Tuesday, February 28, 2006

Google Takes on Value's Terrible Swift Sword.

According to our computations, the Dow Jones 30 is approximately 15% under valued. Dow Jones 11,000 has put up a stout defense for a long time, but everyday the valuation gap widens, and in time, value will win like it always does.

In my last edition, I explained that even though the Dow had pierced the 11,000 level I was not ready to lay it to rest. I mentioned that important psychological levels are usually taken out with a lot of noise caused by short covering. Since the move through 11,000 was very orderly, I suggested that it was unlikely that the shorts had covered and until they did, we would wobble back and forth across 11,000 for a while longer.

As I write this, Google has just announced that they see a slowing in their business; as a result, its stock price is down 10% and the Dow is down about 1%.

What does a high flyer like Google have to do with value investors like us. Nothing and everything. Google does not qualify for our portfolios because it does not pay dividends, and even if it did so, its current selling price has no relationship to any intrinsic value we know how to compute. Google is a fad. It has a wonderful business model and great services, but it is being priced like the techs of the late 1990s: as though the rules of valuation have been repealed. Google has been learning in recent weeks that value has a terrible swift sword, and in time, it visits every company.

I used to say that everyday in the market means something. I don't say that anymore because I know it is untrue. Few days in the market mean much, yet there are thousand of words being written today about what's going on with Google and the greater implications it has for all stocks. I will add as few words to this total as I can.

Google is not a value. The slicing and dicing it is receiving is warranted, and there will be more days like this. Blue Chip America is undervalued. The hit it is taking is not related to value, but psychology. Traders believe Google is one of the most important companies in the world, and if Google is suffering, then something must be wrong with the whole market.

Today the "Sell-Dow 11,000" crowd is winning, but their costs are going up everyday and they know it. They were on the right side of the valuation knife in 2000, and they have big winners. But they are on the wrong side of the battle this time, because some high quality companies with good values are breaking out of long trading ranges. I will detail some next time.

Friday, February 17, 2006

Dow Jones 11000 -- Good Bye, or See You Later?

The markets turned in a very good week spurred by the rather upbeat report new Fed Chairman Ben Bernanke gave congress about the strength of the US Economy. The Dow closed the week at 11,115.32, the highest close since mid-2001. I have had a number of people ask if I think the market will just keep going or if it will continue to oscillate around 11000 for awhile. As I said in the previous edition, 11,000 has, indeed, been a psychological barrier, thus The DJ 30's break to a new multi-year high is very good news. In addition, I still believe the Dow Jones is significantly undervalued; thus, there is plenty of room for the market to move higher.

Having said this, 11,000 has not been pierced in the way that psychological barriers are normally taken out. I said last time, the DJ 30 has been at or near 11,000 8 times in the last 5 years and has turned back every time. One of the reasons the market turned back each time is the influence of what are known as the "shorts." A short trade is when you sell a stock or index that you do not yet own (Shorts borrow the securities they sell from their brokers) with the hopes that the price will fall and you can buy it back later at a lower price and make a profit. Thus in the seven previous times the DJ 30 reached 11,000, if you had shorted it, you would have made handsome profits because each time the market subsequently fell back to lower prices. You could have then covered your short, by buying the same number of shares that you shorted and collected the difference as a capital gain. Big money, and I do mean big money has been made by the shorts over the last few years.

The shorts are big, sophisticated investors, and they do not scare easily. Without a shadow of a doubt they began shorting recently just under 11,000, and I believe they are probably still shorting today. While the shorts do not scare easily, they are completely short-term traders and they will not take losses indefinitely. The shorts will cover by buying the market when they are convinced that stocks are going a lot higher.

When they start to cover, they must buy the market, and they operate in a kind of herd mentality. That means when the shorts start to cover you will know it because it will be accompanied by very high volume and sharp spikes in prices, as many of them head for the exits.

So far the move above 11,000 has been rather orderly. For me to wave good bye to 11,000, I would like to see a week to 10 days of sharply higher prices. Busting out of a 5 year high ought to be worth 500 points in short covering.

This does not mean that this is the only way we can sing our dirge for 11,000, but it is the way that these kinds of psychological barriers normally are laid to rest.

