with lower price to book, price to earnings, and price to sales, and higher dividend yields. The growth sector(not shown) is the other half of the index.

Since we are dividing the S&P 500 into only two sectors, if the value sector is rising vs. the S&P 500, as it is on the bottom graph, that means that the growth sector is falling on a relative basis. The value sector's angle of ascent(shown on the lower graph) is very convincing. This means that not only is value outperforming growth, but the growth is in a freefall. This would corroborate the notion that investors are less willing to bet that high earnings growth will continue.

Thus far in our analysis, large-cap stocks are performing better in the near term than small caps, and among the large-cap stocks, the value sector is performing dramatically better than the growth sector.

The final part of the trilogy is a further "drilling down" to determine what type of large-cap, value stocks are doing the best in the near term. That answer is as you might expect: stocks with a higher than average dividend yield and consistent dividend growth, such as those contained in the Dow Jones Dividend Index.

..........DJ Dividend Index vs. S&P Value Index......

There are two key features to this chart. The top graph shows that dividend stocks have broken to a new 12 month high in recent weeks. No other major indices has done this. Second, the lower graph shows that the relative strength, which had been heading in the wrong direction until April, has made a remarable u-turn and is now headed sharply higher.

Value stocks are doing better than almost all other major sectors, but on a relative basis, the Dow Jones Dividend Index is gaining ground almost daily. I expect this trend to continue.

Large over small, value over growth, dividend over all. That's the picture I see, and the evidence is clear that this trend has a way to go. I'll describe these trends in the weeks ahead.

Dividends are our world, and dividends have come to the forefront in these uncertain times. It is too simple to say that sooner or later they always do, but that says it about as well as we know how.

There are two key features to this chart. The top graph shows that dividend stocks have broken to a new 12 month high in recent weeks. No other major indices has done this. Second, the lower graph shows that the relative strength, which had been heading in the wrong direction until April, has made a remarable u-turn and is now headed sharply higher.

Value stocks are doing better than almost all other major sectors, but on a relative basis, the Dow Jones Dividend Index is gaining ground almost daily. I expect this trend to continue.

Large over small, value over growth, dividend over all. That's the picture I see, and the evidence is clear that this trend has a way to go. I'll describe these trends in the weeks ahead.

Dividends are our world, and dividends have come to the forefront in these uncertain times. It is too simple to say that sooner or later they always do, but that says it about as well as we know how.

Friday, August 04, 2006

Cash Is King

I showed last time how the Dow Jones Dividend Index has caught the S&P 500 Index, on a price basis, for the last 12 months. I made the point in that edition that such a big relative shift towards dividend paying stocks was related to the uncertainties of oil prices and supply, the bloodshed in the Middle East, and the belief that the economy is slowing. In the last few weeks, investors have shifted away from risk and growth toward quality and stability.

Whenever I see big shifts in the market, I always look for corroboration from other significant indicators. If big, savy investors are on the move, they will leave a trail that will show up in other markets and securities.

Today's chart is of the 30 year US Treasury Bond Yield. It holds many important clues as to what big investors may be up to.

Click to enlarge.

......................30-Year T-Bond Yield..............

The chart is of the yield on a 30-Year T-Bond. The chart covers the last 12 months.

A year ago the yield stood at about 4.6%. Rates stayed in a narrow band through the end of '05, even though the Fed was raising short rates. As it became clear, that economic growth was taking off in early 2006, the yield on the 30-T-Bond began a steady rise to near 5.25%.

It was at this point that Fed chairman Bernanke started talking tough. The Fed does not control long rates, such as 30-Year T-Bonds; they are set by the market. Thus, the yield on the 30-year T-bond is a kind of monitor of how well investors believe the Fed is doing its job of fighting inflation. Rising rates on 30-year T-Bonds indicate the market believes the Fed is not tough enough; falling rates say just the opposite.

From March through May of this year, the market was saying that the economy was growing too fast and ran the risk of pushing inflation higher, which drove rates higher. After Bernanke and other Fed members began to talk tough, bond investors were relieved and bond yields fell. But two straight higher-than-expected inflation reports at mid-year pushed rates back toward their 12-month highs.

In July, as bond yields returned to their May highs, Israel and Hezbollah began bombing each other. Unexpectedly, bond yields began to fall and have continued to trend lower. At first, this may seem counterintuitive. After all, the war in the Middle East has pushed oil prices higher and rising oil prices will surely mean higher inflation, won't it?

That line of thinking would conclude that interest rates should have risen when the shooting began. But thinking about it more broadly, falling rates make sense. Bond yield are falling primarily because of a flight to safety(T-Bonds are considered to be among the safest bonds on earth). Additionally, I believe, bond yields are now falling because of recent economic data that suggest the economy is slowing, and the recognition that $3.00 a gallon gasoline will extract a lot of money from consumers' wallets.

