The regression model shows that the current combination of earnings, dividends, and interest rates produces a Dow Jones of near 13,000. That would seem like a outrageous level and not connected to reality.

To ignore the model's high correlation with the actual results, however, would, from a statistical perspective, be irresponsible.

The model correctly called the undervaluation of the late 1980s and the overvaluation of the late 1990s. The model is making a rather simple statement: in an interest rate environment such as today, earnings and dividend growth should be more highly prized.

When is this valuation gap going to close? I don't think that is as important to answer as to just look at the trend of the late 1980s. Stocks were undervalued for eight years, but rose smartly in concert with the rise in intrinsic value. I think that is likely to happen again. The important thing to remember is that, history shows us, that eventually prices will catch up to valuation. That's now nearly 20% higher than today's market.

Forty-five years of high correlations do not a sure thing make, but then again, if we are in the business of buying low and selling high, history says, from a valuation perspective, stocks are certainly not high.

The regression model shows that the current combination of earnings, dividends, and interest rates produces a Dow Jones of near 13,000. That would seem like a outrageous level and not connected to reality.

To ignore the model's high correlation with the actual results, however, would, from a statistical perspective, be irresponsible.

The model correctly called the undervaluation of the late 1980s and the overvaluation of the late 1990s. The model is making a rather simple statement: in an interest rate environment such as today, earnings and dividend growth should be more highly prized.

When is this valuation gap going to close? I don't think that is as important to answer as to just look at the trend of the late 1980s. Stocks were undervalued for eight years, but rose smartly in concert with the rise in intrinsic value. I think that is likely to happen again. The important thing to remember is that, history shows us, that eventually prices will catch up to valuation. That's now nearly 20% higher than today's market.

Forty-five years of high correlations do not a sure thing make, but then again, if we are in the business of buying low and selling high, history says, from a valuation perspective, stocks are certainly not high.

Sunday, April 09, 2006

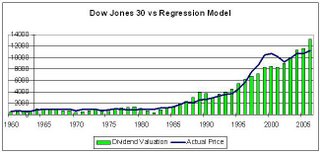

An Update of the Dow Jones Regression Model

The Dow Jones Industrial Average has been making a valiant attempt to move convincingly through 11,000. The usual list of headwinds--interest rates, oil prices, inflation fears, geopolitical problems --, however, have made progress difficult in recent weeks. But it is important to remember that fourth quarter earnings and dividends grew by over 10%, and this week first quarter 2006 earnings start coming out. Estimates for first quarter earnings growth are in the 11%-13% range.

A few basics: The Dow Jones 30 is highly correlated to the fundamentals: earnings, dividends, and GDP. That means that, over time, as the fundamentals have grown, the DJIA has grown. Stocks don't go up in a vacuum. They go higher, as it were, on the shoulders of the profit growth of American corporations.

We have developed a handful of models over the years to keep an eye on the fundamental valuations compared to actual prices. I recently plugged in the earnings and dividend estimates from S&P and Value-Line into our model. I made our own estimate of average interest rates for the coming year and then put everything into our model. The chart below shows 46 years of the model's predictions. They have been good. The coefficient of determination is near 95%.

Please click chart to enlarge.

The regression model shows that the current combination of earnings, dividends, and interest rates produces a Dow Jones of near 13,000. That would seem like a outrageous level and not connected to reality.

To ignore the model's high correlation with the actual results, however, would, from a statistical perspective, be irresponsible.

The model correctly called the undervaluation of the late 1980s and the overvaluation of the late 1990s. The model is making a rather simple statement: in an interest rate environment such as today, earnings and dividend growth should be more highly prized.

When is this valuation gap going to close? I don't think that is as important to answer as to just look at the trend of the late 1980s. Stocks were undervalued for eight years, but rose smartly in concert with the rise in intrinsic value. I think that is likely to happen again. The important thing to remember is that, history shows us, that eventually prices will catch up to valuation. That's now nearly 20% higher than today's market.

Forty-five years of high correlations do not a sure thing make, but then again, if we are in the business of buying low and selling high, history says, from a valuation perspective, stocks are certainly not high.

The regression model shows that the current combination of earnings, dividends, and interest rates produces a Dow Jones of near 13,000. That would seem like a outrageous level and not connected to reality.

To ignore the model's high correlation with the actual results, however, would, from a statistical perspective, be irresponsible.

The model correctly called the undervaluation of the late 1980s and the overvaluation of the late 1990s. The model is making a rather simple statement: in an interest rate environment such as today, earnings and dividend growth should be more highly prized.

When is this valuation gap going to close? I don't think that is as important to answer as to just look at the trend of the late 1980s. Stocks were undervalued for eight years, but rose smartly in concert with the rise in intrinsic value. I think that is likely to happen again. The important thing to remember is that, history shows us, that eventually prices will catch up to valuation. That's now nearly 20% higher than today's market.

Forty-five years of high correlations do not a sure thing make, but then again, if we are in the business of buying low and selling high, history says, from a valuation perspective, stocks are certainly not high.

The regression model shows that the current combination of earnings, dividends, and interest rates produces a Dow Jones of near 13,000. That would seem like a outrageous level and not connected to reality.

To ignore the model's high correlation with the actual results, however, would, from a statistical perspective, be irresponsible.

The model correctly called the undervaluation of the late 1980s and the overvaluation of the late 1990s. The model is making a rather simple statement: in an interest rate environment such as today, earnings and dividend growth should be more highly prized.

When is this valuation gap going to close? I don't think that is as important to answer as to just look at the trend of the late 1980s. Stocks were undervalued for eight years, but rose smartly in concert with the rise in intrinsic value. I think that is likely to happen again. The important thing to remember is that, history shows us, that eventually prices will catch up to valuation. That's now nearly 20% higher than today's market.

Forty-five years of high correlations do not a sure thing make, but then again, if we are in the business of buying low and selling high, history says, from a valuation perspective, stocks are certainly not high.

The regression model shows that the current combination of earnings, dividends, and interest rates produces a Dow Jones of near 13,000. That would seem like a outrageous level and not connected to reality.

To ignore the model's high correlation with the actual results, however, would, from a statistical perspective, be irresponsible.

The model correctly called the undervaluation of the late 1980s and the overvaluation of the late 1990s. The model is making a rather simple statement: in an interest rate environment such as today, earnings and dividend growth should be more highly prized.

When is this valuation gap going to close? I don't think that is as important to answer as to just look at the trend of the late 1980s. Stocks were undervalued for eight years, but rose smartly in concert with the rise in intrinsic value. I think that is likely to happen again. The important thing to remember is that, history shows us, that eventually prices will catch up to valuation. That's now nearly 20% higher than today's market.

Forty-five years of high correlations do not a sure thing make, but then again, if we are in the business of buying low and selling high, history says, from a valuation perspective, stocks are certainly not high.