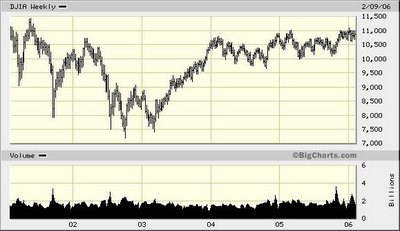

The question that everyone is asking is, "What is it that the sellers know about 11,000 that the buyers do not know?" My answer is simple; 11,000 is just the level where value and price have been near equilibrium and therefore it has been somewhat easy for the sellers to beat back the buyers without much of a fight. But I believe the time for that big fight is very near.

This can be seen using one of our Dividend Valuation charts for the Dow Jones 30.

Chart II

The question that everyone is asking is, "What is it that the sellers know about 11,000 that the buyers do not know?" My answer is simple; 11,000 is just the level where value and price have been near equilibrium and therefore it has been somewhat easy for the sellers to beat back the buyers without much of a fight. But I believe the time for that big fight is very near.

This can be seen using one of our Dividend Valuation charts for the Dow Jones 30.

Chart II

Chart II shows 45 years of the annual price movements of the DJ30 (red line) versus our Dividend Valuation Model (blue line). The model clearly shows that stocks were overpriced between 1998 and 2000 (DJ30 Price far above Dividend Value). Thus, the reason that stocks had problems getting past 11,000 during that time was because value investors were willing to sell all the stock the momentum players wanted.

The chart shows that the DJ30 sharply corrected back toward its Dividend Valuation Line after 9/11. The underlying data for the chart reveal that the market became undervalued in 2002. For years 2003 and 2004, prices and values moved in tandem. But in 2005 the Dividend Valuation Line dramatically separated from the price of the DJ 30.

I have discussed this divergence between prices and values on several occasions over the past year, and it has puzzled me that the market was not able to break through more, even in the face of rate hikes, oil spikes, and natural disasters.

The chart shows that stocks have now gone sideways for 5 years, and I hear all sorts of analysts arguing that 11,000 is likely to be as difficult to pierce as was 1000, which was first broached in 1968 but not laid to rest until 1982. But in my mind this kind of talk is silly. A look at the chart shows why. There was no reason for stocks to have pierced 1000 in any meaningful way prior to the early 1980s because the movement of the Dividend Valuation Line went sideways during the same time.

Things are different now. The chart shows that the Dividend Valuation Line has decisively separated from the DJ 30. The model now projects that the proper valuation for the Dow today is just under 13,000. Before you either accept this figure as a foregone conclusion, or dismiss it, let me explain how the Dividend Valuation Model works and how accurate a predictor of stock prices it has been over the years.

The Dividend Valuation Model analyzes the mathematical relationships between dividends, interested rates, and prices over the last 45 years. This produces a "the way things ought to be" formula. That formula is then tested for its correlation to the actual results. This testing produces something statisticians call a coefficient of determination and a standard error. Hang in here with me; I'll get through these statistics in a moment. The bottom line is this. Our Dividend Valuation Model has "explained" 95% of the annual movements of the DJ 30 with a standard error of about 5%. That is to say, the probability for prices to move higher in 2006 are very high unless the economy just falls apart and takes dividends with it.

Psychological levels can not hold back the true worth of companies indefinitely, and what our model is saying is that stocks are probably undervalued by 15% - 20%. That does not mean the value gap will be closed completely in 2006, but it does mean that the sellers are on borrowed time unless something very negative happens to values. The way the model works, a significant fall in values could only occur if dividends fall dramatically in the year ahead. That is unlikely because the majority of the companies in the Dow are expected to raise their dividends.

Chart II shows 45 years of the annual price movements of the DJ30 (red line) versus our Dividend Valuation Model (blue line). The model clearly shows that stocks were overpriced between 1998 and 2000 (DJ30 Price far above Dividend Value). Thus, the reason that stocks had problems getting past 11,000 during that time was because value investors were willing to sell all the stock the momentum players wanted.

The chart shows that the DJ30 sharply corrected back toward its Dividend Valuation Line after 9/11. The underlying data for the chart reveal that the market became undervalued in 2002. For years 2003 and 2004, prices and values moved in tandem. But in 2005 the Dividend Valuation Line dramatically separated from the price of the DJ 30.

I have discussed this divergence between prices and values on several occasions over the past year, and it has puzzled me that the market was not able to break through more, even in the face of rate hikes, oil spikes, and natural disasters.

The chart shows that stocks have now gone sideways for 5 years, and I hear all sorts of analysts arguing that 11,000 is likely to be as difficult to pierce as was 1000, which was first broached in 1968 but not laid to rest until 1982. But in my mind this kind of talk is silly. A look at the chart shows why. There was no reason for stocks to have pierced 1000 in any meaningful way prior to the early 1980s because the movement of the Dividend Valuation Line went sideways during the same time.

Things are different now. The chart shows that the Dividend Valuation Line has decisively separated from the DJ 30. The model now projects that the proper valuation for the Dow today is just under 13,000. Before you either accept this figure as a foregone conclusion, or dismiss it, let me explain how the Dividend Valuation Model works and how accurate a predictor of stock prices it has been over the years.

The Dividend Valuation Model analyzes the mathematical relationships between dividends, interested rates, and prices over the last 45 years. This produces a "the way things ought to be" formula. That formula is then tested for its correlation to the actual results. This testing produces something statisticians call a coefficient of determination and a standard error. Hang in here with me; I'll get through these statistics in a moment. The bottom line is this. Our Dividend Valuation Model has "explained" 95% of the annual movements of the DJ 30 with a standard error of about 5%. That is to say, the probability for prices to move higher in 2006 are very high unless the economy just falls apart and takes dividends with it.

Psychological levels can not hold back the true worth of companies indefinitely, and what our model is saying is that stocks are probably undervalued by 15% - 20%. That does not mean the value gap will be closed completely in 2006, but it does mean that the sellers are on borrowed time unless something very negative happens to values. The way the model works, a significant fall in values could only occur if dividends fall dramatically in the year ahead. That is unlikely because the majority of the companies in the Dow are expected to raise their dividends.

I am certainly not making gurantees, and the future will bring many surprises, but the great thing about dividend investing is that at least we know what we are looking for, and that is this: If dividends grow as we expect in the year ahead, and if interest rates remain tame, some time in 2006 we will sing a funeral dirge for Dow 11,000.