Here's the bottom line: Bond yields look like they have peaked. That's good news, but what is even more important is the relative strength graph at the bottom of the chart. For most of the last year, the rise in T-Bond yields has been greater than the growth in stock prices. Since June, however, the S&P 500 has been outperforming bonds. This can be seen in the downward slope of the lower graph since that time.

I believe the rally in dividend-paying stocks and the rally in bonds has the same root: The Fed is nearing the end of its rate hikes. That is the good news, but there is also a bit of bad news. If the Fed is ending its rate hikes, it must be convinced the economy is slowing, and a slowing economy will result in slowing earnings growth. The risks of earnings disappointments in the coming year are now on the rise.

The rally in quality dividend-paying stocks and bonds in the face of all of the uncertainties is natural. Money always goes where it is treated the best, and history shows that in times of turmoil and slowing economic growth "cash is king." Dividend-paying stocks and T-Bonds are the best sources of high and predictable cash flow and they will continue to rally until the uncertainties subside.

The chart is of the yield on a 30-Year T-Bond. The chart covers the last 12 months.

A year ago the yield stood at about 4.6%. Rates stayed in a narrow band through the end of '05, even though the Fed was raising short rates. As it became clear, that economic growth was taking off in early 2006, the yield on the 30-T-Bond began a steady rise to near 5.25%.

It was at this point that Fed chairman Bernanke started talking tough. The Fed does not control long rates, such as 30-Year T-Bonds; they are set by the market. Thus, the yield on the 30-year T-bond is a kind of monitor of how well investors believe the Fed is doing its job of fighting inflation. Rising rates on 30-year T-Bonds indicate the market believes the Fed is not tough enough; falling rates say just the opposite.

From March through May of this year, the market was saying that the economy was growing too fast and ran the risk of pushing inflation higher, which drove rates higher. After Bernanke and other Fed members began to talk tough, bond investors were relieved and bond yields fell. But two straight higher-than-expected inflation reports at mid-year pushed rates back toward their 12-month highs.

In July, as bond yields returned to their May highs, Israel and Hezbollah began bombing each other. Unexpectedly, bond yields began to fall and have continued to trend lower. At first, this may seem counterintuitive. After all, the war in the Middle East has pushed oil prices higher and rising oil prices will surely mean higher inflation, won't it?

That line of thinking would conclude that interest rates should have risen when the shooting began. But thinking about it more broadly, falling rates make sense. Bond yield are falling primarily because of a flight to safety(T-Bonds are considered to be among the safest bonds on earth). Additionally, I believe, bond yields are now falling because of recent economic data that suggest the economy is slowing, and the recognition that $3.00 a gallon gasoline will extract a lot of money from consumers' wallets.

Here's the bottom line: Bond yields look like they have peaked. That's good news, but what is even more important is the relative strength graph at the bottom of the chart. For most of the last year, the rise in T-Bond yields has been greater than the growth in stock prices. Since June, however, the S&P 500 has been outperforming bonds. This can be seen in the downward slope of the lower graph since that time.

I believe the rally in dividend-paying stocks and the rally in bonds has the same root: The Fed is nearing the end of its rate hikes. That is the good news, but there is also a bit of bad news. If the Fed is ending its rate hikes, it must be convinced the economy is slowing, and a slowing economy will result in slowing earnings growth. The risks of earnings disappointments in the coming year are now on the rise.

The rally in quality dividend-paying stocks and bonds in the face of all of the uncertainties is natural. Money always goes where it is treated the best, and history shows that in times of turmoil and slowing economic growth "cash is king." Dividend-paying stocks and T-Bonds are the best sources of high and predictable cash flow and they will continue to rally until the uncertainties subside.

The chart is of the yield on a 30-Year T-Bond. The chart covers the last 12 months.

A year ago the yield stood at about 4.6%. Rates stayed in a narrow band through the end of '05, even though the Fed was raising short rates. As it became clear, that economic growth was taking off in early 2006, the yield on the 30-T-Bond began a steady rise to near 5.25%.

It was at this point that Fed chairman Bernanke started talking tough. The Fed does not control long rates, such as 30-Year T-Bonds; they are set by the market. Thus, the yield on the 30-year T-bond is a kind of monitor of how well investors believe the Fed is doing its job of fighting inflation. Rising rates on 30-year T-Bonds indicate the market believes the Fed is not tough enough; falling rates say just the opposite.