I feel confident that 11,000 will be decisively pierced in 2006, but I think it will be accompanied by a lot more noise than we have today. I am bullish on the markets, but I would be surprised if we did not wobble around 11,000 for a while longer.

Friday, February 10, 2006

Dow Jones 11000 -- When Will it Fall?

I will defer my comments about speeches made at the TD Ameritrade National Conference to answer a great question from a client that everyone is asking. How long will 11,000 on the Dow Jones present a barrier to US common stock advances?

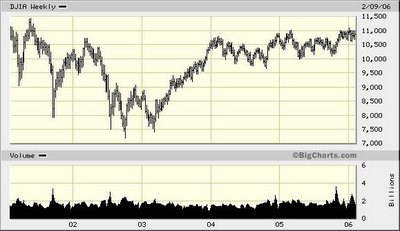

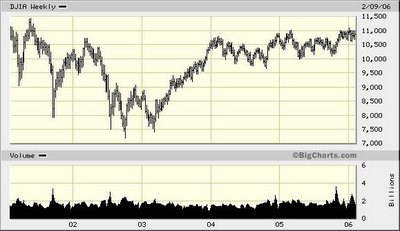

Normally, I'm not much into numerical barriers. The evidence is clear that in the long run stocks follow values and not psychological milestones, but I do admit that in the short run, a certain price level can seem impenetrable. I want to show you two charts that make the case that the Dow Jones is getting very cheap relative to its underlying value.

Chart I shows that 11,000 has, indeed, been a tough level to get through. I count 7 different times over the last 5 years when the Dow pushed toward 11,000, and the only time it broke decisively through that level was in early 2001, which was reversed by the events of 9/11.

Chart I

The question that everyone is asking is, "What is it that the sellers know about 11,000 that the buyers do not know?" My answer is simple; 11,000 is just the level where value and price have been near equilibrium and therefore it has been somewhat easy for the sellers to beat back the buyers without much of a fight. But I believe the time for that big fight is very near.

This can be seen using one of our Dividend Valuation charts for the Dow Jones 30.

Chart II

The question that everyone is asking is, "What is it that the sellers know about 11,000 that the buyers do not know?" My answer is simple; 11,000 is just the level where value and price have been near equilibrium and therefore it has been somewhat easy for the sellers to beat back the buyers without much of a fight. But I believe the time for that big fight is very near.

This can be seen using one of our Dividend Valuation charts for the Dow Jones 30.

Chart II

Chart II shows 45 years of the annual price movements of the DJ30 (red line) versus our Dividend Valuation Model (blue line). The model clearly shows that stocks were overpriced between 1998 and 2000 (DJ30 Price far above Dividend Value). Thus, the reason that stocks had problems getting past 11,000 during that time was because value investors were willing to sell all the stock the momentum players wanted.

The chart shows that the DJ30 sharply corrected back toward its Dividend Valuation Line after 9/11. The underlying data for the chart reveal that the market became undervalued in 2002. For years 2003 and 2004, prices and values moved in tandem. But in 2005 the Dividend Valuation Line dramatically separated from the price of the DJ 30.

I have discussed this divergence between prices and values on several occasions over the past year, and it has puzzled me that the market was not able to break through more, even in the face of rate hikes, oil spikes, and natural disasters.

The chart shows that stocks have now gone sideways for 5 years, and I hear all sorts of analysts arguing that 11,000 is likely to be as difficult to pierce as was 1000, which was first broached in 1968 but not laid to rest until 1982. But in my mind this kind of talk is silly. A look at the chart shows why. There was no reason for stocks to have pierced 1000 in any meaningful way prior to the early 1980s because the movement of the Dividend Valuation Line went sideways during the same time.

Things are different now. The chart shows that the Dividend Valuation Line has decisively separated from the DJ 30. The model now projects that the proper valuation for the Dow today is just under 13,000. Before you either accept this figure as a foregone conclusion, or dismiss it, let me explain how the Dividend Valuation Model works and how accurate a predictor of stock prices it has been over the years.

