Friday, January 27, 2006

Round Trip

Last Friday the market fell by over 200 points amid cries from Wall Street analysts that earnings and revenues were light. Citigroup, GE and other heavy weights had small earnings or revenue miscues of one sort or another. I said it was too early to bury stocks for 2006 on the basis of so few earnings reports, especially when hundreds of reports were due out this week. Just as I guessed, the earnings reports this week have been good to great and stocks have retraced most of last Friday's loss. A few companies have again been a bit light in revenue, but as Mike Hull, our president, said, "The light revenue might be coming from companies holding back a bit of business for next quarter, especially if they already their earnings in the bag."

Today's GDP report came in at growth of 1.1%. That was under the estimate of 2.8% for the quarter and will be the subject of the media's worries this weekend. Let me say again. I would not get too hung up in this number either. It will be revised two more times, and I believe it will end up higher. In any event, auto sales were the biggest contributor to the weakness, and I believe that is due to the hangover effect of the "deep discounting" all the domestic auto companies did over the summer. GDP is volatile and I expect it will pick back up in the next few quarters, although, as I said in our December quarterly letter, I expect the economy will slow in the coming year to near 3%.

Stock prices are a function of the dance between earnings/dividends and interest rates. I have been saying for a while that a "don't fight the Fed" mentality was probably the main reason that stocks were flat in 2005 in the face of great fundamentals. For this reason, a weakening economy may well be good for stocks, even if earnings and dividends grow at a slower rate. Slower economic growth would allow the Fed to go to the sidelines sooner, allowing stocks to be valued more on their fundamentals alone and less on how high or far the Fed will push rates.

I still think stocks in general are between 10% and 15% undervalued. Remarkably, some solid blue-chip growth companies, as I have detailed in recent blogs, are 20% to 25% undervalued.

Hang in there, if you take a long-term investment strategy and combine it with high quality companies with long histories of dividend increases, it is hard to lose. As I told a client today, I don't know when the 10%-15% valuation gap will be closed, but I don't think it is wise to bet against it. Moreover, stocks spend very little time at "fair value." When the gap closes, I would not be surprised to see an overvaluation gap occur. But, then let's fret over that later?

Blessings,

Tuesday, January 24, 2006

Of Prices and Values Part II

Doubleclick to increase size of chart.

Northern Trust is a specialized bank headquartered in Chicago Illinois. Over the past decade, they have narrowed their focus to managing the assets for the wealthiest families in the United States. They continue to add assets through their marketing efforts in high net worth areas of the country, and in good years for stocks, they get an extra kiss to their fees from asset appreciation. It is a rather simple strategy, but they have been at it so long that most of their would-be imitators are years behind them in building a brand.

Our dividend valuation model suggests that NTRS is currently 30% undervalued. This may not seem possible, but the power of NTRS is in periods of rising stock markets. Thus, NTRS is like a mutual fund company in this regard, but I believe their assets are much more sticky and they should be accorded a higher PE.

Fidelity Investments is the only asset manager in the country with the brand recognition of NTRS, and among the very rich, NTRS has few publicy traded rivals.

I believe the stock market is undervalued, and if I am correct, NTRS will not stay undervalued for long.

We own NTRS in our Blue Chip Growth Portfolios.

Doubleclick to increase size of chart.

Northern Trust is a specialized bank headquartered in Chicago Illinois. Over the past decade, they have narrowed their focus to managing the assets for the wealthiest families in the United States. They continue to add assets through their marketing efforts in high net worth areas of the country, and in good years for stocks, they get an extra kiss to their fees from asset appreciation. It is a rather simple strategy, but they have been at it so long that most of their would-be imitators are years behind them in building a brand.

Our dividend valuation model suggests that NTRS is currently 30% undervalued. This may not seem possible, but the power of NTRS is in periods of rising stock markets. Thus, NTRS is like a mutual fund company in this regard, but I believe their assets are much more sticky and they should be accorded a higher PE.

Fidelity Investments is the only asset manager in the country with the brand recognition of NTRS, and among the very rich, NTRS has few publicy traded rivals.

I believe the stock market is undervalued, and if I am correct, NTRS will not stay undervalued for long.

We own NTRS in our Blue Chip Growth Portfolios.

Sunday, January 22, 2006

Of Prices and Values - Part I

Friday's 2% fall in the Dow Jones 30, obviously, got a lot of headlines over the weekend, but I think the reasons given for the fall are very short-sighted, and the markets will recover in the weeks ahead. It might be said that it does not matter what drove prices lower, the end result is several hundred billion dollars in losses. But this is a perfect case of the difference between prices and values. I do not believe the actual underlying values of US corporations fell by 2% on Friday, as did prices. The reasons given for the fall in prices were Citigroup's miss on earnings, GE's miss on revenue, and the rise in oil prices resulting from the showdown with Iran and a new tape from Osama bin Laden.

