Friday, April 28, 2006

The Rising Dividend Story -- The End of the BIG Trend

As I said last time, the crushing of my BIG Trend investment strategy didn’t knock me off balance as much as it put me into slow motion. It was as though everything around me moved in the frames of a filmstrip. I’m not saying I didn’t feel anxiety or worry. I did; but it did not bother me that I didn't know what I was going to do next. That was because I knew that I was going to sit tight until the storm blew over. If any companies were going to weather Black Monday, the companies we owned would. After all, they were still big, growing, industry leaders; and by the end of the day, they would be 23% cheaper. Their rising price trends were devastated, but they were not going to just dry up and blow away.

The phone calls poured in that morning, and didn’t relent the entire day. I spoke with nearly every client I served. Sometimes, up to four calls waited at one time. I was running so far behind because every time I hung up the phone it rang again. I ended my last call of the day around midnight. Surprisingly, people remained relatively calm, considering the circumstances, and agreed with my decision not to sell into the crash.

As I spoke with each person, a type of “Black-Monday talking points” started to emerge in my mind. I was convinced from watching the action of the market that the collapse was, at least in some way, a structural problem. The normal interaction between buyers and sellers was corrupted. I believed this because of the wild swings in stock prices. As an example, on Black Monday, General Electric opened 15% lower than its previous close. It then retraced the entire loss, before falling again by 25%, a swing of over 50% for the day. GE was a one hundred-year old company that produced a wide range of products that people all over the world used everyday. There was no way the fortunes of this company could change that much in a day. As I thought about it, GE’s price swing for the day was wider than it was in a normal year.

The talking points went on to explain that our portfolios were full of “essential services”: companies such as banks, food and beverage, health-care, energy, transportation, and utilities. I explained that no one knew what these companies would sell for in the coming days and months, but their existence was not in danger. Indeed, because they had strong balance sheets and were already the leaders in their industries, there was good reason to believe that their businesses would improve. I concluded by saying that it was important to remember that we own companies and not stocks. Lastly, the economy was strong going into Black Monday, and it was inconceivable that it could fall apart in a short time.

No one listened to the talking points more than I did. My “Price Trend” philosophy was dying with each additional 100 point fall in the Dow. Yet, it was becoming clear to me that the violent action of the market was only marginally connected to the underlying values of most companies.

I realized that while the “Trend” part of BIG Trend investing was dead, the BIG part was going to save the day because big companies that were industry leaders and growing were holding up much better than small and highly leveraged companies. While this was good news, I was careful not to offer anyone false hope to the people I was speaking to. I tried to explain to everyone that the crash was going to take a long time to fix. Indeed, it took almost two years.

On Black Monday, in the midst of the demise of what I thought I knew about investment strategy, almost outside the realm of my consciousness, a new investment strategy was beginning to take shape in me. On that day, The Rising Dividend strategy was set in motion by way of three phone calls I received. Each one was surprising, and each one went against the grain of the day’s events. In the end, each one helped me see a way out of the wreckage of Black Monday by presenting an opportunity and asking me to consider it from a different perspective.

Next time: The Three Calls

Sunday, April 23, 2006

The Rising Dividend Story -- Black Monday

No investment strategy comes to a person's mind fully formed. Neither does it come entirely through the intelligence of a wise professor, or the persuasion of an insightful author. An investment strategy a person is willing to bet his or her life savings on is one that has been molded and tested in the fires of adversity and has shown its mettle and its worth. These pages have been full of stories about the merits of rising dividend investing. Many of you who are reading this blog are sold on this strategy; while many of you may think it is just a clever marketing strategy.

During the next few weeks, I would like to share with you the story of how I came to understand the hidden value of rising dividend investing. As you will see, the Rising Dividend Story is really a story within a story. I have experienced this story first hand, but it is not mine. Indeed, I was aware of many of the elements of this story years ago, but it took the keen intellects of Mike Hull and Rick Roop and a book written in 1937 to fully understand the breadth and width of the power of rising dividends. I will retell the story as faithfully as possible. But please do not mistake my telling of the Rising Dividend Story for the truth of it. When the truth of it apprehends you, you will see investing with entirely new eyes.

I'm not sure whether telling the story will take 10 installments or 20, but we will work our way along in a logical and chronological way. Many of you who are reading this will find yourself included in the story. So many of you have contributed to the Rising Dividend Story that I am dedicating it to the clients of Donaldson Capital Management.

While perhaps not suitable for framing, you may wish to pass the story along to friends and family, especially to young adults. Rising Dividend Investing is not the only way to invest, but we believe it is understandable to almost anyone and it works. It allows a person to disconnect from the frantic search for the next hot tip or hot stock and rest in the knowlege that you own real-live growing companies and not a collection of ticker symbols.