The Dividend Valuation Model analyzes the mathematical relationships between dividends, interested rates, and prices over the last 45 years. This produces a "the way things ought to be" formula. That formula is then tested for its correlation to the actual results. This testing produces something statisticians call a coefficient of determination and a standard error. Hang in here with me; I'll get through these statistics in a moment. The bottom line is this. Our Dividend Valuation Model has "explained" 95% of the annual movements of the DJ 30 with a standard error of about 5%. That is to say, the probability for prices to move higher in 2006 are very high unless the economy just falls apart and takes dividends with it.

Psychological levels can not hold back the true worth of companies indefinitely, and what our model is saying is that stocks are probably undervalued by 15% - 20%. That does not mean the value gap will be closed completely in 2006, but it does mean that the sellers are on borrowed time unless something very negative happens to values. The way the model works, a significant fall in values could only occur if dividends fall dramatically in the year ahead. That is unlikely because the majority of the companies in the Dow are expected to raise their dividends.

Chart II shows 45 years of the annual price movements of the DJ30 (red line) versus our Dividend Valuation Model (blue line). The model clearly shows that stocks were overpriced between 1998 and 2000 (DJ30 Price far above Dividend Value). Thus, the reason that stocks had problems getting past 11,000 during that time was because value investors were willing to sell all the stock the momentum players wanted.

The chart shows that the DJ30 sharply corrected back toward its Dividend Valuation Line after 9/11. The underlying data for the chart reveal that the market became undervalued in 2002. For years 2003 and 2004, prices and values moved in tandem. But in 2005 the Dividend Valuation Line dramatically separated from the price of the DJ 30.

I have discussed this divergence between prices and values on several occasions over the past year, and it has puzzled me that the market was not able to break through more, even in the face of rate hikes, oil spikes, and natural disasters.

The chart shows that stocks have now gone sideways for 5 years, and I hear all sorts of analysts arguing that 11,000 is likely to be as difficult to pierce as was 1000, which was first broached in 1968 but not laid to rest until 1982. But in my mind this kind of talk is silly. A look at the chart shows why. There was no reason for stocks to have pierced 1000 in any meaningful way prior to the early 1980s because the movement of the Dividend Valuation Line went sideways during the same time.

Things are different now. The chart shows that the Dividend Valuation Line has decisively separated from the DJ 30. The model now projects that the proper valuation for the Dow today is just under 13,000. Before you either accept this figure as a foregone conclusion, or dismiss it, let me explain how the Dividend Valuation Model works and how accurate a predictor of stock prices it has been over the years.

The Dividend Valuation Model analyzes the mathematical relationships between dividends, interested rates, and prices over the last 45 years. This produces a "the way things ought to be" formula. That formula is then tested for its correlation to the actual results. This testing produces something statisticians call a coefficient of determination and a standard error. Hang in here with me; I'll get through these statistics in a moment. The bottom line is this. Our Dividend Valuation Model has "explained" 95% of the annual movements of the DJ 30 with a standard error of about 5%. That is to say, the probability for prices to move higher in 2006 are very high unless the economy just falls apart and takes dividends with it.

Psychological levels can not hold back the true worth of companies indefinitely, and what our model is saying is that stocks are probably undervalued by 15% - 20%. That does not mean the value gap will be closed completely in 2006, but it does mean that the sellers are on borrowed time unless something very negative happens to values. The way the model works, a significant fall in values could only occur if dividends fall dramatically in the year ahead. That is unlikely because the majority of the companies in the Dow are expected to raise their dividends.

The question that everyone is asking is, "What is it that the sellers know about 11,000 that the buyers do not know?" My answer is simple; 11,000 is just the level where value and price have been near equilibrium and therefore it has been somewhat easy for the sellers to beat back the buyers without much of a fight. But I believe the time for that big fight is very near.

This can be seen using one of our Dividend Valuation charts for the Dow Jones 30.

Chart II

The question that everyone is asking is, "What is it that the sellers know about 11,000 that the buyers do not know?" My answer is simple; 11,000 is just the level where value and price have been near equilibrium and therefore it has been somewhat easy for the sellers to beat back the buyers without much of a fight. But I believe the time for that big fight is very near.

This can be seen using one of our Dividend Valuation charts for the Dow Jones 30.