The argument being made is that Citigroup and GE are such large companies that their "misses" cast a long shadow over the strength of the US economy and corporate profits in 2006. Citigroup's stock fell by almost 5% on Friday when they missed their earnings target by 2% -- for the quarter. Most of the analysts I follow have now reduced C's full-year 2006 earnings estimates by only about 1%. Having said this, I do not believe C is a good proxy for earnings for the average company or the US economy. They have missed earnings for three consecutive quarters, and in my judgment, have significant management problems, ethical issues, and a lack of a clear strategy.

GE hit their earnings target, but traders sold off the stock because of a miss in the revenue forecast. GE's earnings news was solid: five of GE's six divisions had above 15% earnings growth. The explanation for the revenue slip made sense to me. GE's earnings release would likely have been a non-event had Citigroup's earnings miss not unleashed Wall Street's animal spirits.

The showdown between the US and Iran resulting from the latter's nuclear ambitions has riled the oil markets, sending prices back near $70p/bl. I think it is unlikely that the US and other Western nations will embargo Iran's oil. These kinds of actions don't have a great history of success and would harm Western nations as much as Iran. I think it is also unlikely that Iran will withhold their oil from the market, either. Strategists I follow estimate that Iran substantially subsidizes the energy needs of almost 40% of its population. It is also well known that there is much political unrest in Iran, particularly among students and the young. The Ayatollahs cannot continue to subsidize their citizens' energy needs without the funds they derive from oil sales, and without the subsidies, they are likely to have millions of people in the streets.

The bin Laden tape was just downright strange to me. As I listened to it, even before I heard any of the media give their interpretations, it sounded to me like someone giving a pep talk to his own minions more than an imminent threat to the United States. Politics is politics, so they say, and it is just possible that the number of young men and women willing to blow themselves up and kill their countrymen and women is dwindling in the face of the relentless pursuit by the US military .

In the week ahead, literally hundreds of companies will be reporting their earnings. By this time next week, we will know a lot more about overall corporate earnings. I continue to be optimistic that earnings for the fourth quarter will be above estimates.

Lost in the assault on prices is a bit of very good news: Citigroup raised their dividend by 11%. The way I score it that actually increases C's value. However, as I said earlier, I don't like the stock currently because of what I might call a weakness of their "heart." They need to clean up things at the company. They need one CEO to run the place, they need one CEO to clean up the place, and they need a culture where adding value to their customers and shareholders is their number 1 goal, instead of enriching themselves. Citigroup like several other companies has lost it way because it has heart trouble. These things can change quickly, however, with new blood (to coin a phrase) at the top.

More later.

Tuesday, January 17, 2006

Procter and Gamble - PG -- Wonderful Company at a Good to Great Price

P&G has raised their dividend for 52 consecutive years. P&G has raised their dividend for . . . .

How does a company exist for 52 years, let alone meet the payroll, pay the banks, taxes, and then be able to not only pay a dividend, but raise it for 52 years in a row. P&G has done so by selling modestly priced goods that people use every day and being an innovator in hundreds of products that fill our kitchens, bathrooms, and tummies. There really is no other company like P&G for extending their brands, and adding valuable contributors to their bottom line. They acquired Gillette in 2005 and continued their push into the beauty and personal care business.

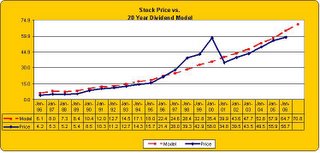

P&G, by any definition is a wonderful company, but is it already priced for perfection? My answer is an emphatic -- NO. I think it is cheap. The chart shows the actual price of P&G (blue line) vs. our dividend valuation model(red line) over the last 20 years. About all you need to get out of the chart is that the red line is higher than the blue line, meaning that P&G is currently selling lower than what our model says is its current valuation.

Our model is estimating that if P&G raises its dividend this year by 10%, that its expected value would be about $71 per share. With the stock currently selling at just under $59, that means it is undervalued by nearly 20%.

The stock yields near 2% and dividends have grown at over 10% per annum for the last 20 years. Remarkable, just remarkable.

P&G has raised their dividend for 52 consecutive years. P&G has raised their dividend for . . . .

How does a company exist for 52 years, let alone meet the payroll, pay the banks, taxes, and then be able to not only pay a dividend, but raise it for 52 years in a row. P&G has done so by selling modestly priced goods that people use every day and being an innovator in hundreds of products that fill our kitchens, bathrooms, and tummies. There really is no other company like P&G for extending their brands, and adding valuable contributors to their bottom line. They acquired Gillette in 2005 and continued their push into the beauty and personal care business.

P&G, by any definition is a wonderful company, but is it already priced for perfection? My answer is an emphatic -- NO. I think it is cheap. The chart shows the actual price of P&G (blue line) vs. our dividend valuation model(red line) over the last 20 years. About all you need to get out of the chart is that the red line is higher than the blue line, meaning that P&G is currently selling lower than what our model says is its current valuation.

Our model is estimating that if P&G raises its dividend this year by 10%, that its expected value would be about $71 per share. With the stock currently selling at just under $59, that means it is undervalued by nearly 20%.

The stock yields near 2% and dividends have grown at over 10% per annum for the last 20 years. Remarkable, just remarkable.