The Story Begins

Black Monday, October 19, 1987, was agonizing, devastating, and surreal, yet from a long-term investment perspective, it was the best thing that ever happened to me. On that day the Dow Jones Industrials fell by 511 points; 22.6% of its value, which would be the equivalent of over 2500 points today. Black Monday’s percentage loss dwarfed the 12.8% one-day loss in the crash of 1929.

When I say Black Monday was the best thing that ever happened to me, I do not mean a kind of Dickinsonian best of times and worst of times happening together. From a financial and psychological perspective for me, it was the worst of times. The only good thing that happened as a result of the crash was the destruction of most of my illusions about investing. If you would have asked me prior to Black Monday what stocks to buy, I had a quick answer and I was convinced I was right. My investment strategy was contained in the acronym BIG trend. BIG stood for Big companies that were Industry leaders and Growing. Trend meant I invested only in BIG stocks whose prices were trending higher.

I made the claim regularly that in sticking with big companies I could know as much about them as the Wall Street analysts, because big companies were widely covered in the popular and financial media. In focusing on industry leadership, I was merely stating the obvious; that size mattered, and companies that were number one or two in their industries were generally the most profitable, efficient, and valuable. However, I must have said ten thousand times in my life that there were lots of big companies that were leaders in their industries, but few of them were growing. Thus, the core of my investment strategy was that earnings growth was the dynamo that propelled price growth.

Finally, since the markets were made up of very bright people with lots of tools for uncovering successful investments, my strategy was to wait until price trends clearly began to move in concert with earnings growth, giving me what I called convergence, and a probable winner.Once I had convergence, I bought the stock and owned it until its price and earnings diverged. Between the two, the price trend was the final word. It was my theory that the so-called “mind of the market”, the millions of investors making buy and sell decisions, would get into a kind of buzz where everyone was looking at the same price and earnings trends. This would pull more and more investors into the buzz and push particular stocks and industries higher.

My approach had been successful for many years. I was confident that if I watched the markets closely enough, I could see which way the winds were blowing and which of them held the most promise.

Other than the trend of earnings growth, I paid little attention to the valuations or fundamentals, such as P/E, sales, and dividends. I believed that my best chance of success depended on watching the trends and not the values.

On Black Monday, the price of every stock suddenly collapsed. Ironically, the crash was made worse because there was no negative economic or political news that appeared to be fueling it. The market just seemed to implode. The companies I owned in my clients’ accounts were still big, industry leaders, and growing, but not a single one now had a friendly trend. All stocks were headed down. The strategy I had used for years was saying to sell everything, but as I thought about the wisdom of selling all the stocks under our management, I found myself recoiling. It flashed through my mind that it made absolutely no sense to throw good stocks at bad prices. I could feel it in my bones that something was wrong with the markets and not our companies, but I was now faced with the dilemma of ignoring my long-established strategy of selling stocks that had broken rising price trends.

At the moment I decided not to sell everything, I realized I was cut adrift from any experiential confidence I possessed. If I ignored sell signals, then when did I sell? And perhaps, if I was not willing to throw good stocks at bad prices, I should be taking advantage of the collapse and start buying. These questions cycled through my mind continuously. As they did, a strange sense of unknowing took up residence in me, and I came face to face with the reality that the BIG trend investment strategy that I had followed for so many years was at an end. Circumstances had shown it was suitable only for “fair weather” investing, and the weather had turned as bad as it had been in 60 years.

Yet, having said this, the sense of unknowing was not a feeling of hopelessness or confusion. I had an intuitive feeling that there was no smart way to escape the crash, and the most important thing to do was to keep things very simple and avoid emotional responses both in myself and in my clients. Short of another 1929 depression, the companies we owned would make it through these times, and I knew when things calmed down, they would be the first to rebound.

As Black Monday wore on and the telephone calls from frightened clients kept coming, I realized that I had few answers for them. Even if they insisted on selling, the market was running so far behind that the prices I saw on my screen, at times, were an hour behind the actual trading. It was anybody's guess what a person would actually receive for the sale of a stock.

A big day for the Dow Jones at that time was a positive or negative change of 20 points. The market opened the day down 200 points before rallying back to down only 80 points by mid morning . When it again fell by over 200 points, something inside of me gave way, and I knew the market was going a lot lower before the end of the day. Lower than I could have ever imagined.

As the market continued to fall through each succeeding 100 point drop, I found myself with a growing recognition that the crash would likely do as much psychological harm as financial harm. It also posed a serious threat to the existence of the small investment firm that I had helped start in the previous year. I had been in the investment business for 12 years, and this small investment firm was the culmination of my dreams. This would be a battle not only to protect our investor’s assets, it would also be a battle to save our company.