Chart II

Chart II shows 45 years of the annual price movements of the DJ30 (red line) versus our Dividend Valuation Model (blue line). The model clearly shows that stocks were overpriced between 1998 and 2000 (DJ30 Price far above Dividend Value). Thus, the reason that stocks had problems getting past 11,000 during that time was because value investors were willing to sell all the stock the momentum players wanted.

The chart shows that the DJ30 sharply corrected back toward its Dividend Valuation Line after 9/11. The underlying data for the chart reveal that the market became undervalued in 2002. For years 2003 and 2004, prices and values moved in tandem. But in 2005 the Dividend Valuation Line dramatically separated from the price of the DJ 30.

I have discussed this divergence between prices and values on several occasions over the past year, and it has puzzled me that the market was not able to break through more, even in the face of rate hikes, oil spikes, and natural disasters.

The chart shows that stocks have now gone sideways for 5 years, and I hear all sorts of analysts arguing that 11,000 is likely to be as difficult to pierce as was 1000, which was first broached in 1968 but not laid to rest until 1982. But in my mind this kind of talk is silly. A look at the chart shows why. There was no reason for stocks to have pierced 1000 in any meaningful way prior to the early 1980s because the movement of the Dividend Valuation Line went sideways during the same time.

Things are different now. The chart shows that the Dividend Valuation Line has decisively separated from the DJ 30. The model now projects that the proper valuation for the Dow today is just under 13,000. Before you either accept this figure as a foregone conclusion, or dismiss it, let me explain how the Dividend Valuation Model works and how accurate a predictor of stock prices it has been over the years.

The Dividend Valuation Model analyzes the mathematical relationships between dividends, interested rates, and prices over the last 45 years. This produces a "the way things ought to be" formula. That formula is then tested for its correlation to the actual results. This testing produces something statisticians call a coefficient of determination and a standard error. Hang in here with me; I'll get through these statistics in a moment. The bottom line is this. Our Dividend Valuation Model has "explained" 95% of the annual movements of the DJ 30 with a standard error of about 5%. That is to say, the probability for prices to move higher in 2006 are very high unless the economy just falls apart and takes dividends with it.

Psychological levels can not hold back the true worth of companies indefinitely, and what our model is saying is that stocks are probably undervalued by 15% - 20%. That does not mean the value gap will be closed completely in 2006, but it does mean that the sellers are on borrowed time unless something very negative happens to values. The way the model works, a significant fall in values could only occur if dividends fall dramatically in the year ahead. That is unlikely because the majority of the companies in the Dow are expected to raise their dividends.

Chart II shows 45 years of the annual price movements of the DJ30 (red line) versus our Dividend Valuation Model (blue line). The model clearly shows that stocks were overpriced between 1998 and 2000 (DJ30 Price far above Dividend Value). Thus, the reason that stocks had problems getting past 11,000 during that time was because value investors were willing to sell all the stock the momentum players wanted.

The chart shows that the DJ30 sharply corrected back toward its Dividend Valuation Line after 9/11. The underlying data for the chart reveal that the market became undervalued in 2002. For years 2003 and 2004, prices and values moved in tandem. But in 2005 the Dividend Valuation Line dramatically separated from the price of the DJ 30.

I have discussed this divergence between prices and values on several occasions over the past year, and it has puzzled me that the market was not able to break through more, even in the face of rate hikes, oil spikes, and natural disasters.

The chart shows that stocks have now gone sideways for 5 years, and I hear all sorts of analysts arguing that 11,000 is likely to be as difficult to pierce as was 1000, which was first broached in 1968 but not laid to rest until 1982. But in my mind this kind of talk is silly. A look at the chart shows why. There was no reason for stocks to have pierced 1000 in any meaningful way prior to the early 1980s because the movement of the Dividend Valuation Line went sideways during the same time.

Things are different now. The chart shows that the Dividend Valuation Line has decisively separated from the DJ 30. The model now projects that the proper valuation for the Dow today is just under 13,000. Before you either accept this figure as a foregone conclusion, or dismiss it, let me explain how the Dividend Valuation Model works and how accurate a predictor of stock prices it has been over the years.