From March through May of this year, the market was saying that the economy was growing too fast and ran the risk of pushing inflation higher, which drove rates higher. After Bernanke and other Fed members began to talk tough, bond investors were relieved and bond yields fell. But two straight higher-than-expected inflation reports at mid-year pushed rates back toward their 12-month highs.

In July, as bond yields returned to their May highs, Israel and Hezbollah began bombing each other. Unexpectedly, bond yields began to fall and have continued to trend lower. At first, this may seem counterintuitive. After all, the war in the Middle East has pushed oil prices higher and rising oil prices will surely mean higher inflation, won't it?

That line of thinking would conclude that interest rates should have risen when the shooting began. But thinking about it more broadly, falling rates make sense. Bond yield are falling primarily because of a flight to safety(T-Bonds are considered to be among the safest bonds on earth). Additionally, I believe, bond yields are now falling because of recent economic data that suggest the economy is slowing, and the recognition that $3.00 a gallon gasoline will extract a lot of money from consumers' wallets.

Here's the bottom line: Bond yields look like they have peaked. That's good news, but what is even more important is the relative strength graph at the bottom of the chart. For most of the last year, the rise in T-Bond yields has been greater than the growth in stock prices. Since June, however, the S&P 500 has been outperforming bonds. This can be seen in the downward slope of the lower graph since that time.

I believe the rally in dividend-paying stocks and the rally in bonds has the same root: The Fed is nearing the end of its rate hikes. That is the good news, but there is also a bit of bad news. If the Fed is ending its rate hikes, it must be convinced the economy is slowing, and a slowing economy will result in slowing earnings growth. The risks of earnings disappointments in the coming year are now on the rise.

The rally in quality dividend-paying stocks and bonds in the face of all of the uncertainties is natural. Money always goes where it is treated the best, and history shows that in times of turmoil and slowing economic growth "cash is king." Dividend-paying stocks and T-Bonds are the best sources of high and predictable cash flow and they will continue to rally until the uncertainties subside.

The chart is of the yield on a 30-Year T-Bond. The chart covers the last 12 months.

A year ago the yield stood at about 4.6%. Rates stayed in a narrow band through the end of '05, even though the Fed was raising short rates. As it became clear, that economic growth was taking off in early 2006, the yield on the 30-T-Bond began a steady rise to near 5.25%.

It was at this point that Fed chairman Bernanke started talking tough. The Fed does not control long rates, such as 30-Year T-Bonds; they are set by the market. Thus, the yield on the 30-year T-bond is a kind of monitor of how well investors believe the Fed is doing its job of fighting inflation. Rising rates on 30-year T-Bonds indicate the market believes the Fed is not tough enough; falling rates say just the opposite.

From March through May of this year, the market was saying that the economy was growing too fast and ran the risk of pushing inflation higher, which drove rates higher. After Bernanke and other Fed members began to talk tough, bond investors were relieved and bond yields fell. But two straight higher-than-expected inflation reports at mid-year pushed rates back toward their 12-month highs.

In July, as bond yields returned to their May highs, Israel and Hezbollah began bombing each other. Unexpectedly, bond yields began to fall and have continued to trend lower. At first, this may seem counterintuitive. After all, the war in the Middle East has pushed oil prices higher and rising oil prices will surely mean higher inflation, won't it?

That line of thinking would conclude that interest rates should have risen when the shooting began. But thinking about it more broadly, falling rates make sense. Bond yield are falling primarily because of a flight to safety(T-Bonds are considered to be among the safest bonds on earth). Additionally, I believe, bond yields are now falling because of recent economic data that suggest the economy is slowing, and the recognition that $3.00 a gallon gasoline will extract a lot of money from consumers' wallets.

Here's the bottom line: Bond yields look like they have peaked. That's good news, but what is even more important is the relative strength graph at the bottom of the chart. For most of the last year, the rise in T-Bond yields has been greater than the growth in stock prices. Since June, however, the S&P 500 has been outperforming bonds. This can be seen in the downward slope of the lower graph since that time.

I believe the rally in dividend-paying stocks and the rally in bonds has the same root: The Fed is nearing the end of its rate hikes. That is the good news, but there is also a bit of bad news. If the Fed is ending its rate hikes, it must be convinced the economy is slowing, and a slowing economy will result in slowing earnings growth. The risks of earnings disappointments in the coming year are now on the rise.

The rally in quality dividend-paying stocks and bonds in the face of all of the uncertainties is natural. Money always goes where it is treated the best, and history shows that in times of turmoil and slowing economic growth "cash is king." Dividend-paying stocks and T-Bonds are the best sources of high and predictable cash flow and they will continue to rally until the uncertainties subside.

Subscribe to:

Comments (Atom)