Sunday, April 09, 2006

An Update of the Dow Jones Regression Model

The Dow Jones Industrial Average has been making a valiant attempt to move convincingly through 11,000. The usual list of headwinds--interest rates, oil prices, inflation fears, geopolitical problems --, however, have made progress difficult in recent weeks. But it is important to remember that fourth quarter earnings and dividends grew by over 10%, and this week first quarter 2006 earnings start coming out. Estimates for first quarter earnings growth are in the 11%-13% range.

A few basics: The Dow Jones 30 is highly correlated to the fundamentals: earnings, dividends, and GDP. That means that, over time, as the fundamentals have grown, the DJIA has grown. Stocks don't go up in a vacuum. They go higher, as it were, on the shoulders of the profit growth of American corporations.

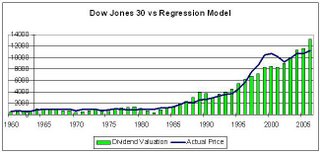

We have developed a handful of models over the years to keep an eye on the fundamental valuations compared to actual prices. I recently plugged in the earnings and dividend estimates from S&P and Value-Line into our model. I made our own estimate of average interest rates for the coming year and then put everything into our model. The chart below shows 46 years of the model's predictions. They have been good. The coefficient of determination is near 95%.

Please click chart to enlarge.

The regression model shows that the current combination of earnings, dividends, and interest rates produces a Dow Jones of near 13,000. That would seem like a outrageous level and not connected to reality.

To ignore the model's high correlation with the actual results, however, would, from a statistical perspective, be irresponsible.

The model correctly called the undervaluation of the late 1980s and the overvaluation of the late 1990s. The model is making a rather simple statement: in an interest rate environment such as today, earnings and dividend growth should be more highly prized.

When is this valuation gap going to close? I don't think that is as important to answer as to just look at the trend of the late 1980s. Stocks were undervalued for eight years, but rose smartly in concert with the rise in intrinsic value. I think that is likely to happen again. The important thing to remember is that, history shows us, that eventually prices will catch up to valuation. That's now nearly 20% higher than today's market.

Forty-five years of high correlations do not a sure thing make, but then again, if we are in the business of buying low and selling high, history says, from a valuation perspective, stocks are certainly not high.

The regression model shows that the current combination of earnings, dividends, and interest rates produces a Dow Jones of near 13,000. That would seem like a outrageous level and not connected to reality.

To ignore the model's high correlation with the actual results, however, would, from a statistical perspective, be irresponsible.

The model correctly called the undervaluation of the late 1980s and the overvaluation of the late 1990s. The model is making a rather simple statement: in an interest rate environment such as today, earnings and dividend growth should be more highly prized.

When is this valuation gap going to close? I don't think that is as important to answer as to just look at the trend of the late 1980s. Stocks were undervalued for eight years, but rose smartly in concert with the rise in intrinsic value. I think that is likely to happen again. The important thing to remember is that, history shows us, that eventually prices will catch up to valuation. That's now nearly 20% higher than today's market.

Forty-five years of high correlations do not a sure thing make, but then again, if we are in the business of buying low and selling high, history says, from a valuation perspective, stocks are certainly not high.

The regression model shows that the current combination of earnings, dividends, and interest rates produces a Dow Jones of near 13,000. That would seem like a outrageous level and not connected to reality.

To ignore the model's high correlation with the actual results, however, would, from a statistical perspective, be irresponsible.

The model correctly called the undervaluation of the late 1980s and the overvaluation of the late 1990s. The model is making a rather simple statement: in an interest rate environment such as today, earnings and dividend growth should be more highly prized.

When is this valuation gap going to close? I don't think that is as important to answer as to just look at the trend of the late 1980s. Stocks were undervalued for eight years, but rose smartly in concert with the rise in intrinsic value. I think that is likely to happen again. The important thing to remember is that, history shows us, that eventually prices will catch up to valuation. That's now nearly 20% higher than today's market.

Forty-five years of high correlations do not a sure thing make, but then again, if we are in the business of buying low and selling high, history says, from a valuation perspective, stocks are certainly not high.

The regression model shows that the current combination of earnings, dividends, and interest rates produces a Dow Jones of near 13,000. That would seem like a outrageous level and not connected to reality.

To ignore the model's high correlation with the actual results, however, would, from a statistical perspective, be irresponsible.

The model correctly called the undervaluation of the late 1980s and the overvaluation of the late 1990s. The model is making a rather simple statement: in an interest rate environment such as today, earnings and dividend growth should be more highly prized.

When is this valuation gap going to close? I don't think that is as important to answer as to just look at the trend of the late 1980s. Stocks were undervalued for eight years, but rose smartly in concert with the rise in intrinsic value. I think that is likely to happen again. The important thing to remember is that, history shows us, that eventually prices will catch up to valuation. That's now nearly 20% higher than today's market.

Forty-five years of high correlations do not a sure thing make, but then again, if we are in the business of buying low and selling high, history says, from a valuation perspective, stocks are certainly not high.

Subscribe to:

Comments (Atom)