Monday, January 09, 2006

Stocks are Very Cheap

The chart below shows total US after-tax corporate profits versus the price of the Dow Jones Industrial Average since the beginning of 1988. You will notice that the two moved in tandem from 1988 through 1996. At that point, they diverged with the Dow going up and profits going down. Even when you say this out loud, something does not sound right -- stock prices started moving higher while profits were going down? That divergence lasted until 2003, when prices and profits once again converged. I have shown this chart before, and I think it explains a lot about the markets in general and the market today in particular.

The markets are not as efficient as the professors would have us believe. They get over valued and undervalued, and can stay that way for much longer than would seem appropriate. I actually knew about this data in the mid 1990s and convinced myself that the divergence in prices and profits was justified by the fall in inflation and interest rates. I was wrong. As it turns out, the market operates pretty much like we all thought -- it stumbles around, gets lost, zigs when it should be zagging, and yet thank goodness, sometimes, it gets it right. In my judgment, we are entering a period when it will get it right.

The chart shows that after-tax corporate profits have been very strong. Before we go any farther consider that these are the profits corporations are willing to pay taxes on; need I say anything further about their authenticity? Profits have been accelerating and have now moved decisively above the very flat line for stock prices. This is my point: with the expected 8%-10% growth in profits for 2006, the profit line will be equivalent to about 13,000 on the Dow Jones Industrial Average.

More Later,

Monday, January 02, 2006

Darn Good Year for the Economy -----Stocks to Follow

The headlines will report that the Dow Jones was down for the year by .6%. The headlines will not be accurate. Adding in the 2.3% average dividend yield of the DJ 30 for the year, the actual total return was 1.7%. I think most of us would have taken a positive return for the year, if in the first week of 2005, we would have been told that the year would see oil prices at $70, incredible devastation from the hurricanes that shut down parts of the country, inflation reaching 4%, eight rate hikes by the Federal Reserve, and the downgrading of General Motors and Ford to junk bond status.

You won't find much good news about stocks or the economy in the millions of words that will spew forth from the main stream media about 2005. Throw in the slide in the President's ratings and the retirement of Alan Greenspan, and we could have the makings of a outright pity party on the front pages of Time, Newsweek, Business Week, The New York Times, The Washington Post, and The Los Angeles Times. But, as usual, the main stream media does not get it, and because of that, many American's won't either. That is a very distressing reality. In my travels over the Holiday season, I have spoken with many people who parrot the media's pity party, and I am amazed that people can be so well informed of the woes of the economy, so incorrectly.

In my early years in the investment business, I would devour Business Week, Forbes, and The New York Times (Sunday) for the "inside scoop" on the economy and stocks. I know now that what I was reading was at best "an angle" of the truth, and not the real thing. It took me a long time to learn that when it comes to making money "an angle" of the truth is about as worthless as a lie.

The real stories of 2005 were the incredible resiliency and strength of the US economy, the remarkable ability of corporate America to control costs and produce profitable growth, and the pluck of US consumers. Nowhere are you likely to read that US GDP growth was near 4%, almost 25% ABOVE the average annual GDP growth of the last 80 years. Lost in the noise of the flat year for stocks will be the fact that S&P 500 profits likely grew by nearly 13%, and overall US after-tax corporate profits were up near 20%. Dividend growth of near 10% will likely be completely ignored.

Overshadowing worries about outsourcing and layoffs, the US economy produced 2,000,000 new jobs in 2005, as the unemployment rate fell from 5.4% in 2004 to 5.0%. Also ignored will be the single most important statistic on the face of the earth -- almost 70% of US citizens own their own homes, more than at anytime in the history of the world.

The main stream media's biased reporting of politics has been exposed, and they have seen a collapse in their subscribers, as people seeking the truth about political claims have moved on to reliable internet blogs to find the facts. The main stream financial press is next. They are "underreporting" the strength of the US economy. I do not blame the media for the flat performance of stocks, but they are entirely wrong in their supposition that the flat stock market is a sign of a weak economy. The flat stock market, in my judgment, is a psychological phenomenon resulting from the uncertainties of 2005 and a desire to "not fight the fed."

In my judgment, 2006 will be another year of solid economic data. I expect GDP growth to be near 3.5%, which, although above the 80 year average of 3.1%, will allow the Fed to go to the sidelines. A somewhat slower economy will also take some pressure off of energy demand, allowing oil prices to fall modestly. 2006 will be another good year for job growth, albeit somewhat slower than this past year.

There will be surprises in the year ahead; there always are. But the free market economy that the United States possess has proven over and over that it is much more resilient than the main stream media understands. It is a job creating engine, it is a wealth creating engine, and it is an innovation producing engine.

If you stand back far enough to get away from the odor that the mains stream media emits, you might think things are pretty good for the average American. If you have reached a place in your life, where you understand this, it is a very short trip to the notion that a flat stock market does not reflect the value that was produced in the US economy in 2005. I believe the current price of the Dow Jones 30 is at least 15% below its value, and that is not including 2006 earnings and dividend growth. In my mind it is just a matter of time before price and value intersect.

Subscribe to:

Comments (Atom)