The Dividend Valuation Model analyzes the mathematical relationships between dividends, interested rates, and prices over the last 45 years. This produces a "the way things ought to be" formula. That formula is then tested for its correlation to the actual results. This testing produces something statisticians call a coefficient of determination and a standard error. Hang in here with me; I'll get through these statistics in a moment. The bottom line is this. Our Dividend Valuation Model has "explained" 95% of the annual movements of the DJ 30 with a standard error of about 5%. That is to say, the probability for prices to move higher in 2006 are very high unless the economy just falls apart and takes dividends with it.

Psychological levels can not hold back the true worth of companies indefinitely, and what our model is saying is that stocks are probably undervalued by 15% - 20%. That does not mean the value gap will be closed completely in 2006, but it does mean that the sellers are on borrowed time unless something very negative happens to values. The way the model works, a significant fall in values could only occur if dividends fall dramatically in the year ahead. That is unlikely because the majority of the companies in the Dow are expected to raise their dividends.

I am certainly not making gurantees, and the future will bring many surprises, but the great thing about dividend investing is that at least we know what we are looking for, and that is this: If dividends grow as we expect in the year ahead, and if interest rates remain tame, some time in 2006 we will sing a funeral dirge for Dow 11,000.

Monday, February 06, 2006

TD Ameritrade National Conference

Several members of our firm attended the TD Ameritrade (the new name of the merger of TD Waterhouse and Ameritrade) annual advisors conference last week. This was one of the best conferences I have ever attended, and I want to share excerpts of a number of speakers, but I want to comment on the speech by Dr. Alan Blinder first. Blinder's comments were of interest for three reasons: 1. He is one of the Democratic Party's heavyweight thinkers on the economy; 2. He was the vice-chairman of the Fed during the Clinton years and thus has keen insights into the thinking of outgoing Fed Chairman Alan Greenspan; and 3. He has worked closely with Ben Bernanke, the new Fed Chairman, while both were professors at Princeton University.

My key interest in Dr. Blinder's comments were his views on the economy. I was pleasantly surprised to hear that he agrees with most economists that 2006 GDP growth will be in the range of 3.5% - 4%. That is actually higher than DCM's estimate of 3%. He thought the recently announced fourth quarter reading of 1.1% annual growth was a fluke that would be compensated for by higher than trend growth in the first quarter.

He was asked about the balance of trade issues with China and other countries. He said that David Ricardo 200 years ago theorized and history had proved that foreign trade is not destructive to job creation. He said if the US were truly exporting jobs, then how could the unemployment rate be only 4.7%. He said the theory of comparative advantage currently says that the most efficient and cost effective place to produce televisions was in Asia, and the best place to produce airplanes was the US. He said you disrupt and weaken an economy by trying to hang on to inefficient and non-competitive industries and jobs. He did not say it, but the outsourcing of manufacturing jobs has been going on for 40 years, and the rise in manufacturing outside the US has caused jobs in shipping, transportation, and warehousing to skyrocket. You could walk across the US on a busy day on the trailer tops of 18 wheelers.

He had harsh things to say about the budget deficits and called on President Bush to abandon his efforts to make permanent the tax cuts instituted in 2001 and 2003. I had the very strong sense, however, that if President Clinton would have been in office on 9/11, Dr. Blinder would have recommended tax cuts to spur the economy and consumer confidence.

In summary, I have followed Dr. Blinder for many years and found him to be a reasonably main stream economist. He takes a populist line from time to time, but I do not believe he harbors notions that the government creates jobs or can do much to stem the free flow of capital. If John Kerry would have won the Presidency, I am reasonably certain Dr. Blinder would have been on his shortlist to replace Dr. Greenspan. I am much happier that Dr. Bernanke is the new Fed Chairman, but I think the markets would have been OK with Dr. Blinder.

Next, I'll detail some of Dr. Blinder's thoughts on Ben Bernanke.

PS: We obviously were interested in what the merger of TD Waterhouse and Ameritrade would mean to our clients and us. We had previously been told that the TD Waterhouse Institutional Services'management team would take the lead in custodial services to money managers such as Donaldson Capital Management. That was confirmed in Orlando. As a result, I see few if any changes in the near term.

odds & ends

Subscribe to:

Comments (Atom)