We believe many high quality, dividend-paying companies are very attractive compared to US Treasury bonds. We have previously described the concept we call "bond-like" stocks. Bond-like stocks to us mean companies that

We believe many high quality, dividend-paying companies are very attractive compared to US Treasury bonds. We have previously described the concept we call "bond-like" stocks. Bond-like stocks to us mean companies that- Have strong balance sheets

- Have a history of paying dividends

- Display a history of raising its dividends,and

- Possess dividend yields that are close to the yield on a 10-year US Treasury bond.

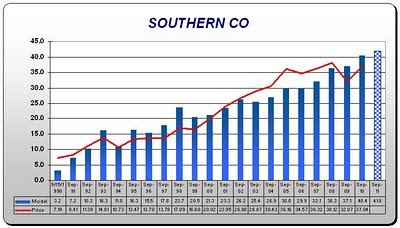

Our Dividend Valuation Model above (click to enlarge), which is based on the relationship between SO's price versus its dividend growth and the level of interest rates on long US Treasuries, suggests that the stock may be undervalued. Indeed, the model is projecting that the total return of SO over the next 12 months may approach 17%. As we always say, our model is based on historical relationships and thus is certainly not a guarantee of the future, but we are inclined to believe that SO is positioned to do well over the next year. Here's why:

- SO's bonds are A rated by both rating agencies, among the highest rated utilities in the US.

- It is the second largest utility in the US and the largest in the Sunbelt, where the population is still growing.

- SO has a near monopoly in its service areas and produces power through a diverse array of power sources from coal to nuclear power.

- SO has generated a 14% annualized return over the last 10 years, far outpacing the S+P.

- The company has paid a dividend since 1948, and its current dividend yield is just under 5%.

- SO has raised its dividend for 9 consecutive years at an annual rate just over 4%.

SO sells a product necessary for our daily lives and is as well run as any utility in the US. It has a current dividend yield of nearly double that of the 10-year Treasury bond. SO's implied return of 9% (5% dividend yield plus 4% dividend growth) compares favorably to the 10-year Treasury yield of 2.75%.

We believe the recent aversion to risk that has gripped the markets can not last forever. As investors realize that they cannot live very well on CDs paying .3%, they will begin looking for quality alternatives, and the first place they will look will be the electric and natural gas utilities. When they start looking at the utilities, it will be hard to beat what they find in Southern Company.

Clients and principals of Donaldson Capital own SO. Please see Term and Conditions of this blogsite on the right sidebar.